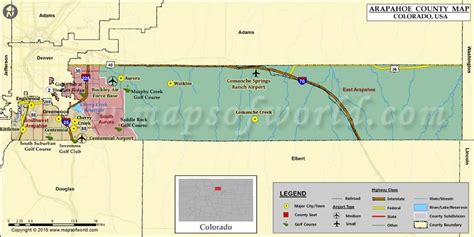

Arapahoe County Property Tax

Property taxes are an essential revenue stream for local governments, and understanding their implications is crucial for property owners and residents. In this comprehensive guide, we will delve into the intricacies of Arapahoe County's property tax system, providing valuable insights and information to help you navigate this complex topic.

Understanding Arapahoe County Property Taxes

Arapahoe County, located in the state of Colorado, has a robust property tax system that contributes significantly to the county’s revenue and infrastructure development. The property tax rates and assessments play a vital role in funding essential services, including schools, public safety, and community development projects.

The property tax structure in Arapahoe County is governed by state laws and regulations, with the county authorities responsible for implementing and administering the tax system. Let's explore the key aspects of property taxes in this region and how they impact property owners.

Property Tax Assessment Process

The first step in understanding property taxes is comprehending the assessment process. Arapahoe County assesses property values to determine the tax liability for each property owner. The assessment is based on several factors, including the property’s location, size, improvements, and market conditions.

The county employs professional assessors who conduct thorough evaluations to ensure fair and accurate assessments. These assessments are typically conducted every odd-numbered year, and property owners receive a notice of valuation, which details the assessed value of their property.

It's important for property owners to review these assessments carefully. If there are any discrepancies or concerns, they have the right to appeal the valuation. The appeal process allows property owners to provide evidence and support for a potential adjustment to their assessed value.

| Assessment Year | Assessment Deadline |

|---|---|

| 2023 | April 30, 2023 |

| 2024 | April 30, 2024 |

Note: The assessment deadlines are subject to change, so it's advisable to check the official Arapahoe County website for the most up-to-date information.

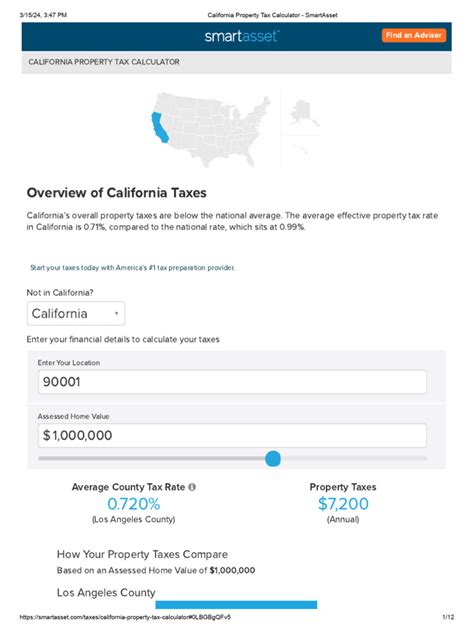

Property Tax Rates and Calculations

Once the assessed value of a property is determined, the property tax rate comes into play. The tax rate is established by the county commissioners and is expressed as a mill levy. One mill represents one-tenth of a cent, and the mill levy is applied to the assessed value of the property to calculate the tax amount.

The mill levy is a combination of rates set by various taxing entities, including the county, school districts, special districts, and municipalities. These entities utilize property taxes to fund their operations and provide essential services to the community.

The formula for calculating property taxes is as follows:

Property Tax = Assessed Value x Mill Levy

For example, if a property has an assessed value of $300,000 and the mill levy is 60 mills, the property tax calculation would be:

Property Tax = $300,000 x 0.060 = $18,000

It's worth noting that the mill levy can vary from one taxing district to another within Arapahoe County, leading to differences in property tax rates across the county.

Property Tax Exemptions and Relief

Arapahoe County offers various property tax exemptions and relief programs to eligible property owners. These initiatives aim to provide financial assistance and reduce the tax burden for specific categories of taxpayers.

One notable exemption is the Senior Citizen Property Tax Exemption. Qualifying seniors can apply for this exemption, which reduces their property taxes by a certain percentage. The eligibility criteria and application process are outlined on the county's website.

Additionally, the county provides information on other exemptions, such as those for disabled veterans, agricultural lands, and historic properties. These exemptions are designed to support specific groups and encourage certain land uses.

Payment Options and Deadlines

Property owners in Arapahoe County have several payment options to choose from when it comes to settling their property tax liabilities. The county accepts payments through various methods, including online payment portals, mail-in checks, and in-person payments at designated locations.

The payment deadlines are crucial to avoid penalties and late fees. Typically, property taxes are due in two installments, with the first installment deadline falling around May and the second installment due in November. However, it's essential to check the official website for the exact dates, as they may vary slightly from year to year.

Late payments may incur interest and penalties, so it's advisable to stay informed and plan your payments accordingly. The county provides resources and reminders to help taxpayers stay on track with their property tax obligations.

Impact on the Community

Property taxes play a significant role in shaping the community and its development. The revenue generated from property taxes is invested back into the community through various initiatives and projects.

For instance, property taxes fund essential services such as fire protection, police services, road maintenance, and waste management. They also contribute to the development of parks, recreational facilities, and cultural centers, enhancing the overall quality of life for residents.

Furthermore, property taxes support the local education system. A portion of the tax revenue is allocated to school districts, ensuring that students receive quality education and necessary resources.

Staying Informed and Engaged

Understanding the intricacies of property taxes is crucial for property owners in Arapahoe County. By staying informed about assessment processes, tax rates, exemptions, and payment deadlines, homeowners can ensure they are meeting their obligations and taking advantage of any available relief programs.

The county provides a wealth of resources and information on its website, including tax guides, assessment details, and contact information for relevant departments. It's recommended to explore these resources and reach out to the county's tax office for any specific inquiries or concerns.

Additionally, attending public meetings and engaging with local government representatives can provide valuable insights into the property tax system and its impact on the community. Staying involved allows residents to have a say in the decision-making process and ensure that their interests are considered.

Conclusion

Property taxes are a vital component of local government funding, and Arapahoe County’s system is no exception. By comprehending the assessment process, tax rates, exemptions, and payment options, property owners can navigate the property tax landscape with confidence.

As we've explored in this comprehensive guide, property taxes contribute to the development and well-being of the community. From funding essential services to supporting local schools, the revenue generated through property taxes plays a pivotal role in shaping Arapahoe County's future.

Stay informed, engage with your local government, and take advantage of the resources available to ensure a smooth property tax experience. Together, we can foster a vibrant and thriving community in Arapahoe County.

What is the current mill levy in Arapahoe County?

+The current mill levy in Arapahoe County can vary depending on the specific taxing district. On average, the mill levy ranges from approximately 50 to 70 mills. However, it’s important to note that this can fluctuate, and it’s advisable to check the official county website for the most accurate and up-to-date information.

How often are property taxes assessed in Arapahoe County?

+Property taxes in Arapahoe County are assessed every odd-numbered year. This means that assessments are conducted in years ending with an odd number, such as 2023, 2025, and so on. Property owners receive a notice of valuation, detailing the assessed value of their property.

Are there any property tax relief programs available for low-income homeowners in Arapahoe County?

+Yes, Arapahoe County offers a Property Tax Assistance Program specifically designed to provide relief to low-income homeowners. This program offers a deferred payment option, allowing eligible homeowners to defer a portion of their property taxes until the time of sale or transfer of ownership. It’s important to review the eligibility criteria and application process on the county’s website.

Can I appeal my property tax assessment if I disagree with the valuation?

+Absolutely! If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal the valuation. Arapahoe County provides a formal appeal process, allowing property owners to present their case and provide evidence supporting a potential adjustment. The appeal process typically involves submitting an appeal form and attending a hearing.