Wake County Nc Real Estate Tax Bill

Real estate tax bills are an essential aspect of property ownership, and understanding them is crucial for homeowners and investors alike. In Wake County, North Carolina, the real estate tax system is designed to fund various local services and infrastructure projects. This comprehensive guide will delve into the specifics of the Wake County real estate tax bill, providing valuable insights for property owners and those considering investing in the area.

Understanding the Wake County Real Estate Tax Structure

The real estate tax system in Wake County is governed by the county government and serves as a primary source of revenue for the local community. Property taxes are calculated based on the assessed value of the property and the applicable tax rate, which varies depending on the property’s location and usage.

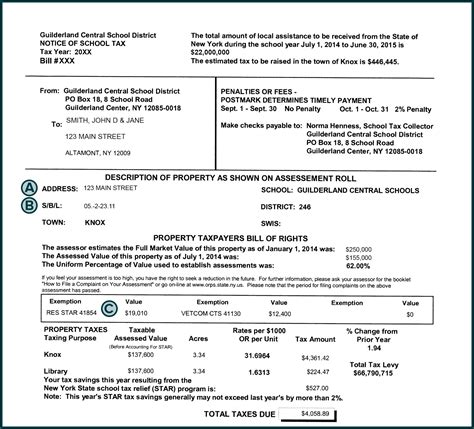

Here's a breakdown of the key components of the Wake County real estate tax bill:

- Assessed Value: The assessed value of a property is determined by the Wake County Tax Assessor's Office. This value is typically based on the property's fair market value, considering factors such as location, size, improvements, and recent sales of similar properties. The assessed value is not the same as the purchase price or appraised value.

- Tax Rate: The tax rate is set annually by the Wake County Board of Commissioners and can vary across different areas within the county. It is expressed as a percentage of the assessed value and includes both county and municipal tax rates. For instance, a property in Raleigh might have a different tax rate compared to a property in Cary or Wake Forest.

- Taxable Value: The taxable value is calculated by applying any applicable exemptions or deductions to the assessed value. Common exemptions include the homestead exemption for primary residences and certain property tax relief programs for elderly or disabled homeowners.

- Tax Amount: The tax amount is the final figure homeowners are responsible for paying. It is calculated by multiplying the taxable value by the tax rate and considering any additional fees or surcharges. This amount is then divided into installments, with due dates typically set for the beginning of each fiscal year.

Real Estate Tax Bill Components in Detail

To better understand the Wake County real estate tax bill, let’s explore each component in depth:

Assessed Value Determination

The Wake County Tax Assessor’s Office conducts periodic assessments to determine the fair market value of properties. These assessments consider various factors, including:

- Property type: Residential, commercial, industrial, or agricultural.

- Property size: Total square footage and land area.

- Improvements: Additions, renovations, or upgrades made to the property.

- Comparable sales: Recent sales of similar properties in the area.

- Location: Neighborhood, proximity to amenities, and overall desirability.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting evidence and supporting documentation to the Wake County Board of Equalization and Review.

Tax Rate and Its Variations

The tax rate in Wake County is set by the Board of Commissioners and is subject to change annually. It is composed of both county and municipal tax rates. For instance, in the 2023 fiscal year, the countywide tax rate was 47.68 cents per $100 of assessed value, while individual municipalities may have their own additional tax rates.

| Municipality | Tax Rate (cents per $100) |

|---|---|

| Raleigh | 53.94 |

| Cary | 44.86 |

| Garner | 48.86 |

| Wake Forest | 56.44 |

| Apex | 53.94 |

It's important to note that tax rates can vary based on the property's location and whether it is within a municipality or the unincorporated county area.

Exemptions and Deductions

Wake County offers various exemptions and deductions to reduce the taxable value of properties, benefiting eligible homeowners. Here are some common exemptions:

- Homestead Exemption: Property owners who use their home as their primary residence can apply for the homestead exemption, which reduces the taxable value by up to $25,000.

- Elderly/Disabled Exemption: Eligible senior citizens or permanently disabled individuals may qualify for an additional exemption, further reducing their taxable value.

- Veteran's Exemption: Veterans who meet certain criteria can receive an exemption based on their military service.

- Agricultural Exemption: Property used for agricultural purposes may be eligible for a reduced tax rate.

It's crucial to research and understand the specific requirements and application processes for these exemptions to determine eligibility.

Payment Options and Due Dates

Wake County offers several payment options for real estate tax bills, providing flexibility to property owners. Here are the primary methods:

- Online Payment: Property owners can make secure online payments through the Wake County Tax Office website. This method allows for convenient payment with a credit or debit card.

- Mail-in Payment: Taxpayers can mail their payments to the Wake County Tax Office. It's essential to include the correct remittance slip and ensure timely delivery to avoid late fees.

- In-Person Payment: Visit the Wake County Tax Office during regular business hours to make payments in person. This option allows for direct interaction with tax officials.

- Automatic Payment Plans: Property owners can enroll in automatic payment plans, which deduct the tax amount from their bank account on the due date.

The due dates for real estate tax bills in Wake County are typically set for January 5th and August 1st of each year. Failure to pay by the due date may result in penalties and interest charges.

Real Estate Tax Bill Analysis and Tips

Understanding your real estate tax bill is crucial for effective financial planning. Here are some tips and insights to help you navigate the process:

Reviewing Your Bill

When you receive your real estate tax bill, take the time to carefully review it. Ensure that the assessed value, tax rate, and applicable exemptions are accurate. If you notice any discrepancies, contact the Wake County Tax Office promptly.

Tax Bill Calculation

To calculate your real estate tax bill, use the following formula:

Tax Bill = (Assessed Value - Exemptions) x Tax Rate

For example, if your property has an assessed value of $300,000, and you qualify for a $25,000 homestead exemption, your taxable value would be $275,000. With a tax rate of 50 cents per $100, your tax bill would be calculated as follows:

Tax Bill = ($275,000 x 0.50) = $137,500

Strategies for Reducing Tax Burden

While real estate taxes are a necessary obligation, there are strategies to minimize their impact on your finances:

- Appeal Your Assessed Value: If you believe your property's assessed value is too high, consider appealing it. Gather evidence, such as recent sales of similar properties, to support your case.

- Explore Exemptions: Research and apply for any exemptions for which you may be eligible. This could include the homestead exemption, elderly/disabled exemption, or other specific programs.

- Consider Payment Options: Evaluate the different payment methods and choose the one that aligns best with your financial situation. Automatic payment plans can help ensure timely payments and avoid late fees.

Future Implications and Trends

Understanding the historical context and future trends of real estate taxes in Wake County can provide valuable insights for property owners and investors. Here’s an overview:

Historical Context

Over the past decade, Wake County has experienced steady growth in property values, leading to increases in real estate tax revenue. The county’s commitment to infrastructure development and service improvements has contributed to this growth. As a result, the tax burden has generally risen for property owners, although exemptions and deductions have helped mitigate the impact.

Future Trends

Looking ahead, several factors may influence real estate taxes in Wake County:

- Population Growth: Wake County's population is projected to continue growing, which may drive demand for housing and commercial properties. This could lead to increased property values and, consequently, higher tax revenue.

- Infrastructure Investments: The county's ongoing commitment to infrastructure projects, such as road improvements, public transportation, and green spaces, may result in stable or slightly increased tax rates to fund these initiatives.

- Economic Factors: Economic conditions, both locally and nationally, can impact property values and, subsequently, real estate taxes. A strong economy may lead to higher property values, while economic downturns could result in adjustments to tax rates.

- Government Initiatives: The Wake County government may introduce new programs or initiatives aimed at supporting specific demographics or promoting economic development. These initiatives could impact tax rates and exemptions.

Conclusion

The Wake County real estate tax system is a crucial aspect of property ownership, funding essential services and infrastructure projects. By understanding the components of your real estate tax bill, exploring exemptions, and staying informed about future trends, you can effectively manage your tax obligations and make informed decisions as a property owner or investor in Wake County.

How often are real estate tax assessments conducted in Wake County?

+Real estate tax assessments are typically conducted every three years in Wake County. However, certain circumstances, such as new construction or significant improvements, may trigger an interim assessment.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting an application to the Wake County Board of Equalization and Review, along with supporting documentation and evidence.

Are there any tax relief programs for elderly or disabled homeowners in Wake County?

+Yes, Wake County offers specific tax relief programs for eligible elderly or permanently disabled homeowners. These programs provide additional exemptions or reductions in taxable value. To qualify, individuals must meet certain income and residency requirements.

What happens if I fail to pay my real estate tax bill on time?

+Late payments of real estate taxes may result in penalties and interest charges. If the tax remains unpaid, the county may initiate legal actions, including tax liens or foreclosure proceedings.

How can I stay updated on changes to real estate tax rates and exemptions in Wake County?

+Stay informed by regularly visiting the Wake County Tax Office website, which provides updates on tax rates, exemptions, and important deadlines. Additionally, subscribing to local news sources and following relevant county government announcements can help you stay abreast of any changes.