Bexar Tax Collector

The Bexar Tax Collector's Office plays a crucial role in the financial and administrative landscape of Bexar County, Texas. With a responsibility to collect various taxes and fees, this office ensures the efficient and transparent management of public funds, contributing to the overall economic stability and growth of the region.

An Overview of the Bexar Tax Collector’s Role and Responsibilities

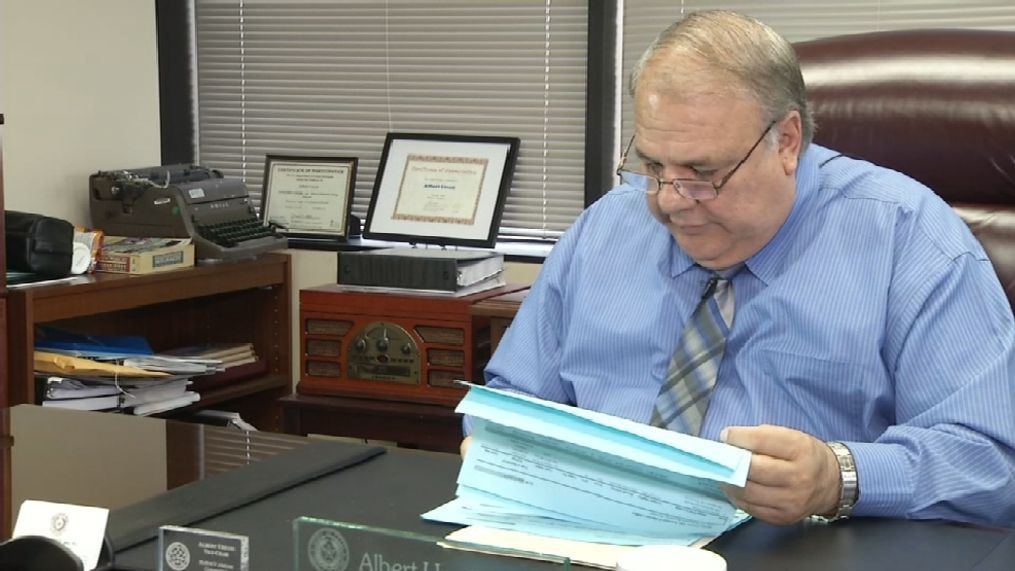

The Bexar Tax Collector, an appointed official, is entrusted with the critical task of overseeing the collection and disbursement of taxes and fees mandated by local, state, and federal governments. This includes property taxes, vehicle registration fees, and other miscellaneous taxes. The office’s primary goal is to facilitate a seamless and accessible process for taxpayers while also ensuring compliance with tax regulations.

In the context of property taxes, the Tax Collector's Office assesses properties, calculates tax liabilities, and issues tax bills to property owners. This process involves a thorough evaluation of property values, taking into account factors such as location, improvements, and market conditions. Property owners are then responsible for making timely payments, which the Tax Collector's Office diligently records and accounts for.

Furthermore, the office handles vehicle registration and titling, ensuring that all vehicles operating within Bexar County are properly registered and titled. This involves verifying vehicle information, processing registration applications, and issuing registration stickers and titles. The Tax Collector's Office also collects and enforces the payment of vehicle-related fees and penalties, ensuring compliance with state and local regulations.

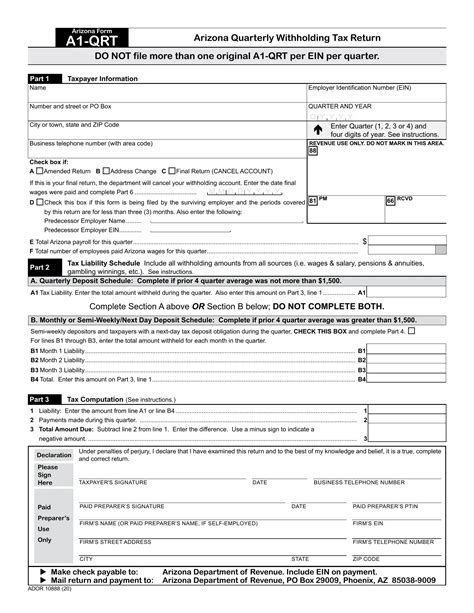

Beyond these core responsibilities, the Tax Collector's Office also manages various other tax collections, including sales tax, business taxes, and special assessments. Each of these tax types has its own unique collection process, and the office ensures that these processes are efficiently managed, with accurate record-keeping and timely disbursement of funds to the appropriate entities.

The Bexar Tax Collector's Office is committed to providing excellent customer service, offering assistance and guidance to taxpayers throughout the year. Whether it's answering queries about tax liabilities, providing payment plans for taxpayers facing financial hardships, or resolving disputes, the office aims to make the tax payment process as smooth and transparent as possible.

The Impact of Technology on Tax Collection in Bexar County

In recent years, the Bexar Tax Collector’s Office has embraced technological advancements to streamline tax collection processes and enhance efficiency. The adoption of online platforms and mobile applications has revolutionized the way taxpayers interact with the office, providing them with convenient, secure, and accessible options for tax payment and information retrieval.

For instance, taxpayers can now access their property tax records, view their tax bills, and make payments online, anytime, anywhere. This not only saves taxpayers time and effort but also reduces the need for in-person visits to the Tax Collector's Office, thereby improving overall operational efficiency.

Moreover, the use of digital platforms has enabled the Tax Collector's Office to implement various initiatives aimed at improving transparency and accountability. Taxpayers can now track the status of their payments, view detailed transaction histories, and receive real-time updates on their tax liabilities. This increased transparency fosters trust and confidence in the tax collection process, ensuring that taxpayers feel more connected to and informed about their financial obligations.

Additionally, the integration of technology has allowed the Tax Collector's Office to automate certain processes, reducing the potential for human error and improving accuracy. For example, automated valuation models and assessment tools are used to ensure that property values are assessed fairly and accurately, leading to more equitable tax burdens for property owners.

Looking ahead, the Bexar Tax Collector's Office is committed to continuing its digital transformation journey, exploring new technologies and innovative solutions to further enhance the tax collection process. By staying at the forefront of technological advancements, the office aims to provide an even more efficient, effective, and user-friendly service to the residents and businesses of Bexar County.

Tax Relief Programs and Initiatives for Bexar County Residents

Recognizing the financial challenges that many residents face, the Bexar Tax Collector’s Office has implemented several tax relief programs and initiatives to provide assistance and support to those in need. These programs are designed to offer relief to qualifying individuals and families, helping them manage their tax liabilities and avoid financial hardship.

One such initiative is the Property Tax Deferral Program, which allows eligible senior citizens and disabled individuals to defer the payment of their property taxes until the sale of their home or their passing. This program provides much-needed financial relief, especially for those on fixed incomes, by reducing the immediate burden of property tax payments.

The office also offers a variety of payment plans and options for taxpayers who are unable to pay their taxes in full. These plans allow taxpayers to spread out their payments over a specified period, making it more manageable to fulfill their tax obligations. The Tax Collector's Office works closely with taxpayers to find a plan that suits their individual financial circumstances, ensuring that everyone has the opportunity to comply with tax regulations.

Furthermore, the office actively promotes awareness of various tax credits and exemptions available to qualifying residents. These credits and exemptions can significantly reduce the tax burden for eligible individuals and families, providing much-needed financial relief. The Tax Collector's Office provides resources and guidance to help residents understand and claim these benefits, ensuring they receive the full extent of the tax relief they are entitled to.

In addition to these programs, the Bexar Tax Collector's Office also organizes outreach events and community workshops to educate residents about their tax obligations and available relief options. These initiatives aim to empower residents with the knowledge and tools they need to manage their taxes effectively, fostering a sense of financial empowerment and responsibility.

The Future of Tax Collection: Innovations and Challenges

As the field of tax collection continues to evolve, the Bexar Tax Collector’s Office is poised to embrace new innovations and adapt to changing dynamics. With the rapid advancements in technology and an increasingly globalized economy, the office is focused on staying ahead of the curve to provide efficient and effective services to the community.

One of the key areas of focus is the implementation of blockchain technology. Blockchain offers a secure and transparent platform for tax collection, providing an immutable record of transactions and ensuring the integrity of tax data. By leveraging blockchain, the Tax Collector's Office can enhance security, reduce fraud, and improve overall operational efficiency.

Additionally, the office is exploring the use of artificial intelligence (AI) and machine learning algorithms to streamline tax assessment and collection processes. These technologies can automate repetitive tasks, such as data entry and document processing, freeing up resources for more complex and value-added activities. AI-powered systems can also analyze large datasets to identify patterns and trends, aiding in more accurate tax assessments and improved revenue forecasting.

However, with these innovations come challenges. The Tax Collector's Office must navigate the complexities of implementing new technologies while ensuring data security and privacy. It is crucial to strike a balance between technological advancement and maintaining the trust and confidence of taxpayers. As such, the office is committed to investing in robust cybersecurity measures and privacy protection protocols to safeguard sensitive taxpayer information.

Moreover, as the tax landscape becomes increasingly complex, the Bexar Tax Collector's Office is dedicated to fostering a culture of continuous learning and professional development. This involves staying abreast of changing tax regulations, both at the local and federal levels, and providing comprehensive training and support to staff members. By investing in its workforce, the office can ensure that it remains equipped to handle the evolving demands of tax collection and provide the highest level of service to the community.

Conclusion: Embracing Progress, Ensuring Transparency

The Bexar Tax Collector’s Office stands at the forefront of tax collection, leveraging technology and innovation to enhance efficiency and transparency. By embracing digital transformation and adopting cutting-edge solutions, the office is revolutionizing the way taxes are collected and managed, making the process more accessible, secure, and user-friendly.

As the office continues to evolve, it remains committed to its core mission of serving the residents and businesses of Bexar County. Through its dedicated efforts, the Bexar Tax Collector's Office is not only ensuring the financial stability of the region but also fostering a culture of compliance and trust. With a focus on continuous improvement and a commitment to excellence, the office is well-positioned to meet the challenges of the future and deliver exceptional services to the community it serves.

What are the office hours of the Bexar Tax Collector’s Office?

+The Bexar Tax Collector’s Office is open from Monday to Friday, 8:00 AM to 5:00 PM, excluding public holidays. The office also provides extended hours during tax season to accommodate the needs of taxpayers.

How can I pay my property taxes in Bexar County?

+You can pay your property taxes online through the Bexar County Tax Office website, by mail, or in person at the Tax Collector’s Office. Online payments are accepted via credit card, debit card, or e-check. In-person payments can be made by cash, check, or money order.

Are there any tax relief programs for senior citizens in Bexar County?

+Yes, the Bexar Tax Collector’s Office offers the Property Tax Deferral Program, which allows eligible senior citizens to defer their property tax payments until the sale of their home or their passing. To qualify, individuals must be 65 years or older and meet certain income and asset criteria.

How can I obtain a vehicle registration in Bexar County?

+To obtain a vehicle registration in Bexar County, you need to visit the Bexar Tax Collector’s Office with the required documents, including a valid driver’s license, proof of insurance, and the vehicle title. The office will process your application and issue a registration sticker and certificate of title.