Los Angeles Sales Tax Rate 2025

The sales tax rate in Los Angeles, California, is a crucial aspect to understand for both residents and businesses, especially when planning for the future. As we look ahead to 2025, it is essential to have a clear picture of the tax landscape to make informed financial decisions. This article aims to provide a comprehensive analysis of the Los Angeles sales tax rate for the year 2025, including its current state, potential changes, and the impact it may have on various sectors.

Understanding the Los Angeles Sales Tax Rate

Sales tax in Los Angeles is a complex system comprising various components. It is primarily composed of two main rates: the state sales tax rate and the local (city) sales tax rate. Additionally, there are special districts and jurisdictions that may impose their own tax rates, adding to the overall complexity.

As of 2023, the state sales tax rate in California stands at 7.25%. This rate is applied uniformly across the state and is used as a baseline for calculating the total sales tax.

On top of the state sales tax, Los Angeles County imposes an additional 0.25% sales tax, bringing the total countywide sales tax to 7.50%. However, it is important to note that Los Angeles County is further divided into various cities and unincorporated areas, each with their own unique tax structures.

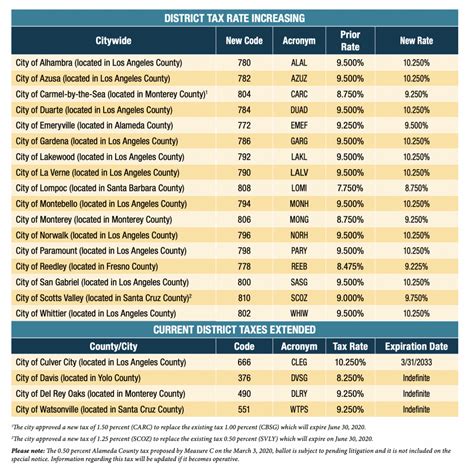

City-Specific Sales Tax Rates in Los Angeles

Within Los Angeles County, different cities have their own sales tax rates, which are added to the countywide rate. These city-specific rates are often implemented to fund local projects, infrastructure, and services.

| City | City Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Los Angeles City | 2.00% | 9.50% |

| Santa Monica | 1.50% | 9.00% |

| Beverly Hills | 3.50% | 11.00% |

| Pasadena | 1.75% | 9.25% |

| Long Beach | 2.00% | 9.50% |

These rates can vary significantly, as seen in the table above, which showcases the total sales tax rates for some of the prominent cities in Los Angeles County. The differences in rates can have a substantial impact on businesses and consumers, influencing their purchasing decisions and overall economic activities.

Projecting the Sales Tax Rate for 2025

Predicting future sales tax rates is a challenging task, as it involves analyzing various economic factors, political decisions, and local initiatives. However, by examining historical trends and considering current economic conditions, we can make informed estimates for the year 2025.

California has a history of relatively stable sales tax rates, with minor adjustments made over the years to account for inflation and fund specific projects. Given this trend, it is reasonable to anticipate that the state sales tax rate of 7.25% will remain unchanged in 2025.

Similarly, Los Angeles County's additional sales tax rate of 0.25% is unlikely to see a significant change. However, it is worth noting that certain cities within the county have been known to periodically adjust their sales tax rates to meet budgetary needs or support specific initiatives.

For instance, the city of Los Angeles increased its sales tax rate by 0.5% in 2013 to fund transportation projects. While such adjustments are rare, they demonstrate the potential for city-specific tax rate changes in the future.

Potential Impact on Businesses and Consumers

Any changes in the sales tax rate, even minor ones, can have a ripple effect on the local economy. For businesses, particularly those operating in multiple cities or counties, differing tax rates can lead to complex tax compliance and reporting processes.

Consumers, on the other hand, may face varying prices for goods and services depending on their location. This can influence consumer behavior, with individuals potentially opting to shop in areas with lower sales tax rates. As a result, businesses may need to adapt their pricing strategies and consider the impact of sales tax on their customer base.

Furthermore, sales tax revenue is a significant source of income for local governments, funding essential services and infrastructure projects. Changes in sales tax rates can directly impact the financial stability and planning of these governments.

Conclusion: Preparing for the Future

As we anticipate the sales tax rates for Los Angeles in 2025, it is evident that while the state and county rates are likely to remain stable, city-specific rates may see some adjustments. This highlights the importance of staying updated on local tax policies and their potential implications.

For businesses, especially those operating in multiple cities, a comprehensive understanding of the sales tax landscape is essential for accurate pricing, tax compliance, and strategic planning. Consumers, too, can benefit from being aware of sales tax rates to make informed purchasing decisions.

As we approach 2025, staying vigilant and informed about sales tax rates will be crucial for both individuals and businesses in Los Angeles, ensuring a smooth and compliant financial journey.

¿Qué impacto puede tener un aumento en la tasa de impuesto de ventas en la economía local?

+Un aumento en la tasa de impuesto de ventas puede tener un impacto significativo en la economía local. Para los negocios, especialmente aquellos con presencia en múltiples ciudades, un aumento en los impuestos puede aumentar los costos operativos y requerir ajustes en los precios. Por otro lado, los consumidores pueden ver un aumento en el costo de los bienes y servicios, lo que podría afectar sus decisiones de compra.

¿Cómo se distribuyen los ingresos generados por los impuestos de ventas en Los Ángeles?

+Los ingresos generados por los impuestos de ventas en Los Ángeles se distribuyen entre el estado de California, el condado de Los Ángeles y las ciudades individuales. El estado recibe la tasa básica, mientras que el condado y las ciudades retienen una porción adicional para financiar sus proyectos y servicios locales.

¿Hay excepciones o artículos exentos del impuesto de ventas en Los Ángeles?

+Sí, en Los Ángeles, como en la mayoría de los lugares, existen excepciones y artículos exentos del impuesto de ventas. Algunos ejemplos incluyen alimentos básicos, medicamentos recetados, ropa infantil y ciertos servicios. Estas excepciones varían según la jurisdicción y pueden estar sujetas a cambios, por lo que es importante estar al tanto de las regulaciones locales.