Tax In Washington State 2020

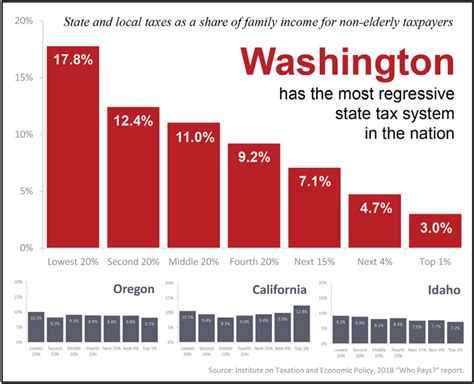

Washington State is renowned for its diverse economy, scenic beauty, and unique tax system. In 2020, the state's tax structure underwent several significant changes, impacting individuals and businesses alike. Let's delve into the intricacies of Washington's tax landscape during this pivotal year, exploring the key features, rates, and implications for taxpayers.

Understanding Washington’s Tax System in 2020

Washington’s tax system is distinct from many other states in the U.S. as it does not levy a personal income tax. Instead, the state relies heavily on sales tax, business taxes, and property taxes to generate revenue. This unique approach has implications for residents and businesses, shaping the economic landscape of the state.

In 2020, Washington's tax system was characterized by a range of tax rates and regulations, some of which were subject to change due to legislative actions and economic fluctuations. Here's an overview of the key components:

Sales Tax

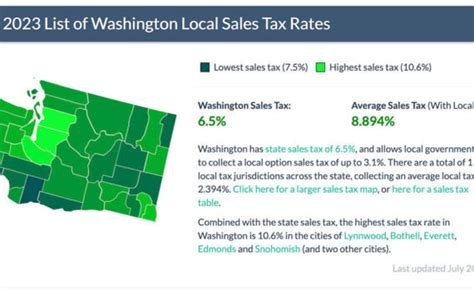

Sales tax is a significant revenue generator for Washington. The state sales tax rate in 2020 was 6.5%, applied to most retail transactions. However, it’s important to note that local sales tax rates could vary, with some areas imposing additional taxes, leading to a combined rate of up to 10.4% in certain jurisdictions.

| Sales Tax Rate | Combined Rate |

|---|---|

| State Sales Tax: 6.5% | Varies up to 10.4% |

Certain items, such as groceries, prescription drugs, and medical devices, are exempt from sales tax, offering some relief to taxpayers. Additionally, Washington has a unique tax structure for certain services, including internet access and streaming services, which were subject to a 6.5% tax.

Business and Occupation (B&O) Tax

Washington’s Business and Occupation (B&O) tax is a gross receipts tax, levied on businesses based on their revenue. The B&O tax is a key component of the state’s revenue stream, contributing significantly to its overall tax income. In 2020, the B&O tax rates varied depending on the type of business activity:

| Business Activity | B&O Tax Rate |

|---|---|

| Retail Sales | 0.471% |

| Manufacturing | 0.484% |

| Service and Other Activities | 1.5% |

Businesses with multiple activities often have to calculate their B&O tax liability based on a complex formula that takes into account the different rates for each activity.

Property Tax

Property tax is another vital source of revenue for Washington. The state’s property tax system is based on the assessed value of real estate and personal property. The tax rate varies by jurisdiction, with the average effective rate in 2020 being approximately 1.11% of the assessed value.

Property tax in Washington is often subject to various exemptions and limitations. For instance, homeowners may qualify for a homestead exemption, which provides a partial exemption from property taxes, and certain agricultural lands are eligible for a lower tax rate.

Other Taxes

In addition to the aforementioned taxes, Washington levies several other taxes, including:

- Excise Taxes: These are taxes on specific goods and services, such as fuel, tobacco, and alcohol.

- Inheritance Tax: Washington has an inheritance tax, which is a tax on the right to receive property from a deceased person's estate.

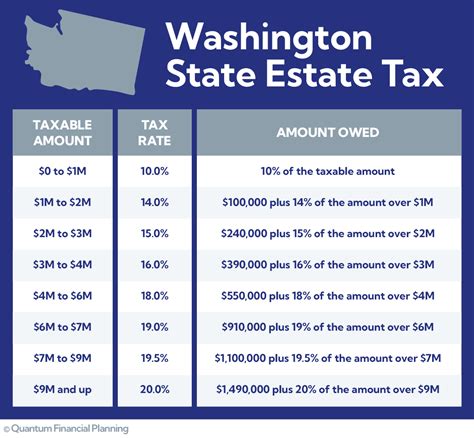

- Estate Tax: The state also imposes an estate tax, which is a tax on the transfer of a decedent's property.

- Vehicle Excise Tax: This tax is levied on the ownership or use of vehicles and is based on the vehicle's value.

Impact of Tax Changes in 2020

The year 2020 brought about several notable tax changes in Washington, some of which were temporary measures in response to the economic challenges posed by the COVID-19 pandemic, while others were part of long-term tax reforms.

COVID-19 Tax Relief Measures

In response to the pandemic, Washington implemented various tax relief measures to support businesses and individuals. These included:

- Temporary suspension of certain business and occupation (B&O) tax rates for impacted industries.

- Waiving late payment penalties for certain taxes, including sales and use tax, B&O tax, and public utility tax.

- Extending tax filing and payment deadlines for individuals and businesses.

- Offering sales tax exemptions for certain personal protective equipment (PPE) and remote learning equipment.

Long-Term Tax Reforms

Beyond the pandemic-related measures, Washington also saw several long-term tax reforms in 2020, aimed at addressing issues such as tax fairness and revenue stability.

- The Capital Gains Tax was introduced, imposing a 7% tax on long-term capital gains exceeding $250,000 for individuals and $500,000 for couples. This tax is intended to contribute to education funding.

- The state implemented a new Sales Tax Fairness Act, requiring out-of-state sellers to collect and remit sales tax on remote sales to Washington residents.

- The Property Tax Relief Program was expanded, providing additional relief to low-income homeowners and certain businesses.

Analysis and Implications

Washington’s tax system in 2020 presented both challenges and opportunities for taxpayers. The absence of a personal income tax can be advantageous for individuals, especially those in higher tax brackets, but it also places a heavier burden on sales and business taxes.

The varying tax rates and structures can make tax compliance complex, particularly for businesses with multiple activities or those selling to customers in multiple jurisdictions. However, the state's tax system also offers opportunities for strategic tax planning, such as taking advantage of tax incentives and exemptions.

Future Outlook

As Washington continues to evolve its tax system, several key trends and potential reforms are on the horizon. Here’s a glimpse into the future of Washington’s tax landscape:

Potential Tax Reform

There have been ongoing discussions about introducing a personal income tax in Washington, which could significantly impact the state’s tax structure. While such a reform has faced opposition, it remains a topic of debate, especially in light of the state’s growing budget needs.

Tax Fairness Initiatives

Efforts to enhance tax fairness are likely to continue. This includes further reforms to ensure that online sellers collect and remit sales tax, as well as ongoing discussions about tax incentives and exemptions to support specific industries or social causes.

Economic Recovery Measures

As Washington recovers from the economic impacts of the pandemic, it’s possible that some of the temporary tax relief measures may be extended or made permanent. This could provide ongoing support for businesses and individuals still facing financial challenges.

Property Tax Reform

The state’s property tax system is a frequent subject of debate. Potential reforms could include adjustments to assessment methods, tax rates, or exemptions, aiming to make the system more equitable and sustainable.

In conclusion, Washington's tax system in 2020 was characterized by a unique set of tax rates and regulations, offering both challenges and opportunities for taxpayers. As the state continues to navigate economic challenges and pursue long-term tax reforms, taxpayers can expect a dynamic tax landscape in the coming years.

What is the current sales tax rate in Washington State for 2023?

+

As of 2023, the statewide sales tax rate in Washington remains at 6.5%. However, it’s important to note that local sales tax rates can vary, with some areas imposing additional taxes, resulting in a combined rate of up to 10.4% in certain jurisdictions.

Are there any income taxes in Washington State?

+

No, Washington State does not have a personal income tax. The state relies on other taxes, such as sales tax, business taxes, and property tax, to generate revenue.

What is the Business and Occupation (B&O) tax in Washington, and how does it work?

+

The Business and Occupation (B&O) tax is a gross receipts tax levied on businesses based on their revenue. The tax rate varies depending on the type of business activity, with rates ranging from 0.471% for retail sales to 1.5% for service and other activities.

Are there any tax incentives or exemptions in Washington for specific industries or activities?

+

Yes, Washington offers various tax incentives and exemptions. For example, certain industries like manufacturing may be eligible for reduced B&O tax rates. Additionally, there are tax exemptions for items like groceries, prescription drugs, and medical devices. It’s advisable to consult with a tax professional to explore all available incentives and exemptions.