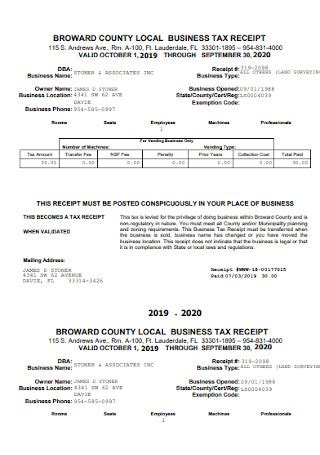

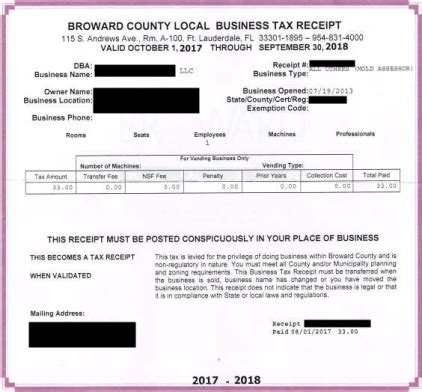

Broward County Business Tax Receipt

The Broward County Business Tax Receipt (BTR) is an essential aspect of doing business in this vibrant Florida county. It serves as a crucial step in the process of establishing and operating a business, ensuring compliance with local regulations and contributing to the county's thriving business community. This article aims to delve into the intricacies of the Broward County BTR, providing a comprehensive guide for business owners and entrepreneurs.

Understanding the Broward County Business Tax Receipt

The BTR, often referred to as a business license or permit, is a legal document that authorizes a business to operate within a specific jurisdiction. In Broward County, this receipt is a vital component of the local business registration process. It signifies that the business has met the necessary requirements and is compliant with local laws and regulations.

Obtaining a BTR in Broward County is a straightforward process, but it requires careful attention to detail to ensure that all the necessary steps are completed accurately. This includes understanding the different types of business activities that require a BTR, the associated fees, and the specific documentation needed to complete the application process.

Business Activities Requiring a BTR

Broward County has a comprehensive list of business activities that mandate the acquisition of a Business Tax Receipt. These activities include, but are not limited to, the following:

- Retail Sales: Any business involved in the sale of goods or products to the public, whether through a physical store or online platforms, requires a BTR.

- Professional Services: This encompasses a wide range of businesses, including consultants, freelancers, and those offering specialized services such as legal, accounting, or design services.

- Manufacturing and Production: Businesses involved in the manufacturing, assembly, or production of goods are subject to BTR requirements.

- Real Estate and Property Management

- Personal Services: Businesses offering personal care services, such as salons, spas, and fitness studios, need a BTR.

- Transportation and Logistics: This includes businesses involved in transportation services, freight forwarding, and warehousing.

It's important to note that some business activities may have specific subcategories or additional requirements. For instance, restaurants and food establishments often have distinct BTR requirements due to health and safety regulations.

Fees and Payment Options

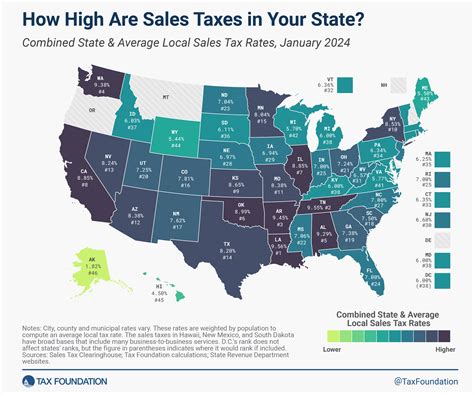

The fees associated with a Broward County BTR vary depending on the type of business and its specific activities. The county’s website provides a detailed fee schedule, which is updated annually. Business owners can expect to pay a base fee, with potential additional charges based on factors like gross receipts, number of employees, or specific services offered.

Broward County offers several convenient payment options, including online payments through its official website. This allows business owners to complete the payment process quickly and securely, ensuring a smooth transition into the next steps of the BTR application.

Application Process and Documentation

The application for a Broward County BTR is typically done online, through the county’s official website. This digital platform guides business owners through the process, ensuring that all necessary information is provided. The application requires detailed information about the business, including its legal name, physical address, nature of business, and contact details.

In addition to the basic application, certain businesses may need to provide additional documentation. This can include business plans, permits from other agencies (such as health or environmental departments), or proof of insurance. It's crucial for business owners to thoroughly review the requirements to ensure a complete and accurate application.

Once the application is submitted, it undergoes a review process by the county's Business Tax Division. This division ensures that the business meets all necessary criteria and is compliant with local laws. Upon approval, the business will receive its official Business Tax Receipt, allowing it to commence operations within the county.

Benefits of Obtaining a Broward County BTR

Beyond the legal requirements, obtaining a BTR in Broward County offers several benefits to business owners:

- Legitimacy and Compliance: A BTR provides legitimacy to a business, ensuring that it operates within the boundaries of the law. This compliance is crucial for maintaining a positive reputation and building trust with customers and partners.

- Access to Resources: Broward County offers a wealth of resources and support to its business community. With a BTR, businesses can access these resources, including business development programs, networking opportunities, and potential funding options.

- Community Engagement: The BTR process encourages businesses to engage with the local community. This can lead to valuable partnerships, increased visibility, and a deeper understanding of the county's unique business landscape.

- Regulatory Support: The Business Tax Division provides ongoing support to businesses, offering guidance on compliance and regulatory matters. This support can be invaluable, especially for new or expanding businesses.

Case Study: Success Through BTR Compliance

Consider the example of EcoTech Solutions, a sustainable technology startup based in Broward County. When EcoTech first launched, its founders were committed to operating ethically and sustainably. They understood the importance of compliance and decided to obtain their BTR promptly.

By doing so, EcoTech gained access to valuable resources offered by the county. They were able to participate in a mentorship program, which provided them with expert guidance on scaling their business. Additionally, they were introduced to potential investors and partners through county-organized networking events.

As a result of their BTR compliance and engagement with the local business community, EcoTech experienced rapid growth. They were able to expand their team, launch innovative products, and establish themselves as a leader in sustainable technology. This success story highlights the tangible benefits that can arise from obtaining a Broward County BTR.

Challenges and Future Outlook

While the BTR process in Broward County is generally efficient, there are a few challenges that businesses may encounter. These include:

- Complexity of Regulations: The county's business regulations can be intricate, especially for businesses operating in multiple sectors or with complex structures. Navigating these regulations can be a challenge, particularly for new business owners.

- Time and Resource Commitment: Obtaining a BTR requires time and resources, which can be a burden for small businesses or those with limited capacity. The application process, documentation, and ongoing compliance can be time-consuming.

- Changing Business Landscape: The business environment is dynamic, with new technologies, market trends, and regulations constantly emerging. Keeping up with these changes and ensuring continued compliance can be a significant challenge.

However, Broward County recognizes these challenges and is committed to supporting its business community. The county continuously updates its regulations and resources to accommodate the evolving business landscape. It also provides educational resources and workshops to help business owners navigate the BTR process and maintain compliance.

Looking ahead, the future of business in Broward County is bright. The county's strategic location, diverse economy, and commitment to business support position it as an attractive destination for entrepreneurs and established businesses alike. By continuing to streamline the BTR process and provide comprehensive resources, Broward County can further enhance its reputation as a business-friendly environment.

Conclusion

The Broward County Business Tax Receipt is more than just a legal requirement; it is a gateway to a thriving business community. By obtaining a BTR, businesses can operate with legitimacy, access valuable resources, and engage with a supportive local network. While the process may present challenges, the benefits far outweigh the efforts involved.

As Broward County continues to evolve and adapt to the changing business landscape, its BTR process will play a crucial role in shaping the success of local businesses. By staying informed, compliant, and engaged, business owners can maximize the opportunities presented by this vibrant county.

How long does it take to obtain a Broward County BTR?

+The processing time for a BTR application in Broward County can vary. Typically, it takes 7-10 business days from the date of submission. However, this timeline may be longer if additional documentation or clarifications are required.

Can I renew my BTR online?

+Yes, renewing your BTR in Broward County can be done online through the county’s official website. The renewal process is similar to the initial application, but it involves updating your business information and paying the renewal fee.

What happens if I operate my business without a BTR?

+Operating a business without a valid BTR in Broward County is illegal and can result in penalties. These penalties may include fines, cessation of business operations, and potential legal consequences. It’s crucial to obtain and maintain a valid BTR to avoid these issues.