Does Texas Have Property Tax

Texas, known for its diverse landscapes, thriving cities, and strong sense of independence, is home to a wide range of property owners, from residential homeowners to commercial businesses and landowners. One of the key considerations for property owners in Texas is the state's unique approach to property taxation. The property tax system in Texas operates differently from many other states, and understanding how it works is essential for both current and prospective property owners.

The Texas Property Tax System: A Comprehensive Overview

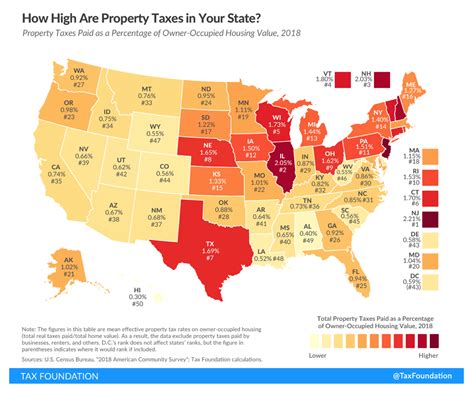

The property tax system in Texas is a complex yet integral part of the state’s fiscal framework. Unlike some other states that rely heavily on income or sales taxes, Texas relies predominantly on property taxes to fund essential services, including public education, local government operations, and infrastructure development.

At its core, the property tax system in Texas is a local tax, meaning it is administered by local governments, primarily counties and cities. These local entities are responsible for assessing property values, collecting taxes, and distributing the revenue to various taxing units, such as school districts, utility districts, and municipal governments. This decentralized approach to property taxation gives Texas communities a high degree of control over their financial resources and the ability to tailor tax rates to local needs.

Property Tax Assessment Process

The process of determining property taxes in Texas begins with the appraisal process. Each year, local appraisal districts, which are independent political subdivisions, appraise all taxable property within their jurisdiction. This appraisal determines the property’s value, which forms the basis for calculating property taxes.

Appraisers consider various factors when determining a property's value, including its market value, location, and any improvements made to the property. The appraisal process is intended to be fair and equitable, ensuring that similar properties are taxed similarly. However, it's worth noting that the appraisal process can be complex and may involve challenges and appeals, especially for properties with unique characteristics or in rapidly developing areas.

| Taxing Unit | Tax Rate (per $100 of Assessed Value) |

|---|---|

| City of Austin | 0.5415 |

| Travis County | 0.3380 |

| Austin ISD | 1.0623 |

| Total Effective Tax Rate | 1.9418 |

In the example above, the total effective tax rate for a property located in Austin, Texas, is calculated by adding the tax rates of the various taxing units, including the city, county, and school district. This rate is then applied to the property's assessed value to determine the annual property tax bill.

Tax Rates and Collections

After the appraisal process, local taxing units set their tax rates, which are expressed as a percentage of the property’s assessed value. These tax rates, also known as tax levies, are approved by the local governing bodies, such as city councils or county commissioners. The tax rates are designed to generate sufficient revenue to cover the budgetary needs of the taxing units, including schools, roads, and public safety services.

Once the tax rates are set, property owners receive their tax bills, which detail the assessed value of their property, the applicable tax rates, and the total amount due. Property taxes in Texas are typically due twice a year, with specific due dates set by each taxing unit. Late payments may incur penalties and interest, and in some cases, unpaid taxes can result in tax liens or even property foreclosure.

Property Tax Exemptions and Discounts

To promote homeownership and provide relief to certain property owners, Texas offers a range of property tax exemptions and discounts. These include homestead exemptions, which reduce the taxable value of a homeowner’s primary residence, and exemptions for senior citizens, disabled veterans, and charitable organizations. Additionally, some counties offer tax deferrals or freeze programs for eligible homeowners, allowing them to defer or limit increases in their property taxes.

For example, in Texas, homeowners who qualify for the Over-65 Homestead Exemption can exclude up to $25,000 of their home's value from taxation. This exemption provides significant savings for seniors, making homeownership more affordable and helping them maintain financial stability in their golden years.

Challenges and Reforms in Texas Property Taxation

The Texas property tax system, while effective in many ways, has faced criticism and scrutiny over the years. One of the primary concerns is the potential for high property tax burdens, particularly in areas with rapidly increasing property values. As property values rise, so do the tax bills, sometimes leading to unaffordable situations for homeowners and businesses.

Addressing Property Tax Burdens

To address these concerns, Texas has implemented various reforms and initiatives. One notable example is the Property Tax Code, which establishes guidelines and limitations for local taxing units. The code sets maximum tax rate increases for various taxing entities, ensuring that tax burdens do not escalate excessively from year to year. It also provides for public hearings and opportunities for property owners to voice their concerns and provide input on proposed tax rates.

Furthermore, Texas has explored alternative funding mechanisms to supplement property taxes. The state has invested in various revenue sources, including oil and gas production taxes, sales taxes, and franchise taxes, to reduce the reliance on property taxes and provide a more balanced approach to funding public services.

The Impact of COVID-19 on Property Taxation

The COVID-19 pandemic has presented unique challenges for property taxation in Texas. With economic disruptions and job losses, many property owners have faced financial hardships, leading to concerns about their ability to pay property taxes. In response, Texas has implemented measures to provide relief and flexibility during this unprecedented time.

Local taxing units have been encouraged to offer payment plans and deferrals to assist property owners struggling with financial difficulties. Additionally, the state has provided resources and guidance to help taxpayers understand their rights and options during the pandemic. These measures aim to strike a balance between ensuring the continued operation of essential services and providing relief to taxpayers in need.

The Future of Property Taxation in Texas

As Texas continues to grow and evolve, the property tax system will remain a critical component of the state’s fiscal landscape. Ongoing discussions and reforms will shape the future of property taxation, with a focus on fairness, transparency, and responsiveness to the needs of Texas communities.

Potential Reforms and Innovations

Looking ahead, Texas may explore further reforms to enhance the property tax system. This could include initiatives to streamline the appraisal process, improve transparency in tax rates and assessments, and provide additional relief for vulnerable property owners. Additionally, with advancements in technology, there may be opportunities to leverage digital tools and data analytics to enhance the efficiency and accuracy of property tax administration.

One potential innovation is the implementation of a property tax cap, which would limit the annual increase in property taxes to a certain percentage. This measure could provide predictability for property owners and help prevent sudden and significant increases in tax burdens. However, such a cap would need careful consideration to ensure it does not hinder the ability of local governments to fund essential services.

Conclusion: Navigating the Texas Property Tax Landscape

The property tax system in Texas is a dynamic and complex mechanism that plays a vital role in funding local services and infrastructure. While it offers local control and a stable revenue source, it also presents challenges and opportunities for improvement. As a property owner in Texas, staying informed about the tax system, understanding your rights and responsibilities, and engaging with local tax authorities are essential steps in navigating this landscape successfully.

By staying up-to-date with tax reforms, exemptions, and relief programs, property owners can make informed decisions and take advantage of opportunities to reduce their tax burdens. Additionally, participating in the public engagement process and providing feedback on tax proposals can help shape a more equitable and sustainable property tax system in Texas.

Frequently Asked Questions

How often do property taxes change in Texas?

+Property taxes in Texas can change annually. Local taxing units, such as cities and school districts, set their tax rates each year based on their budgetary needs. These rates can increase, decrease, or remain the same from one year to the next.

Are there any online resources to help calculate property taxes in Texas?

+Yes, there are several online resources available to help property owners estimate their tax obligations. These tools typically require inputting the property’s location, value, and applicable tax rates to provide an estimated tax amount. However, it’s important to note that these estimates are not official and may not reflect the final tax bill.

What happens if I can’t pay my property taxes on time in Texas?

+If you are unable to pay your property taxes on time in Texas, it’s important to contact your local taxing authority as soon as possible. They may offer payment plans or deferral options to assist you. Failure to pay taxes can result in penalties, interest, and, in some cases, a tax lien or foreclosure on your property.

Are there any property tax exemptions available for seniors in Texas?

+Yes, Texas offers several property tax exemptions specifically for senior citizens. The most common is the Over-65 Homestead Exemption, which allows eligible seniors to exclude a portion of their home’s value from taxation. Additionally, there are exemptions for disabled veterans and charitable organizations.

Can I appeal my property’s assessed value in Texas if I believe it’s inaccurate?

+Absolutely! If you believe your property’s assessed value is inaccurate, you have the right to appeal the appraisal. The process typically involves submitting an appeal to your local appraisal district, providing evidence and arguments to support your case. It’s advisable to consult with a tax professional or legal advisor for guidance on the appeal process.