King County Washington Sales Tax

In the vibrant region of King County, Washington, sales tax plays a crucial role in shaping the local economy and funding essential services. This comprehensive guide delves into the intricacies of King County's sales tax system, offering valuable insights for both residents and businesses alike. As we navigate through the various aspects of this tax structure, we'll uncover the rates, exemptions, and unique features that make it an integral part of the county's fiscal landscape.

Understanding King County Sales Tax

King County, nestled in the heart of the Pacific Northwest, boasts a robust economy and a diverse range of businesses. The sales tax system here is designed to contribute to the county's financial stability while ensuring fair taxation practices. Let's explore the key elements that define this tax regime.

Sales Tax Rates

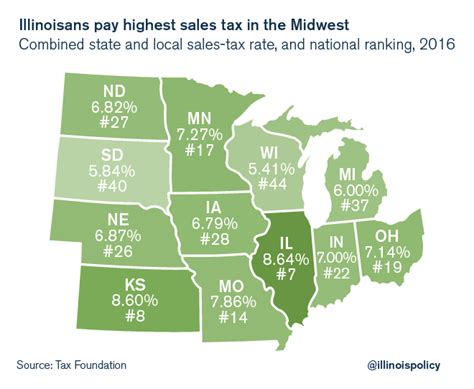

The sales tax rate in King County is subject to a multi-layered structure, incorporating both state and local taxes. Currently, the combined sales tax rate stands at 10.1%, which is applied to most tangible goods and certain services. This rate is a combination of the Washington state sales tax of 6.5% and various local add-on taxes that are specific to King County.

The local add-on taxes are implemented by the King County government and several municipalities within the county, including the city of Seattle. These additional taxes are utilized to fund local initiatives, such as transportation projects, public safety enhancements, and community development programs.

| Tax Component | Rate |

|---|---|

| Washington State Sales Tax | 6.5% |

| King County Tax | 0.4% |

| City of Seattle Tax | 3.1% |

| Other Municipality Taxes | Varies |

| Total Combined Rate | 10.1% |

It's important to note that while Seattle's sales tax rate is included in the county's total, there are other municipalities within King County that have their own additional tax rates. These rates can vary, so it's crucial for businesses and consumers to be aware of the specific tax applicable to their location.

Sales Tax Exemptions and Special Considerations

While the sales tax in King County applies to a broad range of goods and services, there are certain categories that are exempt or subject to reduced rates. These exemptions are designed to support specific industries and promote economic growth within the county.

- Groceries and Food Products: Essential food items, including produce, dairy, meat, and non-alcoholic beverages, are exempt from sales tax in King County. This exemption is a significant benefit for residents, as it reduces the tax burden on basic necessities.

- Prescription Drugs: Sales of prescription medications are also tax-exempt, providing a crucial relief for healthcare consumers in the county.

- Manufacturing and Resale: Sales tax is generally not applicable to goods that are intended for manufacturing processes or resale. This exemption encourages business growth and supports the county's industrial sector.

- Certain Services: Some services, such as healthcare, legal, and financial services, are not subject to sales tax in King County. This aligns with the state's policy of exempting professional services from sales tax.

- Tourism and Entertainment: To promote tourism, certain activities and purchases related to travel, such as hotel stays and admission to cultural events, may be eligible for reduced sales tax rates or tax holidays during specific periods.

Understanding these exemptions is vital for businesses, as it ensures they are compliant with the tax laws and can pass on the benefits to their customers. Residents, too, can benefit from being aware of these exemptions when making purchasing decisions.

Compliance and Reporting

For businesses operating in King County, sales tax compliance is a critical aspect of their financial operations. The Washington State Department of Revenue provides clear guidelines and resources to assist businesses in understanding their tax obligations.

Registration and Licensing

Any business that sells taxable goods or services in King County is required to register with the Washington State Department of Revenue and obtain a Business License and a Sales Tax Permit. This process ensures that businesses are officially recognized and can collect and remit sales tax accurately.

The registration process involves providing detailed information about the business, including its legal structure, ownership, and the types of goods and services it offers. This information is used to determine the applicable tax rates and any specific exemptions or incentives that the business may qualify for.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting sales tax from their customers at the point of sale. The collected tax is then remitted to the Department of Revenue on a regular basis, typically on a monthly or quarterly schedule, depending on the business's sales volume.

The remittance process involves submitting detailed sales tax returns, which include the total taxable sales made during the reporting period, the applicable tax rates, and the calculated tax amount. These returns must be filed electronically through the Department of Revenue's online portal, ensuring a streamlined and efficient process.

Record-Keeping and Audits

Proper record-keeping is essential for sales tax compliance. Businesses must maintain accurate records of all sales transactions, including the date, amount, and applicable tax rate for each sale. These records must be retained for a minimum of four years and made available for audit purposes if requested by the Department of Revenue.

The Department of Revenue periodically conducts audits to ensure businesses are accurately collecting and remitting sales tax. During an audit, businesses may be required to provide detailed sales records, invoices, and other supporting documentation to verify their tax compliance. It's crucial for businesses to have robust record-keeping systems in place to facilitate smooth audit processes.

The Impact of Sales Tax on King County's Economy

Sales tax is a significant revenue source for King County, contributing to the funding of essential services and infrastructure projects. The revenue generated from sales tax supports a wide range of initiatives that enhance the quality of life for residents and promote economic growth.

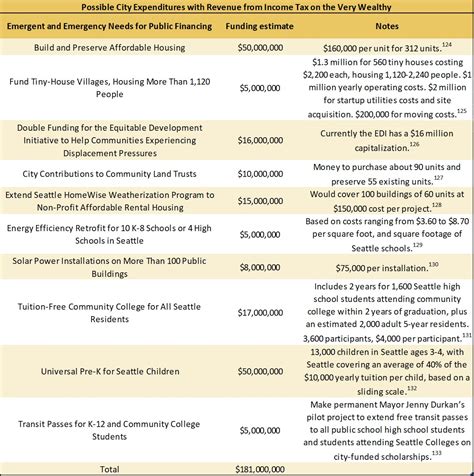

Infrastructure and Community Development

A substantial portion of the sales tax revenue is allocated towards infrastructure development and community enhancement projects. This includes investments in roads, bridges, public transportation systems, and other critical infrastructure that facilitates economic activity and improves connectivity within the county.

Additionally, sales tax funds are utilized for community development initiatives, such as affordable housing programs, community centers, and recreational facilities. These investments aim to create vibrant and sustainable communities, ensuring that King County remains an attractive place to live, work, and visit.

Education and Healthcare

Sales tax revenue plays a vital role in supporting education and healthcare services within King County. A portion of the tax revenue is allocated to public schools, community colleges, and universities, helping to maintain high-quality educational institutions and providing access to education for all residents.

In the healthcare sector, sales tax funds contribute to the operation of public health clinics, hospitals, and mental health services. These investments ensure that residents have access to essential healthcare services, promoting a healthy and resilient community.

Economic Growth and Business Support

The sales tax structure in King County is designed to encourage economic growth and support local businesses. The exemptions and reduced tax rates for certain industries, as mentioned earlier, provide a competitive advantage for businesses operating in these sectors. This, in turn, attracts investment and fosters a vibrant business environment.

Furthermore, the revenue generated from sales tax is often reinvested in initiatives that promote business development, such as startup incubators, small business grants, and job training programs. These efforts create a positive cycle, where a thriving business community generates more revenue, which can then be utilized to further support economic growth.

Frequently Asked Questions

What is the purpose of the sales tax in King County, Washington?

+

The sales tax in King County is primarily aimed at generating revenue to fund essential services, infrastructure projects, and community development initiatives. It is a significant source of funding for the county’s operations, ensuring the delivery of vital public services to residents.

How often do businesses need to remit sales tax in King County?

+

The frequency of sales tax remittance depends on the business’s sales volume. Typically, businesses with higher sales volumes are required to remit taxes more frequently, such as on a monthly basis. Smaller businesses may be permitted to remit taxes on a quarterly basis.

Are there any upcoming changes to the sales tax rates in King County?

+

Sales tax rates in King County are subject to change based on local and state legislative decisions. It is advisable to stay updated with the latest tax laws and consult the Washington State Department of Revenue for any recent or upcoming changes in sales tax rates.

How can businesses ensure they are compliant with sales tax regulations in King County?

+

Businesses can ensure compliance by registering with the Washington State Department of Revenue, collecting sales tax accurately, and remitting taxes on time. Proper record-keeping and staying informed about tax laws and regulations are crucial aspects of sales tax compliance.

What are the consequences for businesses that fail to comply with sales tax regulations in King County?

+

Non-compliance with sales tax regulations can result in penalties, interest charges, and legal consequences. It is essential for businesses to take sales tax compliance seriously to avoid these repercussions and maintain a positive relationship with the tax authorities.