Does Az Have State Tax

The question of whether the state of Arizona imposes a state tax is a crucial one for residents, businesses, and investors alike. In this comprehensive guide, we will delve into the intricacies of Arizona's tax system, exploring the types of taxes levied, their implications, and how they compare to other states.

Understanding Arizona’s Tax Landscape

Arizona, known for its vibrant desert landscapes and thriving economy, has a unique tax structure that sets it apart from many other states in the US. The state’s tax system plays a significant role in funding essential services, infrastructure development, and government operations.

The State Income Tax: A Key Component

One of the primary taxes in Arizona is the state income tax. This tax is levied on the income earned by individuals, businesses, and other entities within the state. Unlike some other states that have a flat tax rate, Arizona’s income tax structure is progressive, meaning that the tax rate increases as income levels rise.

Here's a breakdown of Arizona's state income tax rates for individuals as of [current year]:

| Tax Bracket | Tax Rate |

|---|---|

| 0 to $10,000 | 2.59% |

| $10,001 to $25,000 | 2.88% |

| $25,001 to $50,000 | 3.36% |

| Over $50,000 | 4.54% |

It's important to note that these rates are subject to change, and it's advisable to consult the Arizona Department of Revenue for the most up-to-date information.

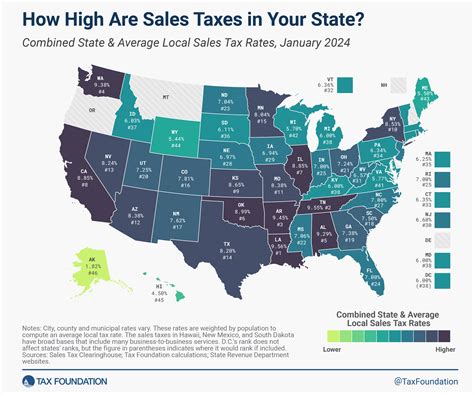

Sales and Use Tax: A Major Revenue Source

In addition to the state income tax, Arizona relies heavily on sales and use tax as a significant source of revenue. This tax is applied to the sale of goods and services within the state, as well as the use, storage, or consumption of tangible personal property.

The sales tax rate in Arizona varies depending on the location. The state imposes a base sales tax rate of 5.6%, which can be combined with additional local and county taxes, resulting in varying effective rates across the state. For instance, in the city of Phoenix, the total sales tax rate is [current rate]%, which includes the state, county, and city taxes.

Here's a table illustrating the sales tax rates in some major cities in Arizona:

| City | Sales Tax Rate |

|---|---|

| Phoenix | [current rate]% |

| Tucson | [current rate]% |

| Mesa | [current rate]% |

| Scottsdale | [current rate]% |

Property Taxes: Assessing Real Estate

Property taxes are another crucial component of Arizona’s tax landscape. These taxes are levied on the value of real estate properties, including land and buildings. The Arizona Department of Revenue assesses property values, and the tax rates are set by local governments, primarily counties.

The property tax rates in Arizona can vary significantly based on the location and the type of property. Residential properties, for instance, may have different tax rates compared to commercial or industrial properties. The average effective property tax rate in Arizona is [current rate]%, which is relatively lower than the national average.

Comparative Analysis: Arizona’s Tax Position

When comparing Arizona’s tax system to other states, several key factors come into play. Understanding these comparisons can provide valuable insights for individuals and businesses considering relocation or investment opportunities.

State Income Tax: A Progressive Approach

Arizona’s progressive state income tax system sets it apart from states with flat tax rates. While a progressive system may be beneficial for individuals with lower incomes, it can also result in higher tax liabilities for those in higher income brackets. States like Florida, for instance, have no state income tax, making them attractive for high-income earners.

Sales Tax: A Varied Landscape

The sales tax rates in Arizona can be significantly different from those in neighboring states. For example, California has a higher base sales tax rate of [current rate]%, while Nevada has no state-level sales tax, relying solely on local taxes. This variability can impact consumer behavior and business operations, especially for cross-border commerce.

Property Taxes: Regional Variations

Arizona’s property tax rates, while generally lower than the national average, can vary significantly within the state. This regional disparity is a common trend across the US, with states like New Jersey and Texas having notably higher property tax rates. The variations in property taxes can influence real estate investment strategies and homeownership costs.

The Impact on Businesses and Residents

Arizona’s tax system has a profound impact on both businesses and residents. For businesses, the tax structure can influence their operating costs, profitability, and growth potential. The varying tax rates across different sectors and jurisdictions can present both opportunities and challenges.

Residents, on the other hand, bear the direct impact of the state's tax policies. The income tax rates, sales taxes, and property taxes collectively shape their financial obligations and overall cost of living. Understanding these tax implications is crucial for individuals when making financial decisions, planning for retirement, or considering relocation.

Attracting Businesses and Investors

Arizona’s tax system, with its progressive income tax and relatively lower sales and property taxes, can be attractive to certain businesses and investors. The state’s approach to taxation can encourage economic growth, job creation, and investment opportunities, particularly in sectors like technology, healthcare, and tourism.

Future Implications and Considerations

As Arizona’s economy continues to evolve, so too will its tax landscape. The state’s tax policies are subject to ongoing review and potential reforms to adapt to changing economic conditions, demographic shifts, and emerging industries.

One key consideration is the impact of remote work and digital nomadism on Arizona's tax revenue. With more individuals and businesses operating remotely, the state may need to reevaluate its tax policies to ensure a fair and sustainable revenue stream. Additionally, the ongoing debate surrounding state and local tax policies, including potential reforms like the elimination of certain taxes, will shape Arizona's future tax landscape.

Staying Informed and Prepared

For individuals and businesses alike, staying informed about Arizona’s tax system and potential changes is essential. Keeping abreast of tax laws, regulations, and amendments ensures compliance, minimizes risks, and allows for proactive financial planning. Regular consultation with tax professionals and industry experts can provide valuable insights and guidance in navigating Arizona’s tax landscape.

How does Arizona’s tax system compare to neighboring states like California and Nevada?

+Arizona’s tax system differs significantly from its neighboring states. While California has a higher sales tax rate and no state income tax, Nevada relies solely on local sales taxes and has no state-level sales tax. Arizona’s progressive income tax system sets it apart, with varying rates based on income brackets.

What are the key advantages of Arizona’s tax structure for businesses and investors?

+Arizona’s tax structure offers a balanced approach, with a progressive income tax system that can be advantageous for businesses and investors. The relatively lower sales and property taxes can make Arizona an attractive destination for economic growth and investment opportunities, particularly in sectors like technology and tourism.

How does Arizona’s property tax system impact real estate investments and homeownership?

+Arizona’s property tax system, with its lower average rates compared to the national average, can be beneficial for real estate investors and homeowners. The varying rates across the state, however, can influence investment strategies and homeownership costs, with some regions offering more favorable tax rates than others.