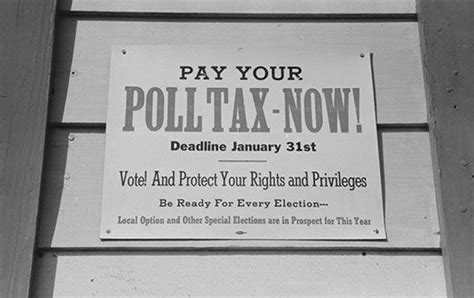

Poll Tax Definition: Understanding Its History, Impact, and Controversies

In a quiet corner of a bustling town hall, an elderly neighbor, Mr. Thompson, vividly recalls a time when his grandparents paid something called the “poll tax” during a period of profound social upheaval. The description of those payments, now decades past, sparks a cascade of questions about what exactly a poll tax is, how it originated, and why it remains a contentious issue in political discourse. These questions underpin a broader exploration of the poll tax’s historical roots, its socio-economic impact, and the myriad controversies that have persisted through generations. To fully understand its multifaceted nature, one must undertake a journey through history, policy analysis, and community perspectives — a journey that reveals much about the intersection of taxation, rights, and societal values.

Defining the Poll Tax: Origin, Nature, and Basic Principles

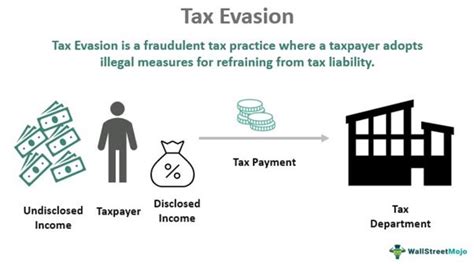

The poll tax, also known as a head tax, fundamentally refers to a fixed sum levied on individuals regardless of income or wealth, payable as a flat fee per person. Its origins trace back to medieval England, where the crown imposed a set charge on villeins and freemen alike, aimed at funding royal expenses and military campaigns. Over time, the poll tax evolved into a tool used by various governments worldwide, often featuring in debates over fairness and economic burden. Unlike income or property taxes, which are progressive and linked to wealth, the poll tax’s flat-rate nature inherently creates regressivity, disproportionately affecting low-income populations.

The Historical Evolution of Poll Taxation

The history of poll tax in modern contexts, especially in the 20th century, underscores its pivotal role in political history and civil rights. The most infamous episode occurred in the United Kingdom during the 1980s and early 1990s, when the government under Prime Minister Margaret Thatcher attempted to replace domestic rates with a uniform poll tax, officially titled the Community Charge. Initially designed to simplify taxation and broaden the revenue base, it met fierce resistance across social strata. Citizens perceived it as unfairly burdensome, especially for the poor and elderly, leading to widespread protests, civil disobedience, and ultimately, the policy’s rejection.

Case Study: The UK Poll Tax Rebellion

The UK poll tax exemplifies how a seemingly straightforward tax can ignite formidable social upheaval. Local councils, empowered to enforce the tax, faced massive resistance. The infamous “Poll Tax Riots” of 1990 symbolized this unrest, prompting a shift back toward more equitable tax systems. This episode highlights the tensions between fiscal policy, social equity, and political legitimacy—concepts that remain central in debates about flat taxes today.

| Relevant Category | Substantive Data |

|---|---|

| Number of protestors | Estimated 200,000 participants during riots in London in 1990 |

| Impact on policy shift | Led to the abolition of the poll tax in favor of council tax reforms by 1993 |

Impact of Poll Tax on Socioeconomic Structures

The effects of a flat-rate tax like the poll tax extend deeply into societal fabric. Economically, it tends to exacerbate income inequality because it doesn’t adjust for ability to pay. Socially, it often triggers protests, particularly among vulnerable populations, and influences political mobilization. For low-income households, paying a fixed fee can mean sacrificing basic necessities, creating a cycle of hardship that can persist across generations.

Economic Analysis: Regresivity and Redistribution

Mathematically, a poll tax’s regressivity is evident as a larger percentage of income is devoted to paying the tax in lower-income brackets. For instance, a fixed 100 poll tax consumes 2% of a household earning 5,000 annually, but 10% of one earning $1,000. This disparity fuels debates over fiscal fairness and calls for mechanisms like exemptions or sliding scales, which somewhat contradict the simplicity and administrative ease touted by proponents.

| Relevant Category | Substantive Data |

|---|---|

| Proportion of income paid | Up to 10% for households at the lowest income levels in flat-rate systems |

| Tax compliance rate | Estimated 85-90%, but non-compliance tends to be higher among impoverished communities |

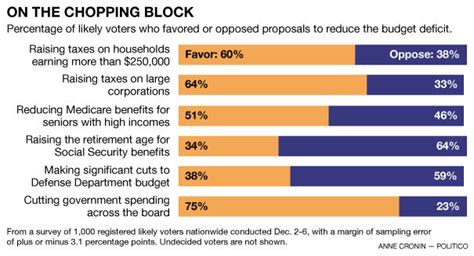

Controversies Surrounding the Poll Tax: Fairness, Equity, and Political Propaganda

The core controversy of the poll tax revolves around fairness and equity. Critics argue that flat taxation ignores income disparities, placing undue burden on marginalized groups. Supporters, however, often frame it as a straightforward, transparent method to fund public services without complex assessments. Tensions escalate when the tax is used as a political tool. In the UK, the introduction of the poll tax was viewed by many as a move away from progressive taxation towards a regressive system, designed ostensibly for efficiency but perceived as a way to suppress dissent among the lower classes.

Political Ramifications and Public Perception

The poll tax’s reputation as an instrument of class division fueled public distrust of policymakers. Populations felt targeted and economically exploited, culminating in widespread protests. These sentiments translated into voting patterns, with opposition parties campaigning explicitly against the tax. The controversy underscores how tax policy is as much about social perception as it is about fiscal efficiency.

| Relevant Category | Substantive Data |

|---|---|

| Public approval rating | Below 30% during peak protests in 1990 |

| Electoral impact | Swing in voter preferences towards parties promising repeal or reform of poll tax policies |

Modern Perspectives and Alternatives to the Poll Tax

Today, the legacy of the poll tax shapes the design of progressive and regressive tax policies. Many countries have abandoned flat head taxes in favor of income or consumption-based taxes that incorporate graduated rates. The advent of modern data collection and digital tax systems allows for more nuanced assessments of ability to pay, making flat taxes less attractive politically or practically.

Innovative Taxation Models Inspired by Poll Tax Lessons

Several jurisdictions explore hybrid models—combining flat fees with income-based adjustments or implementing targeted exemptions—to balance administrative simplicity with fairness. For example, some regions incorporate a basic universal income test coupled with income contingent levies, maneuvering around the pitfalls experienced historically while maintaining transparency. Advances in technology facilitate real-time data integration, decreasing the risks of non-compliance and evasion inherent in past flat-tax systems.

| Relevant Category | Substantive Data |

|---|---|

| Adoption rate of hybrid models | Approximately 15% of modern tax frameworks globally incorporate elements of flat and progressive taxation |

| Efficiency gains | Digital tax systems report up to 30% reduction in collection costs compared to traditional flat taxes |

Addressing the Core Questions: Should the Poll Tax Make a Comeback?

Debates about resurrecting or designing new flat-head taxes often surface amidst economic crises and political upheavals. Advocates tout the low administrative burden and transparency, while opponents cite the risks of social inequity and political exploitation. Evidence suggests that any reintroduction of flat head taxes would necessitate robust safeguards such as exemptions, sliding scales, or complementary progressive measures to mitigate regressivity.

Strategic Considerations for Policymakers

Any decision to implement or reform a poll tax-like system must consider social equity metrics, administrative capacity, and community engagement strategies. Transparency in policymaking and inclusive consultations can alleviate fears and foster acceptance, especially if accompanied by targeted relief programs for vulnerable populations. Ultimately, the question hinges on balancing fiscal efficiency with societal fairness, an ongoing debate at the intersection of economics and ethics.

| Relevant Category | Substantive Data |

|---|---|

| Implementation success factors | Public participation, exemption structures, phased rollouts |

| Economic impact | Potential short-term revenue gains versus long-term social costs |

What is the primary purpose of a poll tax?

+The primary purpose of a poll tax is to generate revenue through a fixed charge on individuals, regardless of income, often used as a means of simplifying taxation or funding specific public projects.

Why has the poll tax been historically controversial?

+Its controversy stems from its regressivity, perceived unfairness, and the social unrest it can provoke, especially when seen as disproportionately burdening low-income groups without adequate safeguards.

Are modern tax systems moving away from flat head taxes?

+Yes, many countries now favor income or consumption-based taxes that incorporate graduated rates and targeted exemptions, leveraging digital technology to improve fairness and efficiency.

Can a hybrid tax system address the shortcomings of the traditional poll tax?

+Hybrid models that combine flat fees with progressive adjustments and technological safeguards can mitigate regressivity while maintaining administrative simplicity, representing a promising direction for modern fiscal policy.