State Of Mn Sales Tax

The sales tax landscape in Minnesota, often referred to as the Land of 10,000 Lakes, is a crucial aspect of the state's fiscal policy and economic strategy. Understanding the intricacies of this tax system is essential for businesses and individuals alike, as it directly impacts their financial obligations and planning.

Unraveling the State of MN Sales Tax

Minnesota's sales tax structure is a blend of state-level and local taxes, creating a comprehensive system that funds various state and local government initiatives. The state sales tax rate currently stands at 6.875%, effective as of January 1, 2022. This state-level tax applies to most retail sales, leases, or rentals of tangible personal property, as well as certain services. However, the true complexity lies in the additional local taxes that can significantly increase the overall sales tax rate.

Minnesota allows its counties, cities, and metropolitan areas to levy their own sales taxes, which are then added to the state sales tax. These local taxes can vary significantly, leading to a wide range of sales tax rates across the state. For instance, the city of Minneapolis has a local sales tax rate of 0.50%, bringing the total sales tax rate in the city to 7.375%. On the other hand, certain metropolitan areas have opted for higher local taxes, resulting in a combined sales tax rate of up to 7.875%.

The diversity in local sales tax rates creates a patchwork of tax jurisdictions across Minnesota. This can be particularly challenging for businesses with operations or sales across multiple counties or cities. They must ensure compliance with the specific tax rates applicable to each transaction, which requires a sophisticated understanding of the state's tax geography.

Taxable and Exempt Items

Minnesota's sales tax applies to a broad range of goods and services, including clothing, electronics, furniture, and most food items. However, certain categories are exempt from sales tax, such as prescription drugs, most medical services, and some agricultural equipment. Additionally, Minnesota offers tax exemptions for specific industries and situations, including manufacturing, research and development, and certain types of nonprofit organizations.

The state also provides tax incentives for businesses, such as the Job Opportunity Building Zones (JOBZ) program, which offers tax breaks to businesses that locate or expand in designated areas. These incentives can significantly reduce the overall tax burden for qualifying businesses, making Minnesota an attractive location for economic development.

| Sales Tax Rate | Description |

|---|---|

| 6.875% | State Sales Tax Rate |

| Varies (up to 0.50%) | Local Sales Tax Rate |

| 7.375% - 7.875% | Combined Sales Tax Rate in Urban Areas |

Compliance and Administration

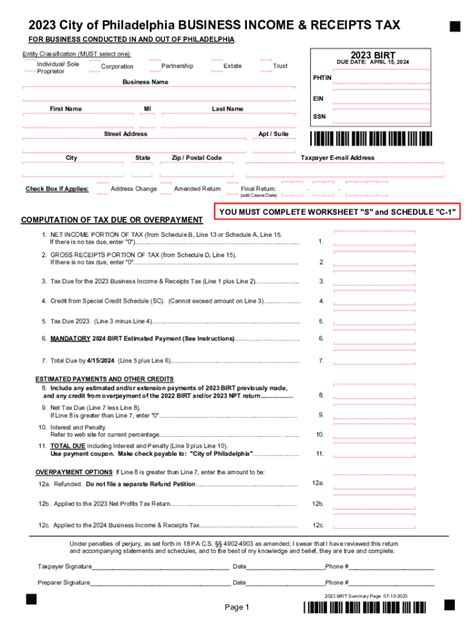

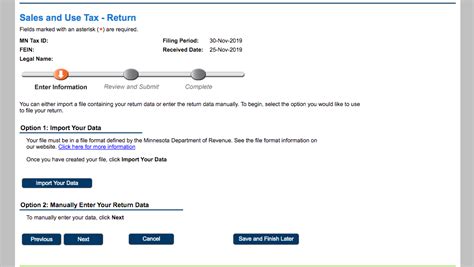

Ensuring compliance with Minnesota's sales tax regulations is a critical task for businesses. The Minnesota Department of Revenue provides detailed guidelines and resources to help businesses understand their tax obligations. This includes guidance on registering for sales tax, filing returns, and remitting taxes. Businesses must maintain accurate records of sales and use tax transactions to ensure they are correctly calculating and remitting the appropriate tax amounts.

For individuals, understanding sales tax is essential for financial planning and budgeting. When making significant purchases, being aware of the applicable sales tax rate can help in making informed decisions and budgeting accordingly. It's important to note that while sales tax is often included in the displayed price of goods and services, it's not always the case, especially for online purchases or in certain industries.

The Impact on Businesses and Consumers

Minnesota's sales tax structure has a profound impact on both businesses and consumers. For businesses, especially those with multiple locations or online sales, managing varying sales tax rates can be complex and resource-intensive. They must invest in robust tax compliance systems and processes to ensure accuracy and avoid penalties. This can be particularly challenging for small businesses with limited resources.

From a consumer perspective, the varying sales tax rates can create a sense of unpredictability when making purchases. While sales tax is a necessary part of funding government services, the lack of uniformity across the state can make budgeting and price comparisons challenging. Consumers may also face situations where they are overcharged or undercharged for sales tax, which can lead to confusion and frustration.

To address these challenges, the Minnesota Department of Revenue offers various resources and tools to assist businesses and consumers. This includes online calculators, tax rate databases, and educational materials. These resources aim to provide clarity and ease the burden of understanding and complying with Minnesota's sales tax system.

Future Considerations

As Minnesota continues to evolve economically, its sales tax structure will likely remain a dynamic and influential component of the state's fiscal policy. The state may consider initiatives to simplify the tax system, potentially through the harmonization of local tax rates or the introduction of new tax incentives to attract businesses and stimulate economic growth.

Additionally, with the increasing prevalence of e-commerce and online sales, Minnesota may need to adapt its sales tax regulations to effectively tax online transactions. This could involve exploring new technologies and partnerships with online platforms to ensure compliance and fair taxation. The state's ongoing commitment to economic development and fiscal responsibility will continue to shape the future of its sales tax system.

What is the current state sales tax rate in Minnesota?

+As of January 1, 2022, the state sales tax rate in Minnesota is 6.875%.

Are there any local sales taxes in Minnesota?

+Yes, Minnesota allows counties, cities, and metropolitan areas to levy their own sales taxes, which are added to the state sales tax rate, resulting in varying combined sales tax rates across the state.

What items are exempt from sales tax in Minnesota?

+Minnesota exempts certain items and services from sales tax, including prescription drugs, medical services, and agricultural equipment. Additionally, there are tax exemptions for specific industries and nonprofit organizations.