Western Australia Tax Calculator

Welcome to the ultimate guide to understanding and navigating the tax landscape of Western Australia. This comprehensive article aims to demystify the tax system and provide you with a detailed insight into the various aspects of taxation in this vibrant state. From income tax brackets to business registration and compliance, we'll explore the intricacies and provide you with the knowledge to make informed financial decisions.

Understanding Western Australia’s Tax Structure

Western Australia, like other Australian states, operates under a comprehensive tax system that encompasses various taxes, each with its own unique characteristics and implications. Let’s delve into the key components of this tax structure.

Income Tax: Unraveling the Brackets

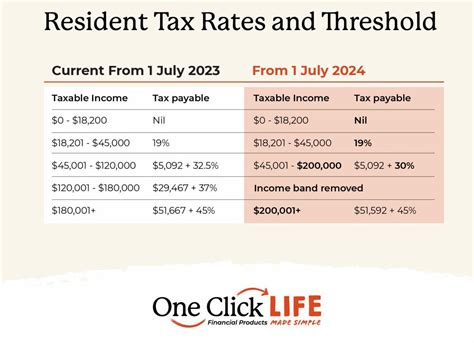

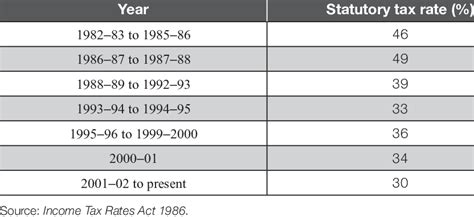

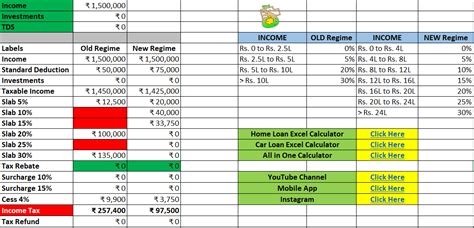

Income tax forms the backbone of Western Australia’s tax revenue. The state follows a progressive tax system, meaning that as your taxable income increases, so does the tax rate applied to that income. Understanding the income tax brackets is crucial for effective financial planning.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $18,200 | 0% |

| $18,201 - $45,000 | 19% |

| $45,001 - $120,000 | 32.5% |

| $120,001 - $180,000 | 37% |

| $180,001 and above | 45% |

These tax brackets are subject to regular review and adjustments by the Australian Taxation Office (ATO). It's essential to stay updated with the latest tax rates to ensure accurate financial planning.

GST: The Goods and Services Tax

The Goods and Services Tax (GST) is a value-added tax applied to most goods and services supplied in Australia. In Western Australia, businesses with an annual turnover exceeding $75,000 are required to register for GST and charge this tax on their supplies. Understanding GST is crucial for businesses to comply with their tax obligations and manage cash flow effectively.

Payroll Tax: Managing Employee Remuneration

Payroll tax is a state-based tax levied on the wages paid by employers to their employees. In Western Australia, employers with a monthly payroll exceeding $7,500 are required to register for payroll tax. The tax is calculated as a percentage of the total wages paid, with rates varying based on the industry and the size of the business.

Land Tax: Property Ownership

Land tax is an annual tax imposed on the ownership of land in Western Australia. This tax applies to individuals, companies, and trustees who own land with a total unimproved value exceeding $379,000. The tax is calculated based on the value of the land and is an important consideration for property investors and landowners.

Stamp Duty: Transactions and Conveyancing

Stamp duty is a state-based tax levied on various transactions, including the purchase of property, vehicles, and certain financial transactions. In Western Australia, stamp duty rates vary depending on the type of transaction and the value of the asset involved. Understanding stamp duty is crucial when engaging in significant transactions to ensure compliance and accurate financial planning.

Tax Compliance and Registration

Ensuring compliance with Western Australia’s tax laws is essential for individuals and businesses alike. Let’s explore the key steps and considerations for effective tax compliance and registration.

Australian Business Number (ABN) Registration

For businesses operating in Western Australia, obtaining an Australian Business Number (ABN) is a crucial step. The ABN is a unique identifier that allows businesses to operate legally, register for various taxes, and engage in transactions. The ABN application process is straightforward and can be completed online through the Australian Business Register (ABR) website.

Tax File Number (TFN) and Superannuation

Individuals working in Western Australia are required to obtain a Tax File Number (TFN) to ensure their income is taxed correctly. The TFN is a unique identifier that allows the Australian Taxation Office (ATO) to track an individual’s tax affairs. Additionally, understanding superannuation contributions and the associated tax implications is essential for effective financial planning.

Business Activity Statements (BAS)

Businesses registered for GST, payroll tax, or other business taxes are required to lodge Business Activity Statements (BAS) periodically. The BAS is a comprehensive report that summarizes the business’s tax obligations, including GST, payroll tax, and fringe benefits tax. Understanding the BAS process and deadlines is crucial for timely compliance and avoiding penalties.

Tax Returns and Lodgment

Whether you’re an individual or a business, lodging tax returns accurately and on time is a critical aspect of tax compliance. Western Australia’s tax returns are typically due by a specific deadline, and late lodgment can result in penalties. Utilizing tax software or engaging a tax professional can simplify the process and ensure compliance.

Maximizing Tax Benefits and Planning

Understanding Western Australia’s tax system opens up opportunities for effective tax planning and maximizing benefits. Let’s explore some strategies and considerations to optimize your tax position.

Tax Deductions and Expenses

Tax deductions and allowable expenses can significantly reduce your taxable income, resulting in lower tax liabilities. From work-related expenses to business deductions, understanding the various deductions applicable to your situation is crucial. Keeping accurate records and utilizing tax software can simplify the process of claiming deductions.

Superannuation Contributions and Strategies

Superannuation contributions are an essential aspect of retirement planning. In Western Australia, individuals can make voluntary contributions to their superannuation funds, which can reduce their taxable income and provide long-term financial benefits. Understanding the different contribution types and strategies can optimize your superannuation planning.

Capital Gains Tax (CGT) and Investment Planning

Capital Gains Tax (CGT) applies to the profit made from the sale of certain assets, including property and shares. In Western Australia, understanding CGT and its implications is crucial for effective investment planning. Strategies such as capital gains discount, rollovers, and concessional tax rates can help minimize the impact of CGT on your investments.

Tax Planning for Business Owners

For business owners in Western Australia, effective tax planning is crucial for long-term success. Strategies such as structuring your business, managing cash flow, and optimizing tax deductions can significantly impact your business’s financial health. Engaging a tax professional or utilizing specialized tax software can provide tailored advice and support.

FAQs

How often do I need to lodge my tax return in Western Australia?

+

In Western Australia, the tax return lodgment deadline is typically October 31st for individual taxpayers. For businesses, the deadline may vary depending on the type of entity and tax obligations. It’s important to stay updated with the latest lodgment requirements to avoid penalties.

Are there any tax incentives for starting a business in Western Australia?

+

Yes, Western Australia offers various tax incentives to encourage business growth and investment. These incentives may include tax concessions, grants, and rebates for specific industries or regions. It’s advisable to consult with a tax professional or the state government’s business development agency for the latest information on available incentives.

How can I calculate my GST liability accurately?

+

Calculating GST liability involves determining the GST-inclusive value of your supplies and the applicable GST rate. For most goods and services, the standard GST rate is 10%. However, certain supplies may have different rates or be exempt from GST. Utilizing tax software or seeking professional advice can ensure accurate GST calculations.

What is the process for disputing a tax assessment in Western Australia?

+

If you disagree with a tax assessment issued by the Australian Taxation Office (ATO), you have the right to lodge an objection. The objection process involves providing detailed reasons and evidence to support your claim. It’s crucial to follow the prescribed objection procedures and seek professional advice to increase the chances of a successful outcome.

Are there any tax breaks for homeowners in Western Australia?

+

Yes, Western Australia offers various tax breaks and incentives for homeowners. These may include concessions on stamp duty for first-time homebuyers, exemptions from land tax for certain types of properties, and energy-efficient home grants. It’s advisable to consult with a tax professional or the state government’s housing authority for the latest information on available homeowner tax benefits.

By delving into the intricacies of Western Australia’s tax system, you now have a comprehensive understanding of the key taxes, compliance requirements, and strategies for effective tax planning. Remember, staying informed, seeking professional advice, and utilizing tax software can simplify your tax journey and maximize your financial opportunities.