Pa State Tax Forms

When it comes to state taxes in Pennsylvania, understanding the forms and processes involved is crucial for individuals and businesses alike. The Pennsylvania Department of Revenue offers a comprehensive set of forms to facilitate the accurate reporting and payment of state taxes. This article aims to provide an in-depth guide to the various PA state tax forms, their purposes, and how to navigate the filing process efficiently.

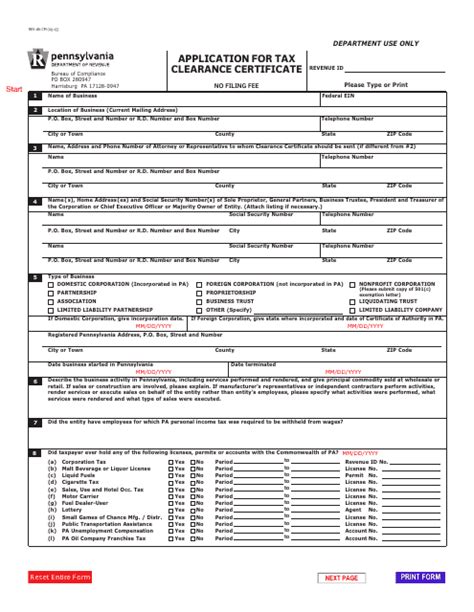

An Overview of PA State Tax Forms

Pennsylvania’s tax system is designed to support the state’s revenue generation, with a range of taxes applicable to different entities and activities. The state tax forms are the official documents used to declare and remit these taxes. These forms are essential for individuals, businesses, and tax professionals to comply with state tax laws and avoid penalties.

Key PA State Tax Forms and Their Purposes

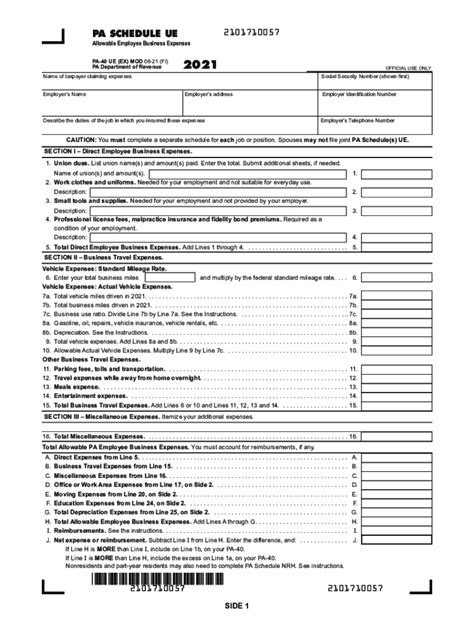

The PA state tax forms cover a wide array of tax types, including income tax, sales and use tax, corporate net income tax, and more. Here’s a breakdown of some of the most common forms and their specific purposes:

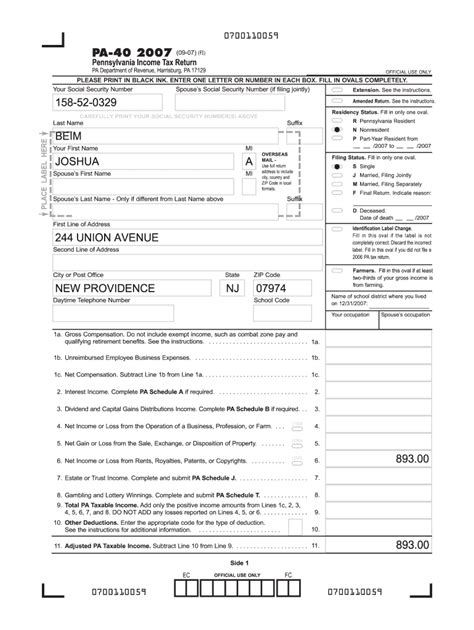

- PA-40: Individual Income Tax Return - This form is used by residents of Pennsylvania to report their annual income and calculate their state income tax liability. It covers various types of income, deductions, and credits.

- PA-40ES: Individual Estimated Income Tax Payments - Designed for quarterly estimated tax payments, this form helps individuals manage their tax obligations throughout the year, especially for those with variable income sources.

- PA-100: Corporate Net Income Tax Return - Corporations doing business in Pennsylvania must use this form to report their net income and calculate their corporate tax liability. It includes provisions for franchise tax, capital stock tax, and other corporate-specific taxes.

- PA-100ES: Corporate Estimated Income Tax Payments - Similar to the individual estimated tax form, this allows corporations to make quarterly estimated tax payments to manage their tax obligations effectively.

- PA-100-WS: Corporate Net Income Tax Worksheets - A companion to the PA-100, this form provides detailed calculations and worksheets for various corporate tax components, aiding in accurate tax reporting.

- PA-1000: Partnership Return of Income - Partnerships operating in Pennsylvania use this form to report their income, deductions, and credits, ensuring compliance with state tax laws.

- PA-1000ES: Partnership Estimated Income Tax Payments - Partnerships can use this form to make quarterly estimated tax payments, helping them manage their tax obligations in a more streamlined manner.

- PA-400: Fiduciary Income Tax Return - This form is for fiduciaries, such as executors, administrators, and trustees, to report income earned by estates and trusts and calculate the applicable taxes.

- PA-400ES: Fiduciary Estimated Income Tax Payments - Fiduciaries can use this form to make quarterly estimated tax payments for estates and trusts.

- PA-100S: School Tax Return - A specialized form for school districts to report their income and calculate the school tax liability, contributing to the state's education funding.

- PA-106: Sales and Use Tax Return - Businesses operating in Pennsylvania must use this form to report their sales and use tax obligations, ensuring compliance with state sales tax laws.

- PA-106-A: Sales Tax Exemptions and Resale Certificate - This form allows businesses to claim sales tax exemptions or provide resale certificates to their customers, ensuring proper tax treatment.

These forms are just a glimpse into the comprehensive suite of PA state tax forms. Each form is designed to cater to specific tax obligations, ensuring a transparent and efficient tax system in Pennsylvania.

Accessing and Completing PA State Tax Forms

The Pennsylvania Department of Revenue provides several resources to help taxpayers access and complete the necessary forms. These resources include:

- Online Filing - The Department offers an online filing system, known as e-file PA, which allows taxpayers to file their state tax returns electronically. This system is secure, efficient, and often preferred for its convenience.

- Paper Forms - For those who prefer traditional methods, paper forms can be downloaded directly from the Department's website. These forms can be filled out manually and mailed to the appropriate address.

- Taxpayer Assistance - The Department provides dedicated taxpayer assistance services. Taxpayers can call or visit local offices to receive help with form completion, tax calculations, and general tax inquiries.

When accessing and completing PA state tax forms, it's crucial to pay attention to the specific instructions provided with each form. These instructions guide taxpayers on the necessary information to include, any required attachments, and the correct submission methods.

Deadlines and Penalties

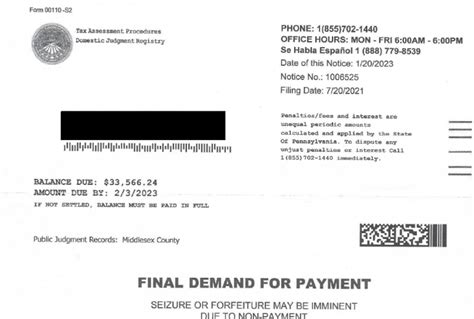

Timely filing of PA state tax forms is essential to avoid penalties and interest charges. The specific deadlines for each form vary based on the tax type and the taxpayer’s circumstances. It’s crucial to refer to the official guidelines provided by the Pennsylvania Department of Revenue to ensure compliance with these deadlines.

Failure to file or pay taxes on time can result in penalties and interest, which can accumulate over time. The Department's website provides detailed information on the calculation of these penalties and the options available for taxpayers who are unable to meet their tax obligations due to financial hardship.

Navigating the PA State Tax System

Understanding the PA state tax system goes beyond just knowing the forms. It involves a comprehensive understanding of the tax laws, regulations, and potential tax benefits available to individuals and businesses. Here are some key aspects to consider:

Tax Rates and Calculations

Pennsylvania has a progressive income tax system, with tax rates varying based on income brackets. The state’s sales and use tax rates also apply differently to various goods and services. Understanding these rates and the applicable calculations is crucial for accurate tax reporting.

| Tax Type | Rate |

|---|---|

| Individual Income Tax | 3.07% |

| Corporate Net Income Tax | 9.99% |

| Sales and Use Tax | 6% |

Tax Credits and Incentives

Pennsylvania provides various tax credits and incentives to encourage economic growth, job creation, and investment. These include tax credits for research and development, film production, renewable energy, and more. Businesses and individuals should explore these opportunities to reduce their tax liability and contribute to the state’s economic development.

Tax Compliance and Audits

Taxpayers must maintain accurate records and ensure compliance with state tax laws to avoid audits. Audits are conducted by the Pennsylvania Department of Revenue to verify the accuracy of tax returns and ensure taxpayers are meeting their obligations. Understanding the audit process and maintaining proper documentation is essential for a smooth audit experience.

Tax Relief Programs

Pennsylvania offers several tax relief programs to assist taxpayers facing financial hardships. These programs provide temporary relief from tax liabilities, interest, and penalties in certain circumstances. Taxpayers who are facing financial challenges should explore these options to alleviate their tax burden.

Future Developments and Tax Reform

Staying updated on potential changes to the PA state tax system is crucial for taxpayers. The state regularly reviews its tax laws and may introduce reforms to align with economic trends and revenue needs. Keeping an eye on legislative updates and proposed tax reforms can help taxpayers anticipate changes and plan their tax strategies accordingly.

Conclusion

The PA state tax system is a comprehensive framework designed to support the state’s revenue needs while providing taxpayers with a fair and transparent process. Understanding the various state tax forms, tax rates, and potential benefits is crucial for individuals and businesses to navigate this system effectively. By staying informed and utilizing the resources provided by the Pennsylvania Department of Revenue, taxpayers can ensure compliance and make the most of the available tax opportunities.

Where can I find the latest PA state tax forms?

+The latest PA state tax forms can be found on the official website of the Pennsylvania Department of Revenue. The website provides a dedicated section for tax forms, where you can download the forms you need. Alternatively, you can also access these forms through the department’s e-file system, which allows you to file your taxes online.

Are there any resources available to help me complete the PA state tax forms?

+Absolutely! The Pennsylvania Department of Revenue offers a range of resources to assist taxpayers in completing their state tax forms accurately. These resources include detailed instructions for each form, frequently asked questions, and even online tax calculators to help with specific tax computations. Additionally, the department provides taxpayer assistance services, where trained professionals can guide you through the form-filling process and answer any tax-related queries.

What are the penalties for late filing or non-payment of PA state taxes?

+Late filing or non-payment of PA state taxes can result in penalties and interest charges. The specific penalties vary depending on the tax type and the amount of tax owed. It’s important to note that the longer the delay, the higher the penalties and interest can accumulate. The Pennsylvania Department of Revenue provides detailed information on their website regarding the calculation of penalties and the options available for taxpayers who are unable to meet their tax obligations on time.

How often do the PA state tax forms change?

+The PA state tax forms may change annually to align with updates in state tax laws and regulations. It’s crucial to use the most recent version of the forms to ensure compliance with the current tax system. The Pennsylvania Department of Revenue typically releases the updated forms in the early part of the year, giving taxpayers sufficient time to prepare for the upcoming tax season.

Are there any tax relief programs available in Pennsylvania for taxpayers facing financial hardships?

+Yes, Pennsylvania offers several tax relief programs to assist taxpayers who are experiencing financial difficulties. These programs provide temporary relief from tax liabilities, interest, and penalties in specific circumstances. For example, the state offers a Taxpayer Relief Program, which can provide extended payment plans or temporary waivers of penalties and interest for eligible taxpayers. It’s important to note that eligibility criteria and the specific relief offered may vary based on the program and the taxpayer’s situation.