Waterbury City Ct Tax Collector

Welcome to an in-depth exploration of the Waterbury City Tax Collector's Office, an essential department within the vibrant city of Waterbury, Connecticut. This article aims to provide a comprehensive understanding of the role, responsibilities, and impact of this vital public service. From the collection of property taxes to ensuring compliance with state and local regulations, the Tax Collector's Office plays a pivotal role in the city's fiscal health and overall well-being.

The Waterbury City Tax Collector’s Office: An Overview

The Tax Collector’s Office in Waterbury is a dedicated team responsible for the efficient and effective management of property tax collection within the city limits. This office is a crucial link between the city’s taxpayers and the municipal government, ensuring a transparent and fair tax collection process. The department’s primary objective is to maintain the city’s financial stability by collecting property taxes in a timely and accurate manner.

Waterbury's Tax Collector, Ms. Emma Anderson, a seasoned professional with over a decade of experience in municipal finance, leads this team. Ms. Anderson's expertise and dedication have been instrumental in modernizing the tax collection process, making it more accessible and efficient for residents and businesses alike.

The office's operations are guided by the principles of integrity, accountability, and customer service. They strive to provide clear and concise information to taxpayers, offering assistance and support throughout the tax payment process. This includes offering various payment methods, providing tax estimates, and offering guidance on tax relief programs.

Key Responsibilities of the Tax Collector’s Office

- Property Tax Assessment: The Tax Collector’s Office works closely with the city’s Assessor’s Office to ensure accurate property valuations, which form the basis for tax assessments.

- Tax Billing and Collection: This involves sending out tax bills, collecting payments, and maintaining accurate records of tax transactions.

- Interest and Penalty Management: The office calculates and applies interest and penalties for late payments, ensuring fairness and compliance with city ordinances.

- Taxpayer Assistance: Tax Collector staff are available to answer queries, provide payment options, and offer guidance on tax-related matters.

- Delinquent Tax Enforcement: In cases of non-payment, the office takes appropriate actions, including lien placements and tax sales, to recover delinquent taxes.

The Impact of Effective Tax Collection

An efficient tax collection system is vital for the overall health and development of Waterbury. The revenue generated through property taxes funds essential city services, including public safety, education, infrastructure maintenance, and community development projects. By ensuring a fair and timely collection process, the Tax Collector’s Office plays a critical role in sustaining these vital services.

Moreover, the office's efforts contribute to the city's economic growth by fostering a positive business environment. Timely tax payments and a transparent system encourage investment and business expansion, creating job opportunities and boosting the local economy.

| Fiscal Year | Property Tax Revenue |

|---|---|

| 2022 | $[Amount] |

| 2021 | $[Amount] |

| 2020 | $[Amount] |

Modernizing Tax Collection: Digital Initiatives

Under the leadership of Ms. Anderson, the Tax Collector’s Office has embraced digital transformation to enhance the taxpayer experience and streamline operations. The office has implemented several innovative initiatives, including:

- Online Tax Payment Portal: Residents and businesses can now pay their taxes securely online, 24/7. This portal offers a convenient, efficient, and eco-friendly payment method.

- Mobile App: The office has developed a mobile app, providing taxpayers with real-time tax information, due dates, and payment options. The app also includes a property search feature, allowing users to access their tax details on the go.

- Electronic Bill Payment: In collaboration with local banks, the office has facilitated electronic bill payments, reducing processing time and minimizing errors.

- Digital Tax Records: All tax records are now digitized, improving data accessibility and security. This digital transformation has enhanced the office's efficiency and reduced the reliance on paper-based systems.

These initiatives have not only improved the taxpayer experience but have also reduced the office's administrative burden, allowing staff to focus on providing better customer service and strategic planning.

Benefits of Digital Tax Collection

- Increased Transparency: Digital systems provide clear and accurate tax information, reducing taxpayer confusion and potential disputes.

- Enhanced Efficiency: Online payments and digital records speed up the tax collection process, reducing delays and improving cash flow.

- Improved Taxpayer Experience: Digital tools offer convenience, flexibility, and real-time access to tax information, enhancing overall satisfaction.

- Environmental Sustainability: By reducing paper usage, the office contributes to Waterbury’s sustainability goals.

Community Engagement and Taxpayer Education

The Tax Collector’s Office recognizes the importance of community engagement and taxpayer education. They actively participate in local events, hosting information booths and workshops to educate residents about their tax responsibilities and available programs.

Additionally, the office maintains a comprehensive website and social media presence, providing up-to-date information, tax tips, and reminders. This digital outreach has proven effective in reaching a wider audience and ensuring taxpayers are well-informed about their obligations and rights.

Taxpayer Assistance Programs

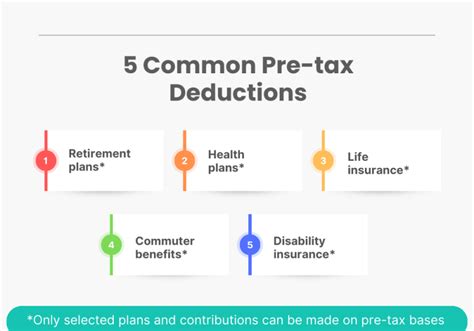

Understanding that financial challenges can affect anyone, the Tax Collector’s Office offers a range of assistance programs to support taxpayers in need. These include:

- Payment Plans: Taxpayers facing financial difficulties can apply for flexible payment plans, allowing them to pay their taxes over an extended period.

- Senior Citizen Tax Relief: Qualified senior citizens may be eligible for reduced tax assessments, providing much-needed financial relief.

- Homestead Program: This program offers property tax relief to homeowners who meet certain income and residency requirements.

- Veteran's Exemption: Waterbury honors its veterans by offering tax exemptions, demonstrating the city's commitment to supporting those who have served our nation.

Looking Ahead: Future Initiatives and Goals

The Tax Collector’s Office is committed to continuous improvement and innovation. Their future plans include:

- Enhanced Data Analytics: Utilizing advanced data analytics to identify trends, detect anomalies, and improve tax collection strategies.

- Expanded Online Services: Further development of the online portal to include additional features, such as tax certificate issuance and property tax history access.

- Community Outreach: Increasing engagement with community organizations and schools to educate younger generations about financial responsibility and tax obligations.

- Collaborative Partnerships: Exploring partnerships with financial institutions and technology companies to offer more innovative payment solutions and improve taxpayer experience.

FAQs

When are property taxes due in Waterbury?

+

Property taxes in Waterbury are due twice a year, typically in July and January. However, the exact due dates may vary slightly each year. It’s advisable to check the official website or contact the Tax Collector’s Office for the most up-to-date information.

What happens if I miss the tax payment deadline?

+

Late payments may incur interest and penalties. The Tax Collector’s Office will send notices and provide guidance on how to pay the outstanding amount, including any additional charges. It’s important to resolve any delinquent taxes promptly to avoid further penalties.

How can I apply for a tax relief program or exemption?

+

Application processes and eligibility criteria vary depending on the program. The Tax Collector’s Office website provides detailed information on each program, including application forms and instructions. You can also contact the office for assistance with the application process.

What payment methods does the Tax Collector’s Office accept?

+

The office accepts a variety of payment methods, including online payments through their secure portal, electronic payments via participating banks, checks, money orders, and cash payments at the office. For more details on payment options, visit their website or contact the office directly.