Sullivan County Tn Property Tax

Sullivan County, nestled in the beautiful Tennessee landscape, is known for its vibrant communities, diverse landscapes, and thriving real estate market. Property taxes are an essential aspect of owning a home or commercial property in this region, and understanding how they work is crucial for residents and prospective buyers alike. This comprehensive guide will delve into the intricacies of Sullivan County property taxes, providing valuable insights and information to help navigate this complex topic.

Understanding Sullivan County Property Taxes

Property taxes in Sullivan County are a primary source of revenue for local government, funding essential services such as schools, emergency services, and infrastructure development. These taxes are levied annually based on the assessed value of the property, which is determined by the Sullivan County Property Assessor’s Office.

The assessment process involves evaluating the property's market value, taking into account factors like location, size, improvements, and recent sales of similar properties. This assessment is then used to calculate the property tax rate, which is expressed as a percentage of the assessed value.

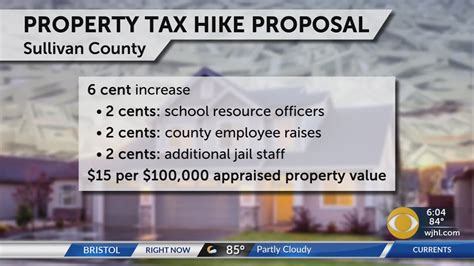

Tax Rate and Assessment

Sullivan County’s property tax rate is set annually by the Sullivan County Commission, taking into consideration the budget requirements of various government departments and services. The rate is typically expressed as dollars per $100 of assessed value, making it easy to calculate the tax liability for any property.

| Sullivan County Tax Rate (2023) | $2.71 per $100 of Assessed Value |

|---|

For example, if a property is assessed at $200,000, the tax liability for that property would be calculated as follows:

$200,000 (Assessed Value) x $2.71 (Tax Rate per $100) = $5,420

So, the property owner would owe $5,420 in property taxes for the year.

Assessment Appeals

If a property owner believes that their property has been overvalued, they have the right to appeal the assessment. The Sullivan County Board of Equalization handles these appeals, providing a formal process for property owners to challenge their assessment.

To initiate an appeal, property owners must submit a written request, along with supporting documentation, within a specified timeframe. The Board of Equalization then reviews the appeal and makes a determination, which can either uphold the original assessment or adjust it accordingly.

Property Tax Exemptions and Discounts

Sullivan County offers various tax exemptions and discounts to eligible property owners, helping to reduce their tax liability. These exemptions are designed to support specific groups and encourage certain types of development.

Homestead Exemption

The Homestead Exemption is a popular tax relief program in Sullivan County, benefiting homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property by a set amount, resulting in lower property taxes.

| Sullivan County Homestead Exemption (2023) | $5,000 |

|---|

For instance, if a homeowner qualifies for the Homestead Exemption, their assessed value would be reduced by $5,000, leading to a lower tax liability.

Veterans and Senior Discounts

Sullivan County shows its appreciation to veterans and senior citizens by offering discounts on property taxes. Veterans who meet certain criteria, such as having a service-connected disability, can receive a discount on their property taxes.

Similarly, senior citizens who are 65 years or older and meet specific income requirements may also be eligible for tax discounts. These discounts can significantly reduce the tax burden for these deserving individuals.

Greenbelt Program

The Sullivan County Greenbelt Program is designed to encourage the preservation of agricultural and forested lands. Property owners who enroll in this program can have their land assessed at its current use value rather than its fair market value, resulting in a lower tax assessment.

This program helps to protect the county's natural resources and promotes sustainable land use practices.

Payment Options and Due Dates

Sullivan County offers various payment options to property owners to ensure convenient and flexible tax payment methods.

Payment Methods

- Online Payments: Property owners can pay their taxes online through the Sullivan County Trustee’s Office website, offering a secure and convenient payment option.

- Mail-in Payments: Tax bills can be mailed along with a check or money order to the Sullivan County Trustee’s Office. Ensure that payments are mailed well in advance of the due date to avoid late fees.

- In-Person Payments: Property owners can visit the Sullivan County Trustee’s Office to make payments in person. This option allows for immediate assistance and resolution of any payment-related queries.

Tax Bill Distribution and Due Dates

Tax bills are typically mailed to property owners in late summer or early fall, providing ample time to make arrangements for payment. The due date for property taxes in Sullivan County is typically in January of each year.

| Sullivan County Property Tax Due Date (2024) | January 31, 2024 |

|---|

Late payments may incur interest and penalties, so it's essential to stay informed about due dates and payment options.

Property Tax Calculator and Resources

Sullivan County provides a property tax calculator on its official website, allowing property owners to estimate their tax liability based on the assessed value of their property and the current tax rate.

Additionally, the Sullivan County Property Assessor's Office and Sullivan County Trustee's Office offer valuable resources and assistance to property owners. These offices provide information on assessment procedures, tax rates, exemptions, and payment options, ensuring that property owners have the necessary knowledge to navigate the property tax system effectively.

Conclusion: Navigating Sullivan County Property Taxes

Understanding the intricacies of Sullivan County property taxes is essential for homeowners and investors alike. From the assessment process to tax exemptions and payment options, this guide provides a comprehensive overview of the property tax system in Sullivan County.

By staying informed and utilizing the resources provided by the county, property owners can ensure they are prepared for their tax obligations and take advantage of any applicable tax relief programs. Remember, knowledge is power when it comes to managing your property tax liability.

How often are property taxes assessed in Sullivan County?

+

Property taxes in Sullivan County are assessed annually. The assessment is based on the property’s value as of January 1st of each year.

Can I pay my property taxes online in Sullivan County?

+

Yes, Sullivan County offers an online payment portal through the Trustee’s Office website. This allows for a convenient and secure way to pay your property taxes.

What happens if I miss the property tax payment deadline?

+

Late payments in Sullivan County may incur interest and penalties. It’s important to stay informed about the due dates and make timely payments to avoid additional charges.

Are there any tax relief programs for seniors in Sullivan County?

+

Yes, Sullivan County offers tax relief programs for senior citizens who meet certain age and income requirements. These programs can provide significant discounts on property taxes.

How can I appeal my property assessment in Sullivan County?

+

To appeal your property assessment, you must file an appeal with the Sullivan County Board of Equalization. The process involves providing supporting evidence to justify a lower assessment. It’s advisable to seek professional advice for a successful appeal.