Maine State Sales Tax

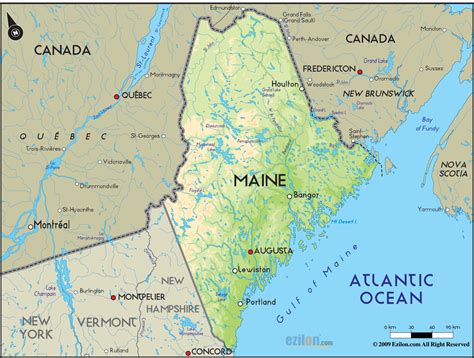

In the United States, each state has its own unique tax system, and Maine is no exception. The state sales tax is an important component of Maine's revenue generation and contributes significantly to its economic landscape. Understanding the intricacies of Maine's sales tax is crucial for businesses, consumers, and anyone interested in the state's fiscal policies. This comprehensive guide will delve into the specifics of Maine's state sales tax, exploring its history, current structure, exemptions, and implications.

Understanding Maine’s Sales Tax System

Maine’s sales and use tax is a consumer tax applied to the sale of tangible personal property, certain services, and rental of property within the state. The tax is collected by the Maine Revenue Services, a state agency responsible for administering and enforcing tax laws. The sales tax is an essential revenue stream for Maine, funding various public services and infrastructure projects.

The history of sales tax in Maine dates back to 1951, when the state first imposed a 2% sales and use tax on retail sales. Over the years, the tax rate has undergone several adjustments, with the most recent change occurring in 2022, when the state implemented a 5.5% sales tax rate, effective from July 1, 2022.

Tax Rate Structure

Maine’s sales tax is generally applied at a uniform rate across the state, with some specific exceptions. As of the latest update, the standard sales tax rate is 5.5%, which is applicable to most transactions. However, certain municipalities have the authority to impose additional local taxes, which can increase the overall tax rate.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 5.5% |

| Local Sales Tax | Varies by Municipality |

For instance, the city of Portland, Maine's largest city, imposes an additional 1% local tax, resulting in a total sales tax rate of 6.5% within the city limits. It's crucial for businesses and consumers to be aware of these local variations to ensure accurate tax compliance.

Taxable Items and Services

Maine’s sales tax applies to a wide range of tangible personal property and services. Some of the commonly taxed items include:

- Clothing and footwear

- Groceries and non-prepared food items

- Vehicles (cars, motorcycles, boats)

- Electronic devices

- Furniture and appliances

- Construction materials

- Services like repairs, installations, and certain professional services

It's important to note that certain items, such as prescription drugs, are exempt from sales tax in Maine. Additionally, the state offers tax holidays during specific periods, where certain items, like school supplies, are tax-free.

Exemptions and Special Considerations

While Maine’s sales tax applies to a broad spectrum of goods and services, there are certain exemptions and special provisions that businesses and consumers should be aware of.

Exemptions for Specific Goods

As mentioned earlier, Maine offers exemptions for certain goods and services. Some of the notable exemptions include:

- Food and beverages: Sales tax is not applicable to unprepared food items, including groceries, produce, and non-alcoholic beverages.

- Prescription drugs: Medications dispensed by pharmacies are exempt from sales tax.

- Manufacturing and wholesale: Sales of tangible personal property in the course of manufacturing or wholesale are generally exempt, as these sales are considered business-to-business transactions.

- Specific services: Certain services, such as legal, accounting, and medical services, are exempt from sales tax.

Taxable Entities and Registration

Any business that sells taxable goods or services in Maine is considered a taxable entity and must register with the Maine Revenue Services to obtain a sales and use tax permit. This permit allows businesses to collect and remit sales tax on behalf of the state. Failure to register and comply with tax laws can result in penalties and legal consequences.

Online Sales and Nexus

With the rise of e-commerce, Maine, like many other states, has implemented regulations regarding online sales. Out-of-state sellers who have a sufficient connection, or nexus, with Maine are required to collect and remit sales tax on transactions with Maine residents. This connection can be established through various factors, such as having a physical presence, employees, or even a certain level of sales within the state.

Compliance and Reporting

Compliance with Maine’s sales tax regulations is essential for businesses to avoid penalties and maintain a positive relationship with the state. Here are some key aspects of compliance and reporting:

Sales Tax Collection

Businesses are responsible for collecting sales tax from customers at the point of sale. This tax is added to the purchase price, and the amount collected should be equal to the applicable tax rate for the customer’s location.

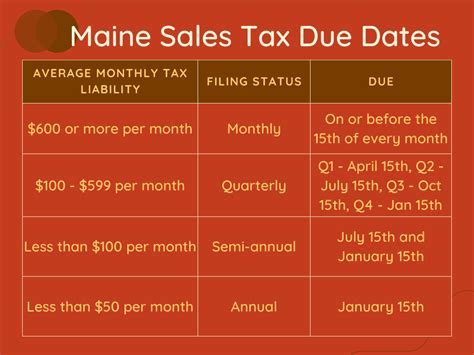

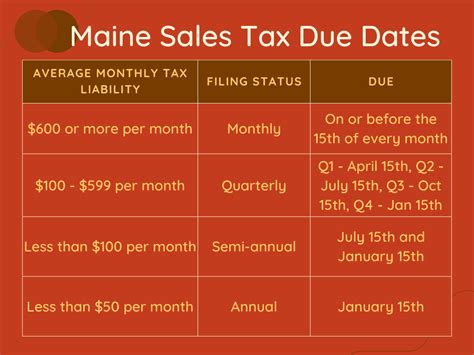

Sales Tax Remittance

Taxes collected from customers must be remitted to the Maine Revenue Services on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to annually. Timely remittance is crucial to avoid penalties and maintain a good standing with the state.

Sales Tax Filing

Along with remitting the collected taxes, businesses are also required to file sales tax returns with the Maine Revenue Services. These returns provide a detailed breakdown of taxable sales, exemptions, and the calculated tax liability. Accurate and timely filing is essential to ensure compliance.

Implications and Future Outlook

Maine’s sales tax system has significant implications for both businesses and consumers. For businesses, especially those operating in multiple locations or online, understanding and complying with Maine’s sales tax laws is crucial for financial planning and legal compliance.

Impact on Businesses

The sales tax system can influence a business’s pricing strategies, as it adds an additional cost to transactions. For businesses with a physical presence in Maine, managing sales tax compliance can be complex, especially with varying local tax rates. Additionally, the burden of collecting and remitting sales tax can impact cash flow and administrative costs.

Consumer Perspective

From a consumer standpoint, the sales tax can affect purchasing decisions and overall spending. The added tax can make certain items more expensive, especially in areas with higher local tax rates. However, the tax also contributes to the funding of public services, which indirectly benefits consumers through improved infrastructure and social programs.

Future Trends and Considerations

Looking ahead, several factors could influence Maine’s sales tax system. One significant trend is the continued growth of e-commerce and the associated challenges of enforcing sales tax on online transactions. Maine, like other states, may need to adapt its regulations to address the complexities of online sales and ensure fair tax collection.

Additionally, the ongoing debate surrounding state-level consumption taxes could impact Maine's sales tax system. Some states are exploring alternative tax structures, such as a value-added tax (VAT) or a gross receipts tax, which could potentially replace or complement the traditional sales tax. Maine's policymakers will need to carefully evaluate these options and their potential impact on the state's economy and revenue generation.

How often do businesses need to remit sales tax in Maine?

+The frequency of sales tax remittance depends on the business’s sales volume. Businesses with high sales may be required to remit taxes monthly, while those with lower sales may remit annually. The Maine Revenue Services provides guidelines and tools to help businesses determine their remittance schedule.

Are there any penalties for late sales tax remittance or filing?

+Yes, late remittance or filing can result in penalties and interest charges. The Maine Revenue Services imposes penalties based on the amount of tax due and the duration of the delay. It’s crucial for businesses to stay on top of their remittance and filing deadlines to avoid these penalties.

Can individuals file for a sales tax refund if they overpay?

+Yes, individuals who believe they have overpaid sales tax can file for a refund. The process involves completing a refund application and providing supporting documentation. The Maine Revenue Services reviews these applications and, if valid, issues a refund to the taxpayer.