Does Al Have State Income Tax

The question of whether Al's income is subject to state income tax is an important consideration for individuals residing in states that impose such taxes. In the United States, income tax regulations can vary significantly from state to state, leading to unique circumstances for taxpayers like Al. This article aims to provide a comprehensive understanding of Al's state income tax obligations, delving into the specific regulations and potential exemptions that may apply to his situation.

Understanding State Income Tax Regulations

State income taxes are a significant source of revenue for many states in the US, with each state having its own set of rules and regulations governing the taxation of personal income. These taxes are typically imposed on wages, salaries, and other forms of income earned within the state’s borders. However, the specific rates and brackets can vary, making it crucial for taxpayers to understand the rules applicable to their state of residence.

In the case of Al, several factors come into play when determining his state income tax liability. These factors include his state of residence, the source of his income, and any applicable tax treaties or agreements that may impact his tax obligations.

Residency Status

The first step in determining Al’s state income tax liability is establishing his residency status. Each state has its own definition of residency, which often involves a combination of physical presence, intent to remain, and various other factors. For example, some states consider individuals who maintain a primary residence within the state to be residents, while others focus more on the duration of their stay.

If Al is a resident of a state that imposes income tax, he would generally be required to pay tax on all his income, regardless of where it was earned. This includes wages, salaries, business income, and even passive income sources like investments or rental properties. However, there are certain exemptions and deductions that Al may be eligible for, which we will explore further.

Non-Resident Income Taxation

In contrast, if Al is a non-resident of the state in question, his income tax obligations would be more limited. Non-residents are typically only required to pay tax on income earned within the state’s borders, such as wages from a job located in the state. This is known as “source-based taxation,” where the state taxes income derived from activities or businesses within its jurisdiction.

For non-residents, the tax rates and brackets may differ from those applicable to residents. Additionally, non-residents may have different filing requirements and deadlines compared to residents. It's crucial for Al to understand the specific regulations of the state where he earned income to ensure he complies with the applicable laws.

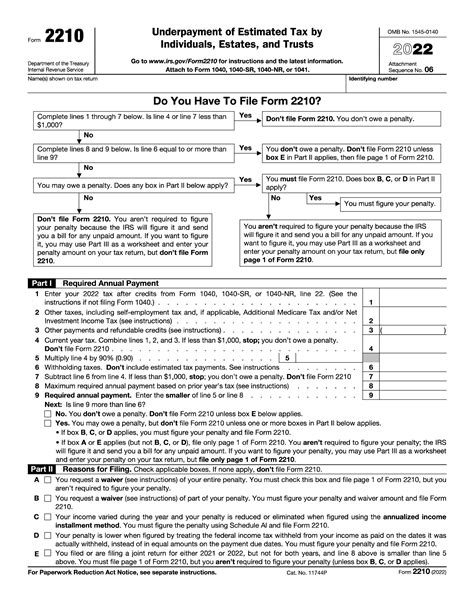

Exemptions and Deductions

Regardless of residency status, Al may be eligible for various exemptions and deductions that can reduce his state income tax liability. These can include standard deductions, itemized deductions for expenses like mortgage interest or charitable contributions, and even specific credits or exemptions offered by the state.

For instance, many states offer tax credits for certain expenses, such as education costs, childcare expenses, or even renewable energy investments. Additionally, some states have programs that provide tax relief for low-income individuals or families. These exemptions and deductions can significantly impact Al's tax liability and should be carefully considered when filing his state income tax return.

Tax Treaties and Agreements

In certain cases, Al’s state income tax obligations may be impacted by international tax treaties or agreements. These treaties are designed to prevent double taxation and ensure fair tax practices between countries or states. If Al has income sourced from outside the US or from a state with which his resident state has an agreement, these treaties may provide specific rules for tax treatment.

For example, some states have reciprocal agreements with neighboring states, allowing taxpayers to deduct taxes paid to the other state from their own state tax liability. This can be particularly beneficial for individuals who work or own property in multiple states.

State-Specific Analysis: Al’s Case Study

To provide a more detailed understanding of Al’s state income tax obligations, let’s consider a hypothetical scenario. Imagine Al resides in the state of California but frequently travels to Nevada for work-related purposes. He owns a small business in California and also works as an independent contractor in Nevada.

California Residency and Taxation

As a resident of California, Al is subject to the state’s income tax laws. California imposes a progressive tax system, with tax rates ranging from 1% to 13.3% depending on income brackets. For individuals with higher incomes, the top marginal tax rate of 13.3% applies.

In this scenario, Al would be required to pay tax on all his income earned in California, including business profits and wages. He may also be eligible for certain deductions and credits, such as the California Earned Income Tax Credit, which provides a refundable credit for low- and moderate-income individuals and families.

| California Income Tax Rates | Taxable Income Brackets |

|---|---|

| 1% - 13.3% | $0 - $9,863, $9,864 - $19,725, and so on up to $1,038,747 |

Nevada Non-Residency and Taxation

In contrast, Nevada does not impose a personal income tax on its residents or non-residents. This means that Al’s income earned as an independent contractor in Nevada would not be subject to state income tax in that state. However, he would still need to comply with federal income tax regulations for his Nevada earnings.

Interstate Tax Considerations

Given that Al works in both California and Nevada, he may benefit from interstate tax agreements between the two states. California and Nevada have a reciprocal agreement that allows taxpayers to deduct taxes paid to the other state from their California tax liability. This means that Al could potentially reduce his California income tax liability by the amount of tax he pays to Nevada on his Nevada-sourced income.

Practical Tips for Al’s State Income Tax Management

To ensure compliance and optimize his state income tax obligations, Al can consider the following strategies:

- Stay Informed: Keep up-to-date with the latest state tax laws and regulations, especially if Al resides in a state with complex tax systems or if his income sources are diverse.

- Understand Residency Status: Clearly establish his residency status in each state where he has income-generating activities. This will help determine the applicable tax rates and filing requirements.

- Maximize Deductions and Credits: Research and claim all applicable deductions and credits for which he is eligible. This can significantly reduce his tax liability and improve his overall financial position.

- Consider Tax Professionals: If Al's tax situation is complex, consulting a tax professional or accountant can provide valuable guidance and ensure accurate tax filing.

- Explore Tax Planning Opportunities: Engage in proactive tax planning to optimize his overall tax position. This may involve structuring his business or investment activities in a tax-efficient manner.

Conclusion

In conclusion, understanding state income tax regulations is crucial for individuals like Al, who may have income sourced from multiple states or countries. By carefully considering his residency status, income sources, and applicable tax treaties, Al can ensure compliance with the law and optimize his tax obligations. With the right strategies and a thorough understanding of the rules, Al can navigate the complexities of state income taxation and manage his financial responsibilities effectively.

What are the key factors that determine state income tax liability for residents like Al?

+

The main factors include residency status, the source of income, and any applicable tax treaties or agreements. Residents are generally subject to tax on all their income, while non-residents are taxed on income sourced within the state. It’s crucial to understand the specific regulations of each state involved.

How do interstate tax agreements impact Al’s state income tax obligations?

+

Interstate tax agreements, like the reciprocal agreement between California and Nevada, allow taxpayers to deduct taxes paid to one state from their tax liability in the other state. This can provide significant tax savings for individuals with income sourced from multiple states.

Are there any common deductions or credits that Al should be aware of to reduce his state income tax burden?

+

Yes, states often offer deductions for expenses like mortgage interest, charitable contributions, and certain state-specific credits like the California Earned Income Tax Credit. It’s important for Al to research and claim all applicable deductions and credits to minimize his tax liability.

What should Al do if he has a complex tax situation involving multiple states or countries?

+

In such cases, it’s advisable for Al to consult a tax professional or accountant who specializes in multi-state or international tax matters. They can provide expert guidance and ensure that Al complies with all applicable tax laws and takes advantage of any available tax planning opportunities.