Ny City Property Tax Bill

Navigating the New York City Property Tax System: A Comprehensive Guide for Property Owners

In the bustling metropolis of New York City, understanding the property tax system is crucial for both residential and commercial property owners. With its unique structure and assessment processes, navigating the property tax landscape can be a complex endeavor. This comprehensive guide aims to demystify the process, offering a detailed breakdown of the New York City property tax system and providing valuable insights for property owners.

Understanding the New York City Property Tax Structure

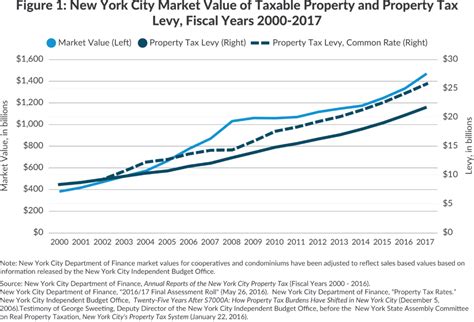

The property tax system in New York City operates on a complex yet organized framework. It is primarily based on the assessed value of the property, which is determined through a comprehensive assessment process conducted by the New York City Department of Finance (DOF).

The DOF assesses properties in the city based on various factors, including market value, location, size, and other physical characteristics. This assessment determines the taxable value of the property, which forms the basis for calculating the property tax bill.

Tax Rates and Classifications

New York City employs a multi-tiered tax rate system, where properties are classified into different tax classes based on their use and ownership. These classes include:

- Class 1: One-, two-, and three-family homes, as well as condos and co-ops.

- Class 2: Rental apartments and multi-family residential properties.

- Class 3: Commercial and industrial properties.

- Class 4: Utilities and railroad properties.

- Class 5: Vacant land.

Each tax class is subject to a different tax rate, with residential properties typically enjoying lower rates compared to commercial properties. The tax rates are determined by the New York City Council and can vary annually.

| Tax Class | Estimated Tax Rate |

|---|---|

| Class 1 | 1.07% |

| Class 2 | 2.73% |

| Class 3 | 3.97% |

| Class 4 | 1.32% |

| Class 5 | 1.87% |

It's important to note that these tax rates are subject to change and may vary based on specific circumstances, such as tax abatements or exemptions.

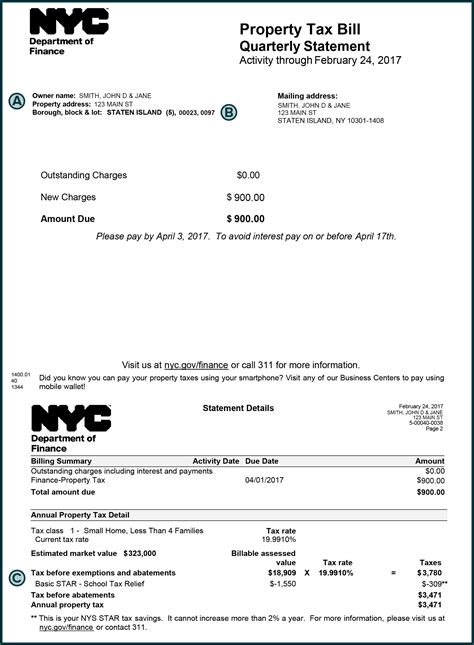

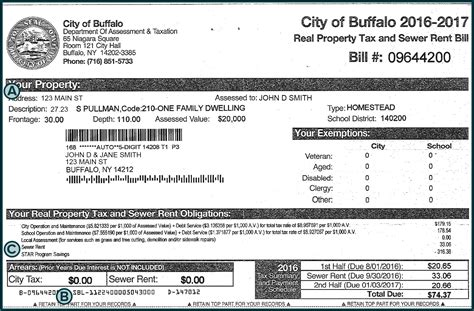

Assessment and Bill Generation

The New York City property tax system operates on a biennial assessment cycle, with assessments conducted every two years. During the assessment period, the DOF conducts physical inspections of properties and gathers data to determine the property’s value.

Once the assessment is complete, the DOF generates a Tentative Assessment Roll, which outlines the proposed taxable values for each property. Property owners receive a notification of this assessment and have the opportunity to review and dispute the valuation if they believe it is inaccurate.

After the assessment period, the DOF finalizes the assessments and generates the Final Assessment Roll. This roll forms the basis for calculating the property tax bills. The DOF then sends out tax bills to property owners, typically in the fall of each year.

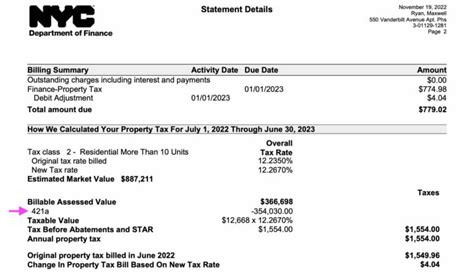

Calculating Your Property Tax Bill

Calculating your property tax bill involves a straightforward formula, taking into account the assessed value of your property and the applicable tax rate for your tax class.

The formula is as follows:

Property Tax Bill = (Assessed Value x Tax Rate) x 100

For example, let's consider a Class 1 property with an assessed value of $500,000. Using the estimated tax rate of 1.07% for Class 1 properties, we can calculate the property tax bill as follows:

Property Tax Bill = ($500,000 x 0.0107) x 100 = $5,350

It's important to note that the assessed value used in the calculation may differ from the market value of the property. The assessed value is determined by the DOF's assessment process, which takes into account various factors beyond just the market value.

Tax Abatements and Exemptions

New York City offers various tax abatements and exemptions to eligible property owners, which can significantly reduce their property tax bills. These abatements and exemptions are designed to encourage certain types of development or provide relief to specific groups of property owners.

Some common tax abatements and exemptions include:

- 421-a Abatement: Offers a partial or full exemption from property taxes for new residential developments, promoting affordable housing.

- J-51 Abatement: Provides tax reductions for properties undergoing substantial rehabilitation or improvements.

- Senior Citizen Exemption: Offers a partial exemption to homeowners aged 65 and above with limited income.

- Veteran Exemption: Provides a partial exemption to honorably discharged veterans and their spouses.

To claim these abatements or exemptions, property owners must meet specific eligibility criteria and file the necessary paperwork with the DOF. It's crucial to research and understand the available options to ensure you take advantage of any applicable benefits.

Payment Options and Due Dates

New York City offers various payment options for property owners to settle their tax bills. These options include:

- Online Payment: Property owners can make payments through the DOF's official website using a credit card, debit card, or electronic check.

- Mail-In Payment: Owners can send a check or money order to the DOF's address, ensuring the payment is received before the due date.

- In-Person Payment: Property owners can visit a designated DOF office and make payments in person.

- Automatic Payment: Property owners can set up automatic payments, where the tax amount is deducted from their bank account on the due date.

The due dates for property tax payments are typically split into two installments, with the first installment due in January and the second in July. It's crucial to pay attention to the due dates to avoid late fees and penalties.

Late Payment Consequences

Failing to pay your property tax bill by the due date can result in significant penalties and interest charges. The DOF imposes a 9% interest rate on late payments, which compounds daily. Additionally, a 1% late fee is applied for each month the payment is overdue.

If the tax bill remains unpaid for an extended period, the DOF may initiate legal action, which could lead to a lien being placed on the property or even a tax foreclosure.

Appealing Your Property Tax Assessment

If you believe that your property’s assessed value is inaccurate or unfair, you have the right to appeal the assessment. The New York City property tax system provides a comprehensive appeals process to address such concerns.

Steps to Appeal

- Obtain a Property Profile: Start by obtaining a detailed property profile from the DOF, which includes information about your property’s assessed value, tax class, and other relevant details.

- Gather Evidence: Collect evidence to support your claim, such as recent sales of comparable properties, appraisals, or any other documentation that demonstrates the inaccuracy of the assessment.

- File an Appeal: Submit a formal appeal to the Tax Commission, providing detailed reasons for your dispute and presenting your evidence.

- Attend a Hearing: If your appeal is accepted, you will be invited to attend a hearing where you can present your case to a panel of commissioners. It’s beneficial to prepare thoroughly and bring any additional evidence to support your argument.

The Tax Commission will review your appeal and make a decision, which may result in a reduction of your assessed value or a denial of your appeal. It's important to note that the appeals process can be time-consuming, and it's advisable to seek professional guidance if needed.

Future Outlook and Potential Changes

The New York City property tax system is subject to ongoing evaluations and potential reforms. With the city’s dynamic real estate market and changing economic landscape, there is always a possibility of adjustments to tax rates, assessment processes, and available abatements.

Currently, there are discussions and proposals aimed at reforming the property tax system to make it more equitable and efficient. These reforms may include reevaluating tax classes, introducing new abatements, or adjusting assessment methodologies.

It's essential for property owners to stay informed about any proposed changes and engage in discussions with relevant authorities to ensure their interests are considered. Being proactive and involved in the decision-making process can help shape a more favorable tax environment for property owners in New York City.

Conclusion

Understanding the intricacies of the New York City property tax system is essential for property owners to effectively manage their tax obligations and take advantage of available benefits. By familiarizing yourself with the assessment process, tax rates, and available options, you can navigate the system with confidence and ensure compliance.

Remember, staying informed, seeking professional guidance when needed, and actively participating in discussions about tax reforms can empower you as a property owner in New York City. With a solid understanding of the property tax landscape, you can make informed decisions and protect your financial interests.

How often are property assessments conducted in New York City?

+Property assessments in New York City are conducted on a biennial basis, meaning they occur every two years. This allows for regular updates to the assessed values of properties.

Can I dispute my property tax assessment if I believe it is inaccurate?

+Absolutely! If you have evidence to support your claim, you can appeal your property tax assessment through the Tax Commission. It’s important to gather relevant documentation and present a strong case.

What are the consequences of missing a property tax payment deadline?

+Missing a property tax payment deadline can result in late fees, interest charges, and potential legal actions. It’s crucial to stay on top of your payment obligations to avoid these consequences.