Oklahoma Tax Percentage

In the Sooner State, taxes play a significant role in shaping the financial landscape for both residents and businesses. Understanding the tax structure is crucial for making informed financial decisions and planning. This article aims to delve into the specifics of Oklahoma's tax system, exploring the various tax percentages that apply to different aspects of life in the state.

Oklahoma’s Tax Structure: An Overview

Oklahoma’s tax system is a comprehensive framework designed to generate revenue for the state’s operations and public services. It encompasses a range of taxes, each with its own set of rules and rates. Let’s break down the key components of the state’s tax structure.

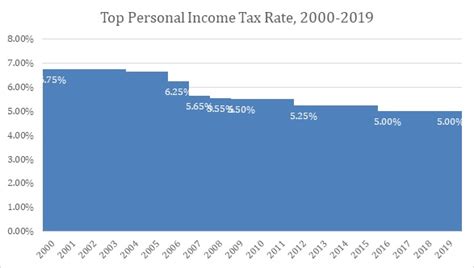

State Income Tax

One of the primary sources of revenue for the state is the Oklahoma Income Tax. This tax is levied on the income earned by individuals, businesses, and other entities. The state’s income tax structure is progressive, meaning that higher income brackets are subject to higher tax rates. As of the current tax year, the state income tax rates range from 0.5% to 5%, depending on taxable income.

For example, let’s consider a hypothetical individual, John, who resides in Oklahoma City and has an annual income of $50,000. Based on the state’s income tax brackets, John would fall into the 3.5% tax bracket for the majority of his income, with a portion subject to the lower rate of 0.5% due to the progressive nature of the tax system.

Sales and Use Tax

Oklahoma imposes a Sales and Use Tax on the sale of tangible personal property and certain services. This tax is collected by businesses and remitted to the state. The statewide sales tax rate is currently set at 4.5%, but it’s important to note that local governments can levy additional sales taxes, resulting in varying effective rates across the state.

Imagine Sarah, a resident of Tulsa, purchasing a new laptop for 1,000. With a combined state and local sales tax rate of <strong>8.5%</strong>, Sarah would pay an additional <strong>85 in taxes on top of the laptop’s price.

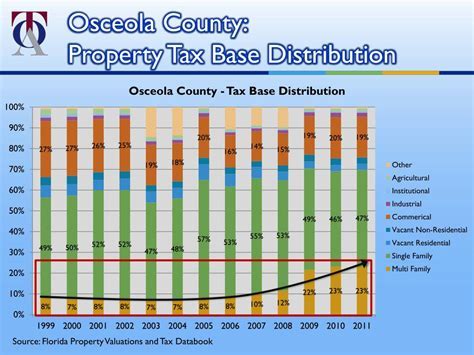

Property Tax

Property taxes are another significant component of Oklahoma’s tax landscape. These taxes are levied on real estate, personal property, and certain intangible property. The tax rates for property taxes vary across the state, as they are determined by local government entities such as counties and municipalities.

Let’s take the example of Mike, a homeowner in Oklahoma County. The property tax rate in Oklahoma County is 1.25% of the assessed value of the property. If Mike’s home has an assessed value of 200,000, he would owe <strong>2,500 in property taxes annually.

| Tax Type | Rate |

|---|---|

| State Income Tax | 0.5% - 5% |

| Sales and Use Tax | 4.5% (statewide) |

| Property Tax | Varies by county (e.g., 1.25% in Oklahoma County) |

The Impact of Tax Percentages

The tax percentages in Oklahoma have a tangible impact on the financial well-being of residents and the overall economy. Let’s explore some key aspects where these tax rates make a difference.

Consumer Spending and Business Operations

The sales and use tax rates directly influence consumer spending habits and business operations. Higher sales tax rates can deter consumers from making certain purchases, especially for high-value items. For businesses, these taxes can impact pricing strategies and overall profitability.

Consider a small business owner, Emily, who operates a local retail store in Oklahoma. With a competitive sales tax rate, she can offer more attractive pricing compared to online retailers, encouraging local spending and supporting her business.

Real Estate Market and Homeownership

Property taxes play a crucial role in the real estate market and homeownership. Higher property tax rates can make homeownership less affordable, especially for those on fixed incomes. Conversely, lower rates can encourage homeownership and stabilize the housing market.

Take the case of David, a first-time homebuyer in Oklahoma. A competitive property tax rate, combined with affordable housing prices, makes it more feasible for him to enter the housing market and achieve the dream of homeownership.

Economic Development and Investment

The tax structure, including income and sales taxes, can influence economic development and investment decisions. Competitive tax rates can attract businesses and investors, fostering economic growth. Conversely, high tax rates may deter investment and hinder economic expansion.

For instance, a large technology corporation considering expansion may choose Oklahoma over other states due to its favorable tax climate, creating job opportunities and contributing to the state’s economic prosperity.

Future Considerations and Tax Reform

As Oklahoma’s economy and demographics evolve, there is an ongoing discussion about tax reform and its potential impact on the state’s financial landscape. Here are some key considerations for the future:

Simplifying the Tax Structure

Some experts advocate for simplifying Oklahoma’s tax structure to make it more transparent and easier to understand for taxpayers. This could involve consolidating tax brackets or standardizing local sales tax rates across the state.

Tax Incentives for Economic Growth

Offering targeted tax incentives, such as tax credits or reduced tax rates for specific industries or investment projects, can attract businesses and stimulate economic growth. These incentives can be particularly effective in attracting high-tech industries or renewable energy projects.

Addressing Tax Equity Concerns

Ensuring tax equity is crucial to maintaining fairness in the tax system. This involves regularly reviewing tax rates and structures to prevent undue burdens on certain income levels or industries. Addressing tax equity concerns can help foster a more balanced and sustainable tax system.

What are the current state income tax brackets in Oklahoma?

+The state income tax brackets in Oklahoma for the current tax year are as follows: 0.5%, 1.25%, 2.5%, 3.5%, and 5%.

Are there any sales tax holidays in Oklahoma?

+Yes, Oklahoma does have sales tax holidays. These are designated periods when certain items, such as school supplies or energy-efficient appliances, are exempt from sales tax. The dates and eligible items vary each year, so it’s advisable to check the official state website for updates.

How often are property tax rates reassessed in Oklahoma?

+Property tax rates in Oklahoma are typically reassessed every year. The assessed value of properties can change based on market conditions, and this directly influences the property tax rates.