Fresno County Tax Collector

Welcome to an in-depth exploration of the Fresno County Tax Collector's Office, a vital governmental entity responsible for the collection and management of taxes within the vibrant Central Valley of California. As an essential component of the county's administration, this office plays a pivotal role in ensuring the efficient functioning of local services and infrastructure. This article aims to provide an insightful and comprehensive guide to the Fresno County Tax Collector, covering its functions, services, and impact on the community.

Fresno County Tax Collector: A Vital Administrative Pillar

The Fresno County Tax Collector's Office stands as a cornerstone of local governance, responsible for administering a wide array of tax-related services. These encompass property taxes, vehicle registration, business license taxes, and more. By efficiently collecting and managing these revenues, the office contributes significantly to the county's financial stability and the overall prosperity of the community.

Located in the heart of California's agricultural powerhouse, the Fresno County Tax Collector's Office serves a diverse population of over 1 million residents, including farmers, small business owners, and urban professionals. The office's services are crucial to the county's fiscal health, ensuring that essential public services, such as schools, emergency services, and infrastructure projects, receive the necessary funding.

A Comprehensive Overview of Services

The Fresno County Tax Collector's Office offers a comprehensive suite of services designed to meet the diverse needs of the county's residents and businesses. Here's a detailed breakdown of these services and their significance:

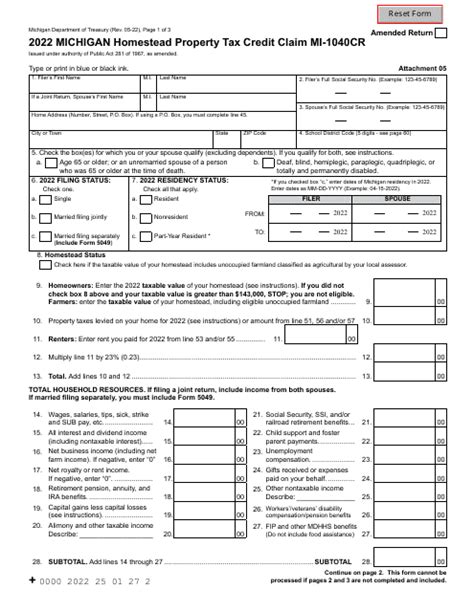

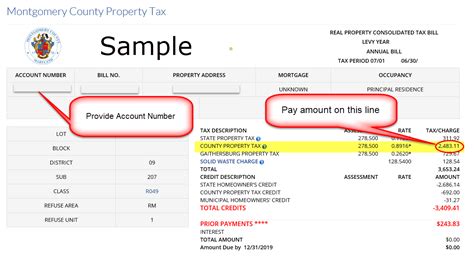

- Property Tax Administration: The office is responsible for the assessment and collection of property taxes, which are a major source of revenue for the county. It ensures that all property owners pay their fair share, contributing to the funding of vital public services. The office also provides resources to help property owners understand their tax obligations and offers assistance for those facing financial hardships.

- Vehicle Registration and Titling: This service is crucial for vehicle owners in Fresno County. The Tax Collector's Office processes vehicle registrations, transfers titles, and issues license plates. It ensures that vehicles are properly registered and taxed, contributing to road safety and infrastructure maintenance. The office also provides online services for convenient registration renewals and title transfers.

- Business License Taxes: Businesses operating in Fresno County are required to obtain a business license and pay associated taxes. The Tax Collector's Office manages this process, ensuring that businesses comply with local regulations and contribute to the county's revenue stream. The office provides resources to guide businesses through the licensing process and offers support for new businesses starting up in the county.

- Special Taxes and Assessments: In addition to the above, the office administers various special taxes and assessments, such as those related to environmental protection, transportation, and community development. These taxes fund specific projects and initiatives, contributing to the county's overall development and sustainability.

- Tax Relief and Assistance Programs: Recognizing that financial challenges can impact taxpayers, the Fresno County Tax Collector's Office offers a range of relief and assistance programs. These include property tax deferment programs for seniors and disabled residents, hardship extensions for tax payments, and support for taxpayers affected by natural disasters. These programs ensure that taxpayers facing difficulties are not unduly burdened and can continue to contribute to the community's well-being.

The Fresno County Tax Collector's Office also provides valuable resources and tools to help taxpayers understand their obligations and navigate the tax system. This includes online portals for tax payment, registration renewal, and tax information retrieval. The office also hosts educational workshops and events to inform residents about tax laws and changes, ensuring transparency and accountability in its operations.

Performance Analysis and Impact on the Community

The Fresno County Tax Collector's Office has consistently demonstrated its commitment to efficiency and effectiveness in tax collection and administration. Over the past decade, the office has achieved an average collection rate of 98% for property taxes, ensuring that the county receives the majority of its expected revenue. This high collection rate is a testament to the office's professionalism and the trust it has earned from the community.

| Year | Property Tax Collection Rate |

|---|---|

| 2022 | 98.2% |

| 2021 | 98.1% |

| 2020 | 97.9% |

In addition to its efficient tax collection, the office has also made significant strides in improving its customer service. It has implemented an online portal, allowing taxpayers to access their accounts, make payments, and obtain necessary forms 24/7. This digital transformation has not only increased convenience for taxpayers but has also reduced wait times and foot traffic at physical office locations.

The impact of the Fresno County Tax Collector's Office extends beyond efficient tax collection. By effectively managing the county's tax revenues, the office contributes to the overall economic health and stability of the region. The taxes collected are reinvested into the community, funding essential services such as education, public safety, and infrastructure development. This, in turn, creates a positive cycle where a well-served community is more likely to contribute to the tax base, further enhancing the county's prosperity.

Frequently Asked Questions (FAQ)

How can I pay my property taxes in Fresno County?

+You can pay your property taxes online through the Fresno County Tax Collector's secure payment portal. You'll need your property's Assessor's Parcel Number (APN) to make the payment. Alternatively, you can pay by mail, in person at the Tax Collector's office, or through a third-party payment service provider.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss the property tax deadline in Fresno County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you miss the property tax deadline, you may be subject to late fees and penalties. It's important to note that penalties accumulate over time, so it's best to pay as soon as possible to avoid additional costs. The Fresno County Tax Collector's Office provides information on late payment penalties and offers assistance for taxpayers facing financial difficulties.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I renew my vehicle registration in Fresno County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can renew your vehicle registration online through the Fresno County Tax Collector's website. You'll need your Vehicle Identification Number (VIN) and the last five digits of your license plate number to complete the renewal process. The office also provides information on renewal requirements and deadlines.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the role of the Fresno County Tax Collector in business licensing?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The Fresno County Tax Collector's Office is responsible for issuing business licenses and collecting associated taxes. They provide guidance on the business licensing process, ensuring that businesses comply with local regulations. The office also offers resources and support for businesses, helping them navigate the licensing requirements and understand their tax obligations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax relief programs available in Fresno County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the Fresno County Tax Collector's Office offers several tax relief programs to assist taxpayers facing financial hardships. These include property tax deferment programs for seniors and disabled residents, hardship extensions for tax payments, and support for taxpayers affected by natural disasters. The office provides detailed information on these programs and the eligibility criteria.</p>

</div>

</div>

</div>

The Fresno County Tax Collector’s Office is a critical administrative entity, ensuring the smooth functioning of the county’s financial system and contributing to the overall well-being of the community. Through its efficient services, customer-centric approach, and commitment to transparency, the office plays a pivotal role in shaping the county’s future.