How To Calculate Property Gain Tax

Understanding how to calculate property gain tax is crucial for property owners and investors. This comprehensive guide will walk you through the process, explaining the key concepts, formulas, and strategies to help you navigate the complex world of property taxation.

Understanding Property Gain Tax

Property gain tax, also known as capital gains tax, is a tax levied on the profits or gains made from the sale of a property. It is an essential consideration for anyone involved in real estate transactions, as it can significantly impact the overall financial outcome.

When you sell a property, the profit or gain is calculated by subtracting the purchase price (adjusted for certain expenses) from the sale price. This gain is then subject to taxation, and the amount owed depends on various factors, including the holding period, property type, and applicable tax laws.

Let's delve deeper into the process of calculating property gain tax and explore the key steps and considerations.

Step 1: Determining the Property’s Acquisition Cost

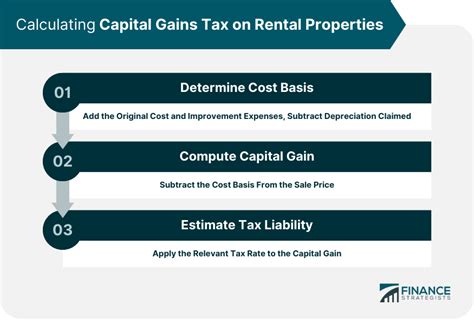

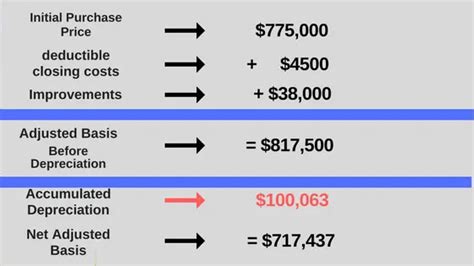

The first step in calculating property gain tax is to establish the acquisition cost of the property. This includes the original purchase price, any additional costs incurred during the acquisition process, and adjustments for improvements or repairs made to the property.

For example, let's consider a property purchased for $500,000. Additional costs during acquisition, such as legal fees and transfer taxes, amount to $10,000. Furthermore, improvements made to the property over the years, including a new roof and kitchen renovation, total $50,000. Thus, the adjusted acquisition cost would be $560,000.

Step 2: Calculating the Property’s Sale Price

The next step is to determine the sale price of the property. This is typically the price agreed upon by the buyer and seller, excluding any additional costs or commissions associated with the sale.

Imagine our property is sold for $700,000. This sale price represents the income or gain from the transaction, which will be subject to property gain tax calculations.

Step 3: Identifying Adjustments and Exclusions

Not all expenses and costs are considered when calculating property gain tax. Certain adjustments and exclusions may be applicable, depending on the jurisdiction and specific circumstances.

For instance, some jurisdictions allow for the exclusion of a certain amount of gain on the sale of a primary residence. Additionally, expenses directly related to the sale, such as real estate agent commissions and legal fees, may be deductible.

Let's assume our jurisdiction allows for an exclusion of $250,000 on the sale of a primary residence. Furthermore, the real estate agent commission for our property sale is $20,000, and there are $5,000 in legal fees associated with the transaction.

Step 4: Calculating the Property Gain

With the acquisition cost, sale price, and applicable adjustments and exclusions in hand, we can now calculate the property gain.

Using the example figures, we can calculate the property gain as follows:

| Property Gain Calculation | |

|---|---|

| Sale Price | $700,000 |

| Adjusted Acquisition Cost | $560,000 |

| Property Gain | $140,000 |

In this case, the property gain is $140,000, which represents the profit made from the sale.

Step 5: Determining the Taxable Gain

Not all property gains are taxed at the same rate. The taxable gain is calculated by applying the applicable tax rates and any relevant deductions or exemptions.

For instance, let's assume the tax rate for our property is 15% on the first $50,000 of gain and 20% on any gain above that amount. We can calculate the taxable gain as follows:

| Taxable Gain Calculation | |

|---|---|

| Property Gain | $140,000 |

| Tax Rate on First $50,000 | 15% |

| Tax Rate on Gain Above $50,000 | 20% |

| Taxable Gain | $19,000 (first $50,000) + $30,000 (gain above $50,000) = $49,000 |

In this example, the taxable gain is $49,000, which is subject to the respective tax rates.

Step 6: Paying Property Gain Tax

Once the taxable gain is determined, it is important to pay the corresponding property gain tax. This can typically be done through the appropriate tax authority or by including it in your annual tax return.

For our example, the property gain tax owed would be calculated as follows:

| Property Gain Tax Calculation | |

|---|---|

| Taxable Gain | $49,000 |

| Tax Rate on First $50,000 | 15% |

| Tax Rate on Gain Above $50,000 | 20% |

| Property Gain Tax Owed | $7,350 (15% of first $50,000) + $9,800 (20% of gain above $50,000) = $17,150 |

Therefore, the property gain tax owed for our example property would be $17,150.

Strategies for Minimizing Property Gain Tax

While understanding how to calculate property gain tax is crucial, it’s equally important to explore strategies to minimize the tax burden. Here are some approaches to consider:

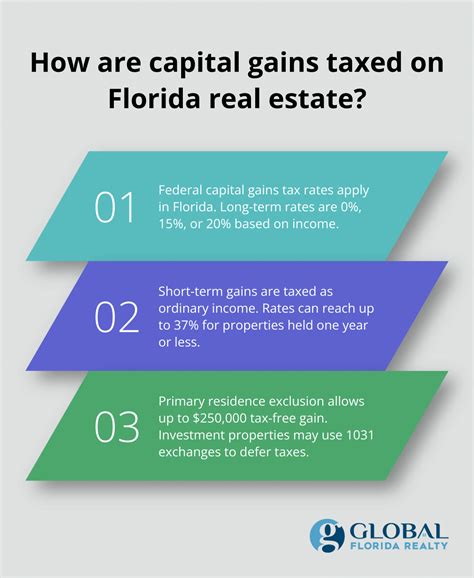

- Hold Periods: Different jurisdictions may have varying tax rates or exemptions based on the holding period of the property. Understanding these rules can help you strategize the timing of your property sale.

- Cost Basis Adjustments: Keep detailed records of improvements and repairs made to the property. These expenses can help increase your cost basis, reducing the taxable gain.

- Section 1031 Exchanges: In some jurisdictions, like the United States, a Section 1031 Exchange allows you to defer capital gains tax by reinvesting the proceeds from a property sale into a similar property.

- Primary Residence Exclusion: Many countries offer an exclusion or exemption for the sale of a primary residence. Understanding the criteria and requirements can help you maximize this benefit.

- Tax Loss Harvesting: If you have multiple properties, consider selling a property at a loss to offset gains from other properties. This strategy can help reduce your overall tax liability.

Real-World Examples and Case Studies

To illustrate the concepts further, let’s explore a few real-world examples and case studies:

Example 1: Long-Term Investment Property

Imagine an investor who purchased an investment property for 300,000 10 years ago. Over the years, they made significant improvements, totaling 80,000. The property is now valued at $600,000, and the investor decides to sell.

By calculating the property gain tax, they can understand the financial implications. Using the adjusted acquisition cost ($380,000) and the sale price ($600,000), the property gain is $220,000. With a favorable tax rate structure, the investor can minimize their tax liability through strategic planning.

Example 2: Primary Residence Sale

A homeowner decides to sell their primary residence, which they purchased for 450,000 15 years ago. They made various improvements, including a new kitchen and solar panels, totaling 75,000. The property is now worth $800,000, and the homeowner is eligible for the primary residence exclusion.

By understanding the tax implications, the homeowner can calculate the property gain tax and plan accordingly. With the exclusion, they can significantly reduce their taxable gain, resulting in a lower tax burden.

Case Study: Real Estate Investment Trust (REIT)

REITs are popular investment vehicles that own and operate income-generating real estate. Understanding property gain tax is crucial for REITs, as they can impact their financial performance and investor returns.

By analyzing the tax strategies employed by successful REITs, investors can gain insights into how to navigate the complex world of property taxation. This includes understanding the tax benefits of REIT structures and the impact of property gain tax on dividend distributions.

Future Implications and Trends

The world of property taxation is constantly evolving, and it’s important to stay informed about future implications and trends. Here are some key considerations:

- Tax Reform: Governments may introduce tax reforms or changes to capital gains tax regulations. Staying updated on these reforms can help property owners and investors adapt their strategies accordingly.

- Inflation and Property Values: Inflation can impact property values, potentially affecting the calculation of property gain tax. Understanding the relationship between inflation and property values is crucial for accurate tax calculations.

- Technology and Tax Software: The use of technology and specialized tax software can streamline the property gain tax calculation process. These tools can help ensure accuracy and provide valuable insights for tax planning.

Conclusion

Calculating property gain tax is a complex process that requires a thorough understanding of tax laws, regulations, and strategies. By following the steps outlined in this guide and staying informed about the latest trends, property owners and investors can navigate the world of property taxation with confidence.

Remember, it's essential to consult with tax professionals and seek expert advice to ensure compliance and optimize your tax strategy. Stay informed, stay proactive, and make informed decisions to maximize your financial outcomes.

How often do I need to calculate property gain tax?

+

Property gain tax is typically calculated at the time of property sale. However, it’s important to keep accurate records and calculate potential gains periodically to stay informed and plan accordingly.

Are there any tax benefits for property owners?

+

Yes, many jurisdictions offer tax benefits and incentives for property owners. These can include deductions for mortgage interest, property taxes, and certain expenses. It’s important to consult with tax professionals to understand the specific benefits available in your region.

What is the difference between short-term and long-term capital gains tax rates?

+

Short-term capital gains tax rates typically apply to properties held for a shorter period, often less than a year. These rates are often higher compared to long-term capital gains tax rates, which apply to properties held for a longer duration, often exceeding a specified time frame (e.g., one year or more). Consult with tax professionals to understand the specific rates and holding periods in your jurisdiction.