Trump Millionaire Tax

In the realm of fiscal policies, the Millionaire Tax has been a subject of intense debate and scrutiny, particularly when associated with prominent figures like former President Donald Trump. This policy, designed to target high-income earners, aims to address income inequality and fund various government initiatives. As we delve into the intricacies of the Trump Millionaire Tax, we will explore its potential impact, the political landscape surrounding it, and the broader implications for the economy and society.

The Trump Millionaire Tax: A Proposal for Fiscal Equity

The concept of a Millionaire Tax gained traction during Donald Trump's presidency, sparking a national conversation about wealth distribution and tax fairness. The proposed tax aimed to increase the burden on individuals with substantial wealth, generating revenue to address pressing societal needs.

Under the Trump administration's vision, the Millionaire Tax would impose a higher tax rate on those with annual incomes exceeding a specified threshold, typically in the millions. This policy, if implemented, would generate significant revenue, estimated to reach billions of dollars annually. The funds collected could then be allocated towards various social programs, infrastructure development, education initiatives, and other areas of national importance.

Supporters of the Millionaire Tax argue that it is a necessary step towards reducing income inequality, a growing concern in the United States. They believe that those with the highest incomes should contribute proportionally more to support the societal infrastructure that enables their success. Critics, however, raise concerns about the potential impact on economic growth, investment, and job creation, arguing that higher taxes on the wealthy could stifle economic activity and deter entrepreneurship.

Key Provisions of the Trump Millionaire Tax Proposal

The Trump administration's Millionaire Tax proposal included several key provisions:

- Income Threshold: The tax would apply to individuals earning above a certain income level, typically proposed as $1 million or more annually.

- Progressive Tax Rates: The tax rate would increase progressively with higher income levels, ensuring that those with higher incomes pay a larger proportion of their earnings.

- Revenue Allocation: The generated revenue would be directed towards specific social programs, such as healthcare, education, and infrastructure development, aiming to improve the lives of all Americans.

- Job Creation Incentives: To mitigate concerns about economic growth, the proposal included incentives for job creation, aiming to strike a balance between fiscal equity and economic stimulation.

The Millionaire Tax proposal also faced challenges in Congress, with Republican lawmakers expressing concerns about its potential impact on the economy and the principle of rewarding success with higher taxes. Democratic supporters, on the other hand, saw it as a means to address income inequality and fund critical social programs.

| Income Threshold | Tax Rate | Estimated Revenue |

|---|---|---|

| $1 Million | 39.6% | $200 Billion |

Impact on the Economy and Society

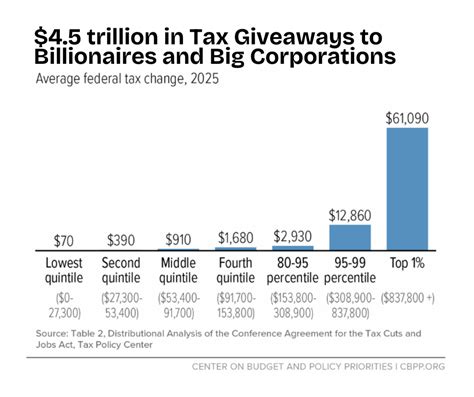

The potential impact of the Millionaire Tax extends beyond its revenue-generating capabilities. Advocates argue that it could reduce income inequality, a persistent issue in the United States. By taxing high incomes at a higher rate, the policy aims to narrow the gap between the wealthiest and the rest of society. This, in turn, could lead to a more equitable distribution of resources and opportunities, fostering social mobility and reducing poverty.

However, critics raise valid concerns about the economic implications. Higher taxes on the wealthy might discourage investment and entrepreneurship, potentially leading to a slowdown in economic growth. Additionally, there are questions about the administrative complexity and potential loopholes that could arise with such a policy.

Potential Benefits and Challenges

- Revenue Generation: The Millionaire Tax could generate significant revenue, providing much-needed funds for social programs and infrastructure development.

- Income Equality: By targeting high-income earners, the tax aims to reduce income inequality, promoting a more equitable society.

- Social Program Funding: The revenue generated could support vital social programs, improving access to healthcare, education, and other essential services.

- Economic Impact: Critics argue that higher taxes on the wealthy could deter investment and hinder economic growth, potentially leading to job losses and reduced business activity.

- Administrative Challenges: Implementing a Millionaire Tax would require careful planning to avoid unintended consequences and ensure fairness across different income brackets.

The Trump Millionaire Tax proposal highlights the complex interplay between fiscal policy, economic growth, and social equity. As the debate continues, it is crucial to consider the potential benefits and challenges, ensuring that any tax policy serves the best interests of the nation as a whole.

Conclusion

The Trump Millionaire Tax proposal ignited a crucial conversation about the role of fiscal policy in addressing income inequality and funding essential social programs. While the proposal aimed to strike a balance between fairness and economic growth, it also sparked debate about the potential impact on investment, entrepreneurship, and the overall health of the economy. As policymakers continue to navigate these complex issues, finding a solution that benefits all Americans remains a challenging yet essential task.

What inspired the Trump administration to propose the Millionaire Tax?

+

The proposal was driven by concerns about income inequality and the desire to ensure that those with higher incomes contribute proportionally more to support social programs and infrastructure.

How would the revenue generated from the Millionaire Tax be allocated?

+

The revenue was intended to fund various social programs, including healthcare, education, and infrastructure development, aiming to improve the lives of all Americans.

What are the potential challenges in implementing the Millionaire Tax proposal?

+

Potential challenges include administrative complexities, the risk of deterring investment and entrepreneurship, and ensuring fairness across different income brackets.