State Tax Rate Nc

North Carolina, known as the Tar Heel State, is renowned for its diverse landscapes, vibrant cities, and rich cultural heritage. Beyond its picturesque scenery and thriving industries, the state's tax structure plays a crucial role in shaping its economic landscape and the daily lives of its residents.

Understanding North Carolina’s State Tax Rate

When it comes to taxation, North Carolina operates under a progressive income tax system, which means that as your income increases, so does the tax rate you pay. This approach ensures fairness and contributes to the state’s fiscal stability. As of my last update in January 2023, North Carolina had six income tax brackets with corresponding tax rates, as outlined below:

| Income Bracket | Tax Rate |

|---|---|

| First $21,500 | 5.25% |

| $21,501 - $75,000 | 5.49% |

| $75,001 - $125,000 | 5.75% |

| $125,001 - $250,000 | 5.94% |

| $250,001 - $300,000 | 6.04% |

| Over $300,000 | 6.21% |

These tax rates apply to individuals, trusts, and estates. For married couples filing jointly, the income brackets are doubled. It's important to note that these rates may be subject to change, so it's advisable to consult official sources or tax professionals for the most current information.

Sales and Use Tax

In addition to income tax, North Carolina levies a sales and use tax on the purchase of tangible personal property and certain services. The state’s sales tax rate is 4.75%, and this applies to most retail sales. However, it’s worth mentioning that certain counties and municipalities may impose additional local sales taxes, which can vary across the state.

Property Tax

Property taxes in North Carolina are primarily assessed and collected by county governments. The state does not have a separate property tax, but it does have a 5.75% rate on certain real property sales and transfers. The assessment and collection process can vary between counties, and it’s crucial for homeowners and property owners to understand their local tax obligations.

The Impact of North Carolina’s Tax Structure

North Carolina’s tax structure has a profound impact on the state’s economy and its residents’ financial well-being. The progressive income tax system ensures that those with higher incomes contribute a larger share, promoting social and economic fairness. This approach can help fund essential public services and infrastructure development, benefiting the entire state.

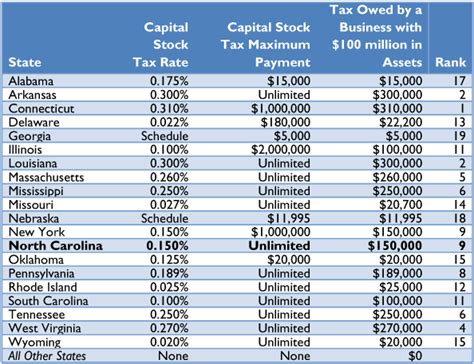

The state's tax system also influences business decisions. A well-managed tax structure can attract new businesses and investments, contributing to economic growth and job creation. However, it's crucial for businesses to carefully consider the tax implications of their operations, including sales tax obligations and potential incentives or deductions.

Navigating Tax Obligations

Understanding and complying with North Carolina’s tax obligations is essential for individuals and businesses alike. Whether it’s filing income tax returns, remitting sales tax, or managing property taxes, staying informed and seeking professional guidance can help avoid potential pitfalls and ensure compliance with state regulations.

For individuals, tax preparation can be simplified by utilizing tax software or engaging a tax professional. Businesses, on the other hand, often require more complex tax strategies and may benefit from consulting accountants or tax advisors who specialize in business taxation.

Conclusion: A Comprehensive Approach to Taxation

North Carolina’s tax structure is a vital component of its economic framework, influencing the state’s growth, development, and financial stability. By understanding the state’s tax rates, brackets, and obligations, individuals and businesses can make informed decisions and contribute effectively to the Tar Heel State’s thriving economy.

As the state continues to evolve and adapt to economic changes, its tax policies will play a pivotal role in shaping its future. Whether you're a resident, a business owner, or simply interested in North Carolina's economic landscape, staying informed about its tax system is a valuable step toward financial literacy and responsible citizenship.

What is the sales tax rate in North Carolina for online purchases?

+The sales tax rate for online purchases in North Carolina is the same as the state’s general sales tax rate, which is 4.75%. However, it’s important to note that local sales tax rates may apply, and these can vary by county or municipality. When making online purchases, it’s advisable to check the applicable sales tax rate for your specific location.

Are there any tax incentives for renewable energy projects in North Carolina?

+Yes, North Carolina offers various tax incentives to promote renewable energy projects. These include a 30% Investment Tax Credit for solar energy systems and a Property Tax Exemption for qualified renewable energy property. It’s recommended to consult the North Carolina Department of Revenue’s website for the most up-to-date information on these incentives.

How often does North Carolina update its tax rates and brackets?

+North Carolina’s tax rates and brackets are subject to periodic review and potential changes. The state legislature has the authority to amend tax laws, and these changes are typically proposed and enacted during legislative sessions. It’s advisable to stay updated through official government sources or tax professionals to ensure you have the most current information.