Tax Collector Brevard

In the intricate web of government operations, the role of the tax collector often goes unnoticed, yet it is a pivotal position that ensures the smooth functioning of public services and the stability of a community. This article delves into the world of the Brevard Tax Collector, a vital office that handles a range of crucial tasks, from collecting taxes to offering a plethora of citizen services. Through this exploration, we aim to shed light on the significance of this role and its impact on the community.

The Office of the Tax Collector: A Multifaceted Role

The Tax Collector’s Office in Brevard, Florida, is more than just a revenue collection entity; it is a hub of activity and assistance for residents. With a mandate that extends beyond tax collection, this office serves as a one-stop shop for a variety of government-related services, making it an essential pillar of the community.

Tax Collection: The Primary Function

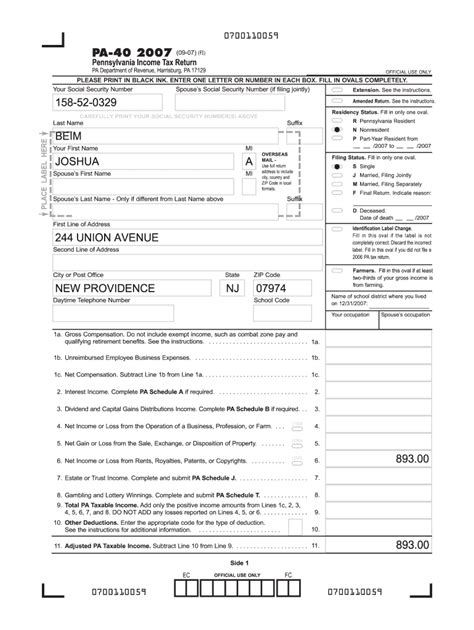

At its core, the Tax Collector’s Office is responsible for the efficient and effective collection of taxes, including property taxes, vehicle registration fees, and other miscellaneous taxes. This function is critical to the financial stability of the county, as it ensures the continuous operation of essential services such as education, public safety, and infrastructure development.

The office employs a range of strategies to ensure timely tax payments, including online payment systems, payment plans, and convenient physical locations across the county. These measures not only make tax payment more accessible but also reduce the administrative burden on taxpayers.

Vehicle Registration and Titling

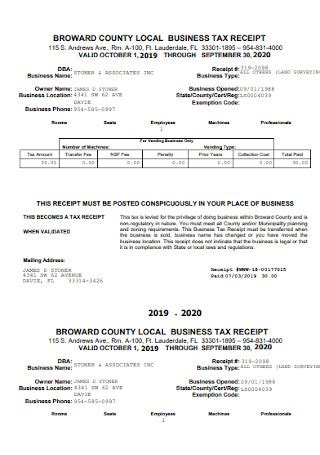

The Tax Collector’s Office also plays a vital role in vehicle registration and titling. Residents of Brevard can visit their local tax collector’s office to register their vehicles, apply for title transfers, and obtain specialized license plates. This service is particularly beneficial for new residents, providing them with a streamlined process to get their vehicles legally registered in their new county.

| Service | Fees |

|---|---|

| Vehicle Registration | $22.50 (plus applicable fees and taxes) |

| Title Transfer | $75.25 (plus $2.00 per lien) |

| Specialized License Plates | Varies based on plate type |

Passenger Vehicle Registration Renewal

For residents with a valid Florida driver’s license or ID card, the Tax Collector’s Office offers a convenient online service for renewing vehicle registrations. This service not only saves time but also reduces the need for physical visits to the office, making it a more efficient process for both residents and the office.

Property Appraisal and Tax Assessment

The Tax Collector’s Office works closely with the Property Appraiser’s Office to ensure accurate property appraisal and tax assessment. This collaboration is crucial for maintaining fairness in the tax system, as it ensures that property owners are taxed appropriately based on the current value of their properties.

The office provides a transparent and accessible process for property owners to understand their tax assessments and offers avenues for appealing assessments if needed. This ensures that the tax system remains fair and equitable for all residents.

Citizenship and Voter Services

In addition to its core tax-related functions, the Tax Collector’s Office also provides a range of citizenship and voter services. This includes issuing and renewing identification cards, processing voter registrations, and providing information on upcoming elections. These services are integral to the democratic process, ensuring that citizens can actively participate in their community’s governance.

Performance and Impact

The Tax Collector’s Office has consistently demonstrated its commitment to efficient service delivery. Its adoption of digital technologies and online services has streamlined processes, reduced wait times, and provided residents with convenient access to a range of services. This approach has not only improved the taxpayer experience but has also contributed to the overall economic efficiency of the county.

Furthermore, the office's focus on community engagement and education has fostered a culture of tax compliance. Through outreach programs and initiatives, the Tax Collector's Office has successfully raised awareness about the importance of timely tax payments and the role of taxes in community development. This has resulted in a higher level of tax compliance and a more positive perception of the tax collection process among residents.

Financial Transparency and Accountability

The Tax Collector’s Office operates with a high degree of financial transparency. Regular financial reports and audits ensure that taxpayers can track how their tax dollars are being utilized. This transparency not only instills trust in the tax collection process but also holds the office accountable for its financial management practices.

Community Impact

The impact of the Tax Collector’s Office extends beyond its core functions. By providing a range of services under one roof, the office serves as a central hub for residents to access government services. This convenience saves time and resources for residents, contributing to a higher quality of life in the community.

Additionally, the office's commitment to community engagement and education has fostered a sense of civic responsibility among residents. Through its outreach initiatives, the Tax Collector's Office has empowered residents to actively participate in their community's governance and development, leading to a more engaged and informed citizenry.

Future Prospects

Looking ahead, the Tax Collector’s Office is well-positioned to continue its excellent service delivery. With a focus on technological advancements and a commitment to community engagement, the office can further streamline its processes and enhance its services. This includes potential expansions into mobile services and further integration of digital technologies to provide even more accessible and efficient services to residents.

Moreover, the office's ongoing educational initiatives can be expanded to reach a wider audience, particularly new residents and younger demographics. By fostering a deeper understanding of the tax system and its role in community development, the Tax Collector's Office can further enhance tax compliance and community engagement.

Frequently Asked Questions

What services does the Tax Collector’s Office offer besides tax collection?

+In addition to tax collection, the Tax Collector’s Office provides a range of services including vehicle registration and titling, passenger vehicle registration renewal, property appraisal and tax assessment support, and citizenship and voter services such as issuing ID cards and processing voter registrations.

How has the Tax Collector’s Office utilized technology to improve services?

+The office has embraced digital technologies and online services, offering online tax payment systems, vehicle registration renewal, and various other services. These initiatives have streamlined processes, reduced wait times, and provided residents with convenient access to services.

What is the role of the Tax Collector’s Office in community engagement and education?

+The office plays a crucial role in fostering community engagement and education. Through outreach programs and initiatives, it raises awareness about the importance of timely tax payments and the role of taxes in community development, thereby enhancing tax compliance and civic responsibility among residents.

How does the Tax Collector’s Office ensure financial transparency and accountability?

+The office maintains financial transparency through regular financial reports and audits, allowing taxpayers to track the utilization of their tax dollars. This practice not only instills trust in the tax collection process but also holds the office accountable for its financial management practices.

What are the future prospects for the Tax Collector’s Office in Brevard?

+The future looks bright for the Tax Collector’s Office, with potential expansions into mobile services and further integration of digital technologies to enhance service accessibility and efficiency. Additionally, ongoing educational initiatives can be expanded to reach a wider audience, fostering a deeper understanding of the tax system and community development.