Dallas Property Tax Lookup

The city of Dallas, Texas, is renowned for its vibrant culture, diverse neighborhoods, and bustling business districts. However, property ownership in this dynamic metropolis comes with a unique set of responsibilities, including understanding and managing property taxes. The Dallas Property Tax Lookup system is an invaluable tool for residents, businesses, and investors, offering transparency and ease of access to crucial tax information. In this comprehensive guide, we will delve into the intricacies of the Dallas Property Tax Lookup system, exploring its features, benefits, and how it empowers property owners to navigate the tax landscape with confidence.

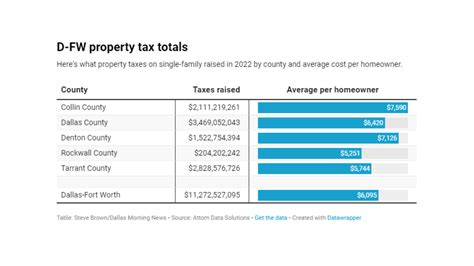

Understanding the Dallas Property Tax Landscape

Dallas, like many other cities, operates on a complex property tax system that varies depending on the property’s location, type, and value. These taxes fund essential city services, infrastructure development, and public institutions. Navigating this system can be challenging, but the Dallas Property Tax Lookup serves as a centralized, user-friendly platform to streamline the process.

The city's tax system is administered by the Dallas Central Appraisal District (DCAD), which assesses property values annually. These assessments are then used by various taxing entities, including the city itself, to determine the tax rates and, subsequently, the property tax bills. Understanding this process is crucial for property owners, as it directly impacts their financial obligations and planning.

Introducing the Dallas Property Tax Lookup System

The Dallas Property Tax Lookup is an innovative online platform developed to provide property owners and interested parties with real-time access to critical tax-related information. It serves as a one-stop resource, offering a wealth of data and tools to simplify the often-complex world of property taxes.

Key Features of the Dallas Property Tax Lookup

- Property Search: Users can search for specific properties by address, account number, or even by performing an advanced search with detailed parameters such as owner name, property type, or location.

- Tax Assessment Details: The platform provides transparent access to tax assessment information, including the property’s appraised value, market value, and any exemptions or special valuations applied.

- Tax History: Property owners can view a comprehensive history of their tax payments, including due dates, amounts, and any applicable penalties or discounts.

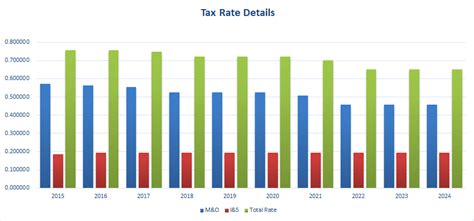

- Tax Rates and Calculations: The system calculates and displays the current tax rates for each property, breaking down the rates by taxing entity, making it easier to understand the distribution of tax obligations.

- Online Payment Portal: Property owners can conveniently pay their taxes online, ensuring timely payments and reducing the risk of late fees.

- Notices and Alerts: The platform offers a notification system, alerting users to important tax-related events, such as assessment notices, payment deadlines, or changes in tax rates.

- Comparison Tools: Users can compare their property’s tax information with similar properties in the area, providing valuable insights into the fairness of their tax assessments.

- Data Visualization: Interactive charts and graphs help users visualize tax trends over time, making it easier to understand the historical context of their tax obligations.

Benefits for Property Owners and Investors

The Dallas Property Tax Lookup offers a multitude of benefits to property owners, both residential and commercial, as well as investors:

- Transparency and Accessibility: Property owners can access their tax information anytime, eliminating the need for manual record-keeping and reducing the risk of lost or misplaced documents.

- Efficient Tax Planning: With real-time data, property owners can better plan their financial strategies, ensuring they have sufficient funds available for tax payments and taking advantage of any available exemptions or discounts.

- Dispute Resolution: If a property owner believes their tax assessment is inaccurate, the platform provides a streamlined process for filing disputes, making it easier to resolve issues promptly.

- Investor Insights: Investors can use the platform to research potential investment properties, gaining valuable insights into tax obligations and the overall financial health of a property before making a purchase decision.

- Community Engagement: The platform fosters a sense of community, allowing property owners to connect and share experiences, providing a support network for navigating the tax landscape.

Navigating the Platform: A Step-by-Step Guide

Let’s walk through the process of utilizing the Dallas Property Tax Lookup system to access and understand your property’s tax information.

Step 1: Accessing the Platform

The Dallas Property Tax Lookup is accessible through the official website of the Dallas Central Appraisal District (DCAD). Simply visit https://www.dallascad.org and navigate to the “Property Tax Lookup” section.

Step 2: Searching for Your Property

On the Property Tax Lookup page, you will find a search bar. You can enter your property’s address, account number, or perform an advanced search using specific criteria. Once you locate your property, you will be directed to its dedicated page.

Step 3: Exploring Property Details

The property page provides a wealth of information, including:

- Property Address and Account Number: Basic details to identify your property.

- Taxable Value: The assessed value of your property for tax purposes.

- Tax Rates: A breakdown of the tax rates applied to your property, including the rates for the city, county, and other taxing entities.

- Tax History: A record of past tax payments, including the dates, amounts, and any applicable discounts or penalties.

- Assessment Notices: Any official notices or changes related to your property's assessment.

Step 4: Paying Your Taxes

The platform offers a convenient online payment option. You can choose to pay your taxes in full or set up a payment plan. The system provides secure payment gateways, ensuring your financial information is protected.

Step 5: Monitoring Tax Changes

To stay informed about any changes to your property’s tax status or upcoming deadlines, enable the notification system. You will receive alerts via email or text, keeping you up-to-date with important tax-related information.

Case Study: A Real-Life Example

Let’s consider a hypothetical scenario to illustrate the practical application of the Dallas Property Tax Lookup system.

Scenario: John, a recent homeowner in Dallas, wants to understand his property tax obligations. He accesses the Property Tax Lookup platform and searches for his property by address. The system provides him with a detailed overview of his property's tax information, including the assessed value, tax rates, and a breakdown of the various taxing entities.

John notices that the assessed value of his property is higher than he expected. He decides to explore the platform further and discovers a section on property tax exemptions. After researching, he realizes that he is eligible for a homestead exemption, which could significantly reduce his tax burden. John proceeds to file for the exemption online, a process made simple and efficient by the platform's user-friendly interface.

As the tax payment deadline approaches, John receives a notification reminding him to pay his taxes. He logs back into the platform, pays his taxes online, and even sets up automatic payments for future tax obligations. With the Dallas Property Tax Lookup, John feels empowered and confident in managing his property taxes, ensuring he meets his financial responsibilities without any unnecessary stress.

Future Implications and Innovations

The Dallas Property Tax Lookup system continues to evolve, incorporating new features and improvements to enhance user experience and streamline the tax process. Some potential future developments include:

- AI-Assisted Tax Assessment: Integrating artificial intelligence algorithms to automate and enhance the accuracy of property assessments, reducing the need for manual inspections.

- Blockchain Integration: Utilizing blockchain technology to create a secure, transparent, and tamper-proof record of property tax transactions, increasing trust and efficiency.

- Mobile App: Developing a dedicated mobile application to provide users with on-the-go access to their property tax information, enabling quick checks and payments.

- Community Collaboration: Encouraging community engagement by allowing users to share tax-related experiences, providing a platform for collective learning and support.

Conclusion: Empowering Property Owners in Dallas

The Dallas Property Tax Lookup system is a powerful tool that empowers property owners, investors, and the community at large. By providing transparent, accessible, and user-friendly tax information, it simplifies the complex world of property taxes. With its innovative features and continuous improvements, the platform ensures that property owners can navigate the tax landscape with confidence, enabling them to focus on what matters most: thriving in the vibrant city of Dallas.

How often are property tax assessments conducted in Dallas?

+Property tax assessments in Dallas are conducted annually by the Dallas Central Appraisal District (DCAD). These assessments determine the property’s taxable value, which forms the basis for tax calculations.

Can I dispute my property’s tax assessment?

+Yes, if you believe your property’s assessment is inaccurate, you can file a protest with the DCAD. The platform provides a step-by-step guide on the protest process, ensuring a fair and transparent resolution.

Are there any tax exemptions available for property owners in Dallas?

+Yes, Dallas offers various tax exemptions, such as the homestead exemption for primary residences and exemptions for seniors, disabled individuals, and veterans. The platform provides detailed information on these exemptions and how to apply for them.

What happens if I miss a tax payment deadline?

+Missing a tax payment deadline may result in penalties and interest charges. The platform sends reminders and notifications to help you stay on track, but it’s essential to pay your taxes on time to avoid additional fees.

Can I pay my property taxes online through the Dallas Property Tax Lookup platform?

+Absolutely! The platform offers a secure online payment portal, allowing you to pay your taxes conveniently from the comfort of your home. You can even set up automatic payments to ensure timely tax submissions.