New York Ny Sales Tax

Understanding sales tax regulations is crucial, especially for businesses operating in diverse regions. This article delves into the intricacies of sales tax in New York City, offering a comprehensive guide to help businesses navigate the complex tax landscape and ensure compliance with local regulations.

Unraveling New York City’s Sales Tax Structure

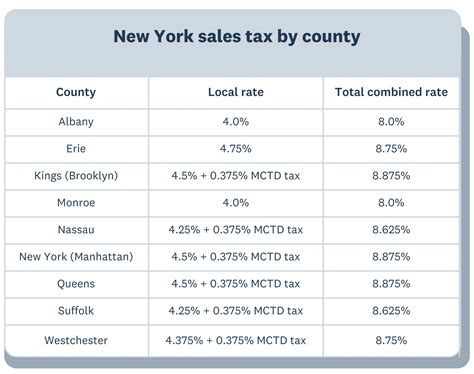

New York City, often referred to as the economic powerhouse of the United States, imposes a sales tax that varies based on the type of goods or services being sold and the location of the sale. The city’s sales tax rate is applied on top of the state sales tax, creating a two-tiered tax system that can be complex for businesses to navigate.

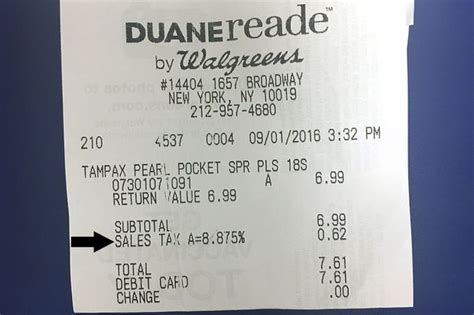

As of 2023, the statewide sales tax rate in New York is 4%, with additional local rates varying by county and city. New York City, being the most populous city in the state, imposes a local sales tax of 4.5%, bringing the total sales tax rate to 8.5% for most goods and services. This rate is applied uniformly across the five boroughs of Manhattan, Brooklyn, Queens, the Bronx, and Staten Island.

However, it's important to note that certain areas within New York City have their own special taxing districts that impose additional local taxes. For instance, Staten Island's special taxing district adds an extra 0.375% to the total sales tax rate, making it 8.875% for businesses and consumers in that specific area.

To further complicate matters, New York City also has a sales tax cap on certain items. For instance, the city imposes a $110 sales tax ceiling on clothing and footwear purchases, which means that even if the total sales tax rate exceeds 8.5% or 8.875% (depending on the area), the tax payable on these items is limited to a maximum of $110.

| Sales Tax Rate | New York State | New York City | Special Taxing Districts |

|---|---|---|---|

| Statewide Rate | 4% | N/A | N/A |

| New York City Rate | N/A | 4.5% | N/A |

| Staten Island Special Tax | N/A | 0.375% | 0.375% |

| Total Sales Tax | 4% | 8.5% | 8.875% |

Understanding Taxable Items and Exemptions

Not all goods and services are subject to the same sales tax rate in New York City. Certain items, such as prescription drugs, certain types of medical equipment, and some types of food, are exempt from sales tax to encourage consumer spending and support healthcare accessibility.

On the other hand, luxury items like jewelry, watches, and high-end clothing often carry a higher sales tax rate, which can go up to 8.875% in New York City, making these items more expensive for consumers. This is a strategy employed by the city to generate additional revenue and discourage excessive spending on non-essential items.

Additionally, New York City has a use tax that applies to items purchased outside the city but brought back for use within its boundaries. This tax ensures that all goods are taxed, regardless of where they were purchased, and is designed to prevent tax evasion.

Sales Tax Registration and Compliance

Businesses operating in New York City are required to register for a sales tax permit with the New York State Department of Taxation and Finance. This permit authorizes businesses to collect and remit sales tax on behalf of the state and city governments.

The sales tax registration process involves filling out specific forms, providing business details, and outlining the types of goods and services the business plans to sell. Once registered, businesses must collect the appropriate sales tax rate from customers and remit it to the state and city governments on a regular basis, typically monthly or quarterly.

Failing to register or comply with sales tax regulations can result in significant penalties, including fines, interest charges, and potential legal repercussions. Therefore, it is imperative for businesses to understand and adhere to the city's sales tax laws.

Sales Tax Filing and Payment Deadlines

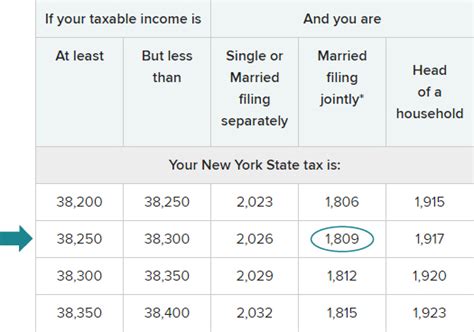

In New York City, sales tax returns must be filed and payments made monthly or quarterly, depending on the business’s sales volume and the type of goods or services sold. The due dates for filing and payment are as follows:

- Monthly filers: The 20th day of the month following the reporting period.

- Quarterly filers: The 20th day of the month following the end of the quarter.

For example, if a business is a quarterly filer and its reporting quarter ends on June 30th, the sales tax return and payment would be due on July 20th. Failure to meet these deadlines can result in penalties and interest charges.

Sales Tax Audits and Enforcement

The New York State Department of Taxation and Finance conducts regular audits to ensure businesses are accurately reporting and remitting sales tax. These audits can be complex and time-consuming, often requiring businesses to provide extensive documentation and records.

During an audit, the department may examine a business's sales records, purchase orders, invoices, and other financial documents to verify the accuracy of the reported sales tax. If discrepancies are found, the business may be required to pay additional tax, interest, and penalties.

To prepare for potential audits, businesses should maintain accurate and detailed records of all sales transactions, including the date, amount, and type of goods or services sold. This documentation can help businesses defend their sales tax positions and resolve any disputes that may arise during an audit.

The Future of Sales Tax in New York City

As New York City continues to evolve and adapt to changing economic landscapes, the sales tax structure is likely to undergo further modifications. The city government is constantly evaluating its tax policies to ensure they align with economic goals and support local businesses and residents.

One potential future development could be the harmonization of sales tax rates across the five boroughs. Currently, Staten Island has a slightly higher sales tax rate due to its special taxing district, but there have been discussions about equalizing rates to simplify the tax system and reduce administrative burdens on businesses.

Additionally, with the rise of e-commerce and online sales, New York City may need to adapt its sales tax laws to ensure fair taxation of online transactions. This could involve implementing new regulations or modifying existing ones to keep up with the evolving digital economy.

The city's sales tax policies also have implications for businesses considering expansion into New York City. Understanding the local tax landscape is crucial for making informed business decisions and ensuring long-term financial viability.

Conclusion: Navigating the Complex World of Sales Tax

Sales tax in New York City is a complex and ever-evolving aspect of doing business in the city. From understanding the varying tax rates to complying with registration and filing requirements, businesses must stay informed and proactive to avoid costly mistakes.

By staying up-to-date with the latest sales tax regulations and seeking professional guidance when needed, businesses can ensure they are meeting their legal obligations and contributing to the economic growth of New York City.

What is the current sales tax rate in New York City for 2023?

+The current sales tax rate in New York City for 2023 is 8.5%. This includes the statewide rate of 4% and the local city rate of 4.5%. Certain areas, like Staten Island, have an additional local tax, bringing the total rate to 8.875%.

Are there any items exempt from sales tax in New York City?

+Yes, there are certain items exempt from sales tax in New York City. These include prescription drugs, some types of medical equipment, and certain types of food. These exemptions are designed to encourage consumer spending and support healthcare accessibility.

How often do businesses need to file and pay sales tax in New York City?

+Businesses in New York City must file and pay sales tax either monthly or quarterly, depending on their sales volume and the type of goods or services sold. Monthly filers have a due date of the 20th of the month following the reporting period, while quarterly filers have a due date of the 20th of the month following the end of the quarter.

What happens if a business fails to comply with sales tax regulations in New York City?

+Failing to comply with sales tax regulations in New York City can result in significant penalties, including fines, interest charges, and potential legal repercussions. It is crucial for businesses to register, collect, and remit sales tax accurately to avoid these consequences.