West Virginia Sales Tax

Welcome to the comprehensive guide on the West Virginia sales tax, a crucial component of the state's tax system. Understanding sales tax is essential for businesses and consumers alike, as it directly impacts their financial obligations and strategies. This article aims to provide an in-depth analysis of West Virginia's sales tax laws, offering a clear overview of its rates, exemptions, collection, and filing processes. We'll delve into the specifics, ensuring you grasp the nuances of this critical tax.

Unraveling the West Virginia Sales Tax

Sales tax in West Virginia is a consumption tax levied on the sale of tangible personal property and certain services. It is an essential revenue stream for the state, contributing significantly to its fiscal health. The tax rate is uniform across the state, making it a straightforward system for taxpayers and businesses.

West Virginia's sales tax rate is currently set at 6%, which is applicable to most goods and services. However, there are certain categories that have unique tax rates, which we will explore in detail later. It's worth noting that while the state tax rate is fixed, local jurisdictions can impose additional sales taxes, which can vary significantly across counties and municipalities.

A Historical Perspective

The history of sales tax in West Virginia is an interesting narrative, reflecting the state’s economic evolution. The sales tax was first introduced in the state in 1933, during the depths of the Great Depression. It was implemented as a temporary measure to boost state revenue, with an initial rate of 2%. Over the decades, the rate has been adjusted several times, with the most recent increase occurring in 2010, when the rate was raised from 6% to 6.5%. However, a subsequent reduction in 2015 brought the rate back down to its current level of 6%.

This historical context is crucial, as it showcases the state's commitment to balancing its fiscal needs with the economic realities faced by its citizens and businesses. The state's sales tax policy has evolved to strike a delicate balance, ensuring that revenue generation does not overly burden its residents.

Taxable Items and Services

West Virginia’s sales tax applies to a broad range of goods and services, including clothing, electronics, furniture, and various retail products. Additionally, it extends to services like repairs, maintenance, and certain professional services. However, there are certain items that are exempt from sales tax, and understanding these exemptions is vital for both businesses and consumers.

For instance, many states exempt groceries and medications from sales tax, and West Virginia is no exception. These exemptions are designed to reduce the tax burden on essential goods and services, making them more affordable for consumers. Additionally, there are specific exemptions for businesses, such as the resale of goods, which we will delve into further.

Local Sales Tax Variations

While West Virginia has a uniform state sales tax rate, it’s important to recognize the impact of local sales taxes. Local governments, including counties and municipalities, have the authority to impose additional sales taxes to fund specific projects or initiatives. These local taxes can significantly impact the overall sales tax rate in a given area.

For example, the city of Charleston, West Virginia, imposes an additional 1% sales tax, bringing the total sales tax rate to 7% within city limits. These local variations can be complex, and businesses operating in multiple jurisdictions must carefully navigate these differences to ensure compliance.

| Jurisdiction | Additional Sales Tax Rate |

|---|---|

| Charleston | 1% |

| Huntington | 0.5% |

| Morgantown | 0.5% |

The table above provides a glimpse of some of the additional sales taxes imposed by major West Virginia cities. These rates are subject to change, and it's crucial to stay updated on local tax laws to avoid any compliance issues.

Exemptions and Special Cases

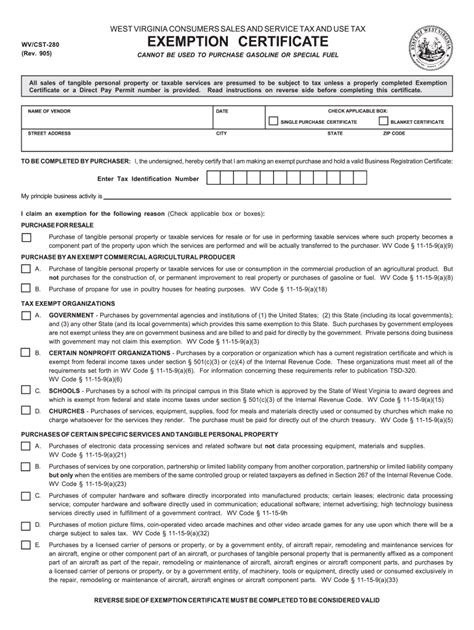

West Virginia’s sales tax regime includes several exemptions and special cases, which can significantly impact a business’s tax liability. Understanding these exemptions is crucial for accurate tax filing and compliance.

For instance, sales tax is generally not applied to sales made to the federal government or to sales made to certain state entities. Additionally, there are specific exemptions for agricultural equipment, manufacturing inputs, and certain types of transportation. These exemptions are designed to support specific industries and encourage economic growth.

One notable exemption is the Resale Exemption. When a business purchases goods for resale, it is not required to pay sales tax on those purchases. This exemption ensures that the tax is ultimately paid by the end consumer, rather than burdening businesses with unnecessary tax obligations.

Sales Tax Collection and Filing

Collecting and filing sales tax is a critical responsibility for businesses operating in West Virginia. The process involves several steps, from registering with the state to remitting the collected taxes.

Registration and Licensing

Before a business can begin collecting sales tax, it must register with the West Virginia State Tax Department. This process involves obtaining a Sales and Use Tax License, which authorizes the business to collect and remit sales tax. The license application requires detailed information about the business, including its legal structure, ownership, and expected sales volume.

Once registered, the business receives a unique license number, which must be displayed prominently at all places of business. This number is crucial for identifying the business in all tax-related communications and transactions.

Tax Collection and Remittance

Once registered, the business is responsible for collecting sales tax from customers at the point of sale. This involves adding the appropriate tax rate to the sale price and displaying it separately on the customer’s receipt. It’s essential to maintain accurate records of all sales transactions, including the tax collected, to ensure compliance.

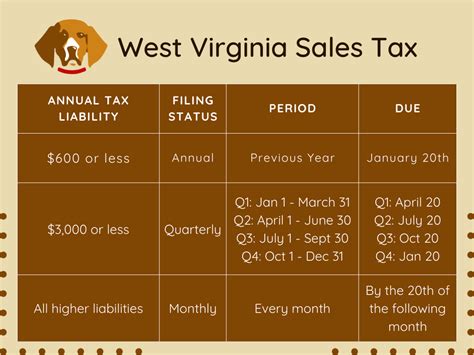

The collected sales tax must be remitted to the state tax department on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to annually. Late or incomplete remittances can result in penalties and interest charges, so it's crucial to stay organized and meet all deadlines.

Sales Tax Returns

In addition to remitting the collected tax, businesses must also file sales tax returns. These returns provide a detailed account of the business’s sales and the corresponding tax collected. The information on the return is used by the state tax department to verify the accuracy of the remitted tax and to ensure compliance with tax laws.

Sales tax returns are typically due on the same schedule as the remittances. Businesses can file their returns electronically, which is the preferred method due to its efficiency and accuracy. The state tax department provides online tools and resources to assist businesses in filing their returns correctly.

Penalties and Compliance

Failure to comply with West Virginia’s sales tax laws can result in significant penalties and interest charges. The state tax department takes non-compliance seriously and has the authority to audit businesses to ensure they are meeting their tax obligations.

Penalties for non-compliance can be substantial, including fines, interest on unpaid taxes, and even criminal charges in severe cases. To avoid these penalties, it's crucial for businesses to understand their sales tax obligations, maintain accurate records, and stay up-to-date with tax law changes.

Sales Tax for Online Sellers

The rise of e-commerce has presented unique challenges for sales tax collection. West Virginia, like many states, has adapted its tax laws to address the online sales market. Online sellers must understand their sales tax obligations to avoid penalties and maintain compliance.

Economic Nexus

The concept of economic nexus has been a game-changer for online sellers. Under this principle, a business may be required to collect sales tax in a state even if it has no physical presence there. This is often based on the volume of sales or the number of transactions the business has in the state.

In West Virginia, a remote seller is required to collect and remit sales tax if its sales in the state exceed $100,000 in a calendar year or if it has more than 200 separate transactions in the state during a calendar year.

Marketplace Facilitator Rules

West Virginia has also adopted marketplace facilitator rules, which require online marketplaces to collect and remit sales tax on behalf of their third-party sellers. This rule applies to marketplaces that facilitate more than $100,000 in gross sales or more than 200 transactions in the state during a calendar year.

Marketplaces that fall under these rules are responsible for registering with the state tax department, collecting sales tax from their sellers, and remitting the collected tax to the state. This system ensures that online sellers, even those with no physical presence in the state, are still contributing to West Virginia's tax revenue.

Sales Tax for Remote Sellers

Remote sellers, those with no physical presence in West Virginia, must also understand their sales tax obligations. While they may not be required to collect sales tax under the economic nexus rules, they still have certain responsibilities.

Use Tax

Remote sellers are generally not required to collect sales tax from West Virginia residents. However, the state does impose a use tax on purchases made from out-of-state sellers. This tax is the responsibility of the consumer, who is expected to self-report and pay the use tax on their purchases.

While remote sellers are not responsible for collecting this tax, they are required to provide a notice to West Virginia customers informing them of their use tax obligations. This notice typically includes information on how to calculate and pay the use tax, ensuring consumers understand their responsibilities.

Voluntary Compliance

Remote sellers can also choose to voluntarily collect and remit sales tax in West Virginia. This option is particularly beneficial for businesses that want to simplify their tax obligations and avoid the complexities of use tax compliance. By voluntarily collecting sales tax, remote sellers can provide a seamless shopping experience for their West Virginia customers.

To voluntarily collect sales tax, remote sellers must register with the West Virginia State Tax Department and obtain a sales tax license. They then collect the tax at the point of sale and remit it to the state on a regular basis, just like any other West Virginia business.

Sales Tax for Special Events

Sales tax obligations can be particularly complex for businesses operating at special events, such as festivals, fairs, and pop-up shops. These events often involve temporary locations and unique sales scenarios, which can impact tax compliance.

Temporary Location Permits

Businesses operating at special events in West Virginia may need to obtain a Temporary Location Permit from the state tax department. This permit authorizes the business to collect and remit sales tax at the event, even if it does not have a permanent location in the state.

The permit application requires detailed information about the event, including its location, duration, and expected sales volume. The state tax department uses this information to determine the appropriate tax obligations and to ensure compliance.

Event-Specific Sales Tax Rates

Special events may have unique sales tax rates, especially if they are located in areas with additional local sales taxes. It’s crucial for businesses to understand these rates to ensure they are collecting the correct amount of tax from customers.

For example, a festival held in a city with a 1% local sales tax would have a total sales tax rate of 7% (state rate + local rate). Businesses operating at the festival must ensure they are collecting this rate to avoid any compliance issues.

Event-Specific Exemptions

Some special events may offer specific exemptions or reduced tax rates for certain goods or services. These exemptions can be a significant benefit for businesses, reducing their tax liability and potentially boosting their sales. It’s essential to stay informed about any event-specific tax incentives to take full advantage of them.

Sales Tax for Tourism and Hospitality

The tourism and hospitality industry plays a significant role in West Virginia’s economy, and sales tax obligations for this sector can be complex. Understanding these obligations is crucial for businesses in this industry to maintain compliance and manage their tax liabilities effectively.

Lodging Tax

In addition to the standard sales tax, West Virginia imposes a lodging tax on accommodations, such as hotels, motels, and vacation rentals. This tax is typically charged as a percentage of the room rate and is included in the total cost of the stay. The lodging tax rate varies depending on the location, with rates ranging from 3% to 6% across the state.

Businesses in the hospitality industry must collect and remit this tax to the state tax department, in addition to the standard sales tax. The lodging tax is an important source of revenue for the state, supporting tourism-related initiatives and infrastructure.

Meals and Entertainment Tax

West Virginia also imposes a meals and entertainment tax on certain food and beverage sales. This tax is typically charged at a rate of 1% and is in addition to the standard sales tax. It applies to meals served in restaurants, as well as food and beverages sold at events, catering services, and other similar transactions.

Businesses in the hospitality industry, especially those involved in food service, must collect and remit this tax to the state. The meals and entertainment tax is designed to generate revenue for the state while ensuring that the hospitality industry contributes fairly to the tax base.

Sales Tax for Tourism Promotions

West Virginia actively promotes tourism, and businesses in this sector can take advantage of various tax incentives and programs. For example, the state offers a Tourism Development Fund, which provides grants and loans to support tourism-related projects and initiatives.

Businesses in the tourism and hospitality industry can access these funds to enhance their operations and attract more visitors. In return, they are expected to contribute to the state's tax revenue, including sales tax, to support the continued development of the tourism sector.

Sales Tax for E-commerce and Online Sales

The e-commerce sector has seen tremendous growth in recent years, and sales tax obligations for online sellers can be complex. West Virginia has implemented several measures to ensure that online sellers are meeting their tax obligations, while also providing clarity and support for businesses operating in this space.

Online Marketplace Sales

West Virginia has adopted rules that require online marketplaces to collect and remit sales tax on behalf of their third-party sellers. This applies to marketplaces that facilitate more than $100,000 in gross sales or more than 200 transactions in the state during a calendar year.

Marketplaces that fall under these rules must register with the state tax department, collect sales tax from their sellers, and remit the collected tax to the state. This system ensures that online sellers, even those with no physical presence in the state, are contributing to West Virginia's tax revenue.

Remote Seller Obligations

Remote sellers, those with no physical presence in West Virginia, may also have sales tax obligations in the state. If their sales in West Virginia exceed $100,000 in a calendar year or if they have more than 200 separate transactions in the state during a calendar year, they are required to collect and remit sales tax.

Remote sellers can choose to voluntarily collect and remit sales tax, which simplifies their tax obligations and provides a seamless shopping experience for their West Virginia customers. To do this, they must register with the West Virginia State Tax Department and obtain a sales tax license.

Use Tax Notice Requirements

Remote sellers are generally not required to collect sales tax from West Virginia residents. However, they are required to provide a notice to West Virginia customers informing them of their use tax obligations. This notice should include information on how to calculate and pay the use tax, ensuring consumers understand their responsibilities.

By providing this notice, remote sellers can help promote compliance with West Virginia's use tax laws, while also ensuring their customers are aware of their tax obligations.

Sales Tax for Startups and Small Businesses

Startups and small businesses often face unique challenges when it comes to sales tax compliance. West Virginia provides resources and guidance to help these businesses navigate their tax obligations, ensuring they can focus on their core operations while maintaining compliance.

Sales Tax Registration for Startups

Startups in West Virginia must register with the state tax department to obtain a Sales and Use Tax License. This process involves providing detailed information about