Ca Tax Board Payment

The California State Board of Equalization (BOE) is responsible for administering and collecting various taxes in the state, including sales and use tax, property tax, and more. When it comes to making tax payments, individuals and businesses have several options to ensure timely and efficient transactions. This comprehensive guide will walk you through the different methods available for making tax payments to the California Tax Board, providing you with the information needed to navigate the process seamlessly.

Online Payment Options

The California Tax Board offers convenient online payment methods through its official website. These options provide a fast and secure way to make tax payments without the need for physical visits or postal mail.

e-Pay System

The BOE’s e-Pay system is a user-friendly online platform that allows taxpayers to make payments for various tax types, including sales and use tax, cigarette and tobacco tax, and alcohol and beverage tax. Here’s how it works:

- Access the e-Pay portal on the BOE website.

- Create an account or log in if you already have one. This step ensures secure access to your tax information.

- Select the tax type and period for which you need to make a payment.

- Choose your preferred payment method: credit card, debit card, or electronic funds transfer (EFT) from your bank account.

- Follow the on-screen instructions to complete the payment process. The system will guide you through the necessary steps, including entering your payment details and confirming the transaction.

The e-Pay system provides a quick and efficient way to make tax payments, and it’s an excellent option for those who prefer online transactions. It’s important to note that the BOE charges a convenience fee for credit and debit card payments, so opting for EFT can be more cost-effective.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer is a secure and convenient method to pay taxes directly from your bank account. Here’s how to set up an EFT payment:

- Log in to your online banking account or use your bank’s mobile app.

- Locate the option for setting up a new payee or vendor.

- Enter the BOE’s information as the payee. You’ll need to provide the following details:

- Payee Name: California State Board of Equalization

- Payee Address: P.O. Box 942879, Sacramento, CA 94279-0040

- Payee Account Number: Your BOE account number (found on your tax bill or notice)

- Payee Routing Number: 122000496

- Schedule the payment for the desired date and enter the amount you wish to pay.

- Review and confirm the payment details. Your bank will handle the transfer, and the funds will be electronically transferred to the BOE’s account.

EFT payments are typically processed within 1-2 business days and are a cost-effective way to make tax payments without incurring additional fees.

Payment by Mail

If you prefer a more traditional method, you can pay your taxes by mailing a check or money order to the BOE. Here’s what you need to know:

Steps to Pay by Mail

- Obtain a remittance voucher from the BOE website or your tax bill. This voucher ensures that your payment is properly credited to your account.

- Fill out the remittance voucher with your personal or business information, the tax type, and the period for which you are making the payment.

- Make your payment via check or money order, payable to the “California State Board of Equalization.” Ensure that the amount matches the amount due as indicated on your tax bill or notice.

- Include the completed remittance voucher with your payment. This helps the BOE process your payment accurately and quickly.

- Mail your payment and remittance voucher to the address provided on the voucher or the BOE’s website. It’s essential to use the correct mailing address to avoid processing delays.

When paying by mail, allow sufficient time for the BOE to receive and process your payment. It’s recommended to send your payment at least 7-10 days before the due date to ensure timely processing.

Payment by Phone

For those who prefer a more personal approach, the BOE offers the option to make tax payments over the phone. This method provides convenience and allows you to speak with a representative who can guide you through the payment process.

Phone Payment Instructions

- Call the BOE’s toll-free number: 1-800-400-7115. This number is specifically designated for tax payments.

- Follow the automated voice prompts or select the option for making a payment. You may be asked to enter your tax identification number or provide other details to verify your identity.

- Have your credit or debit card information ready if you choose to pay by card. The BOE accepts major credit cards for phone payments.

- Provide the necessary payment details to the representative, including the tax type, period, and the amount you wish to pay.

- Confirm the payment details and complete the transaction. The representative will guide you through the process and ensure your payment is processed securely.

Phone payments are processed in real-time, so you’ll receive immediate confirmation of your payment. However, it’s important to note that phone payments may incur a convenience fee, similar to online credit card payments.

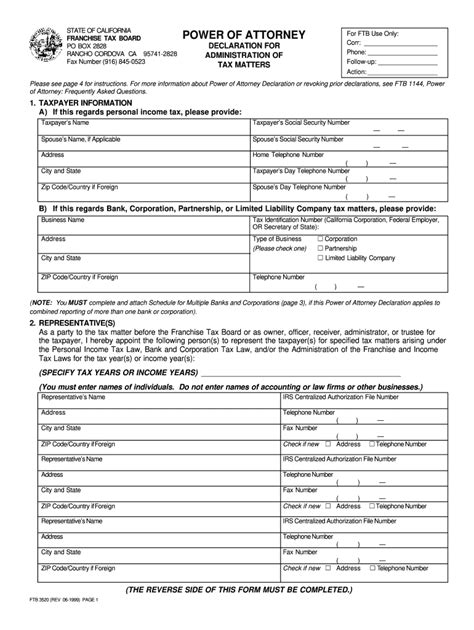

Payment Plans and Installment Agreements

In cases where taxpayers are unable to pay their taxes in full, the BOE offers payment plans and installment agreements. These options provide flexibility and help taxpayers manage their tax obligations over time.

Setting Up a Payment Plan

To establish a payment plan or installment agreement, taxpayers must meet certain eligibility criteria and provide financial information to demonstrate their ability to make regular payments.

- Contact the BOE’s Taxpayer Assistance Center at 1-800-400-7115 or visit their website to request a payment plan.

- Provide the necessary financial documentation, such as income statements, bank statements, and any other relevant information to support your request.

- Work with a BOE representative to determine the terms of your payment plan, including the amount of each installment and the frequency of payments.

- Once approved, make your payments according to the agreed-upon schedule. Late or missed payments may result in penalties and interest, so it’s essential to stay current with your installments.

Payment plans and installment agreements are tailored to the taxpayer’s financial situation and provide a structured approach to resolving tax liabilities. They offer a valuable option for taxpayers facing financial challenges.

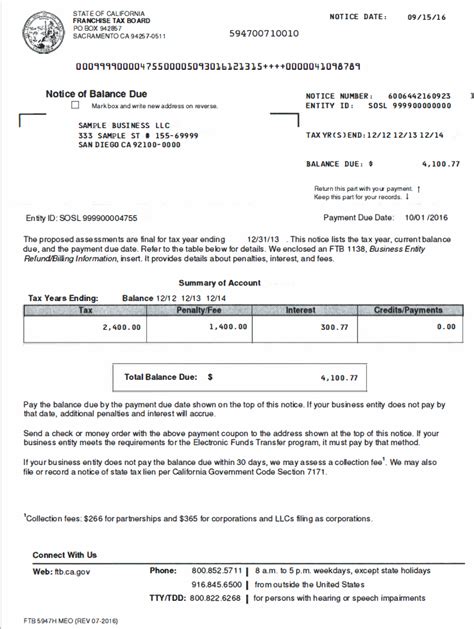

Payment Deadlines and Penalties

Understanding the payment deadlines and potential penalties is crucial to avoid additional costs and legal complications. The BOE imposes penalties and interest for late payments, and these charges can accumulate over time.

Penalty and Interest Charges

When taxpayers fail to pay their taxes by the due date, the BOE assesses penalties and interest on the outstanding balance. The penalty rate is typically 10% of the unpaid tax, and interest accrues at a rate of 1% per month or fraction of a month until the balance is paid in full.

| Penalty Type | Rate |

|---|---|

| Failure to File Penalty | 10% of the unpaid tax |

| Late Payment Penalty | 10% of the unpaid tax |

| Interest | 1% per month |

It’s important to note that penalties and interest are in addition to the original tax amount owed. Therefore, it’s in taxpayers’ best interest to pay their taxes on time to avoid these additional charges.

Conclusion: Navigating Tax Payments with Ease

Making tax payments to the California Tax Board doesn’t have to be a daunting task. With the various payment options available, taxpayers can choose the method that best suits their preferences and financial situation. Whether it’s through online platforms, mail, phone, or payment plans, the BOE aims to provide flexibility and convenience.

Remember to stay organized, keep track of payment deadlines, and utilize the resources provided by the BOE to ensure timely and accurate tax payments. By understanding the different payment methods and being aware of potential penalties, taxpayers can navigate the tax payment process with confidence and avoid unnecessary complications.

Frequently Asked Questions

Can I pay my taxes with a credit card online?

+Yes, the BOE accepts credit card payments online through its e-Pay system. However, a convenience fee applies to credit and debit card payments.

What if I need to make a payment for a specific tax type that isn’t listed in the e-Pay system?

+The e-Pay system covers a wide range of tax types, but if you need to make a payment for a specific tax not listed, contact the BOE’s Taxpayer Assistance Center for guidance. They can provide alternative payment methods or direct you to the appropriate department.

Are there any additional fees for paying taxes by phone?

+Yes, phone payments typically incur a convenience fee, similar to online credit card payments. The fee varies depending on the amount paid, so it’s advisable to consider other payment methods to minimize costs.

Can I make a partial payment if I cannot afford to pay my taxes in full?

+Yes, the BOE understands that taxpayers may face financial challenges. You can make partial payments, but it’s important to communicate with the BOE and consider setting up a payment plan to avoid penalties and interest.

How long does it take for an EFT payment to be processed and reflected on my BOE account?

+EFT payments are typically processed within 1-2 business days. Once the payment is processed, it will be reflected on your BOE account, and you’ll receive a confirmation notification.