How To Obtain Tax Transcripts

Tax transcripts are official records provided by the Internal Revenue Service (IRS) that contain valuable information about an individual's tax return. These transcripts are often requested for various reasons, such as verifying income, resolving tax issues, applying for loans or mortgages, or even for personal financial record-keeping. In this comprehensive guide, we will delve into the process of obtaining tax transcripts, exploring the different types available, the steps involved, and the various scenarios where these transcripts can be beneficial.

Understanding Tax Transcripts

Tax transcripts serve as a summary of the tax information reported on a taxpayer’s return. They provide an accurate and official record of key details, making them an essential tool for individuals and businesses alike. There are several types of tax transcripts, each catering to specific needs and purposes.

Types of Tax Transcripts

- Return Transcripts: These transcripts provide the most comprehensive view of a tax return. They include information from the original return as filed, along with any amendments or corrections. Return transcripts are ideal for verifying income and tax payments.

- Account Transcripts: Account transcripts offer a detailed history of a taxpayer’s account with the IRS. They include information on payments, adjustments, and any actions taken by the IRS. Account transcripts are useful for understanding the status of a tax account and resolving potential issues.

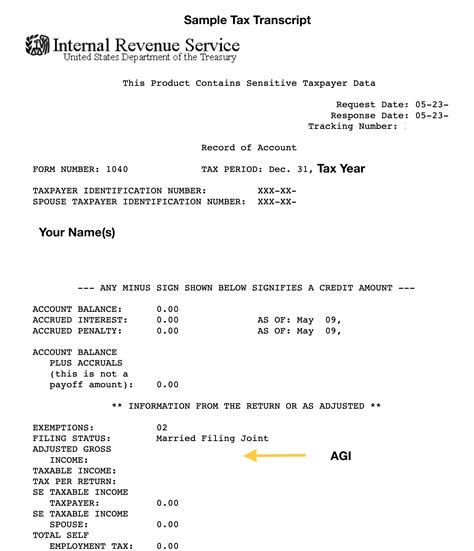

- Record of Account: This transcript combines elements of both return and account transcripts. It provides a chronological view of the tax return and subsequent actions, including payments, adjustments, and notices. The Record of Account is often requested for complex tax situations or when a detailed history is required.

- Wage and Income Transcripts: These transcripts focus on the income information reported to the IRS by employers and other payers. They include data from Forms W-2, 1099, and other income-related forms. Wage and Income Transcripts are commonly used for verifying income for loans, financial aid, or other purposes.

Requesting Tax Transcripts

The process of obtaining tax transcripts is straightforward and can be completed online, by phone, or by mail. The IRS offers several methods to ensure accessibility for taxpayers.

Online Request

The most convenient way to request tax transcripts is through the Get Transcript Online service provided by the IRS. To use this service, you’ll need an Identity Protection PIN (IP PIN) or other verification methods. Once you have the necessary credentials, follow these steps:

- Visit the Get Transcript Online page on the IRS website.

- Select the type of transcript you need (Return, Account, Record of Account, or Taxpayer).

- Enter your personal information, including your name, Social Security Number (SSN), date of birth, and filing status.

- Choose the tax year(s) for which you require transcripts.

- Provide the necessary verification details, such as your IP PIN or other authentication methods.

- Review and submit your request. The transcripts will be available for download or viewing within a few minutes.

Phone Request

If you prefer not to use the online service, you can request tax transcripts by calling the IRS. The telephone number for requesting transcripts is 800-908-9946. When calling, you’ll need to provide the following information:

- Your name, address, and phone number.

- Your SSN or Individual Taxpayer Identification Number (ITIN)

- The tax year(s) for which you need transcripts.

- The type of transcript you require (Return, Account, Record of Account, or Wage and Income)

The IRS representative will guide you through the process and may ask additional questions for verification purposes. Your transcripts will be mailed to you within 5 to 10 business days.

Mail Request

For those who prefer traditional methods, tax transcripts can also be requested by mail. The IRS provides a Form 4506-T specifically for this purpose. Here’s how to request transcripts by mail:

- Download and print the Form 4506-T from the IRS website.

- Complete the form with your personal information, including your name, address, and SSN.

- Select the type of transcript you need (Return, Account, Record of Account, or Wage and Income) and specify the tax year(s) requested.

- Provide your contact information, including a phone number and email address.

- Sign and date the form. If you’re requesting on behalf of someone else, ensure you have the necessary authorization.

- Mail the completed form to the address provided on the form. The IRS will process your request and mail the transcripts to you within 30 days.

Using Tax Transcripts

Tax transcripts are versatile documents that serve multiple purposes. Here are some common scenarios where tax transcripts can be beneficial:

Verifying Income

Tax transcripts, particularly Wage and Income Transcripts, are often used to verify income for various purposes. Lenders, mortgage companies, and financial institutions may request these transcripts to assess an individual’s financial stability and creditworthiness. Additionally, tax transcripts can be useful for resolving discrepancies in reported income, such as when applying for financial aid or government benefits.

Loan and Mortgage Applications

When applying for loans or mortgages, lenders typically require verification of income and tax history. Tax transcripts provide a comprehensive record of tax returns and payments, helping lenders assess the borrower’s financial situation and creditworthiness. By including tax transcripts with your loan application, you can expedite the approval process and demonstrate your financial stability.

Financial Record-Keeping

Tax transcripts can be valuable tools for personal financial record-keeping. By obtaining and reviewing your tax transcripts annually, you can ensure the accuracy of your tax returns and identify any potential errors or discrepancies. This practice can help you maintain a clear and organized financial record, making it easier to manage your taxes and plan for the future.

Resolving Tax Issues

In cases of tax disputes, audits, or inquiries, tax transcripts can be crucial for resolving issues with the IRS. Account transcripts, in particular, provide a detailed history of your tax account, including any adjustments, penalties, or credits applied. Having access to these transcripts can help you understand the IRS’s perspective and work towards a resolution.

| Transcript Type | Description |

|---|---|

| Return Transcripts | Summary of tax return information |

| Account Transcripts | Detailed history of tax account actions |

| Record of Account | Combined view of return and account information |

| Wage and Income Transcripts | Income information reported to the IRS |

FAQs

How long does it take to receive tax transcripts after requesting them online or by phone?

+When requesting tax transcripts online or by phone, you can typically expect to receive them within 10 to 15 minutes. The IRS processes these requests quickly, and you can access the transcripts as soon as they are available.

Can I request tax transcripts for multiple tax years at once?

+Yes, you can request tax transcripts for multiple tax years simultaneously. Whether using the online service, calling the IRS, or mailing a Form 4506-T, you can specify the range of tax years for which you need transcripts.

Are tax transcripts free of charge?

+Yes, tax transcripts are provided free of charge by the IRS. Whether you request them online, by phone, or by mail, there is no cost associated with obtaining these official records.

Can I request tax transcripts on behalf of someone else?

+Yes, you can request tax transcripts on behalf of someone else, but you must have the necessary authorization. This typically involves having a valid power of attorney or a signed Form 2848, which grants you the authority to act on behalf of the taxpayer.

How far back can I request tax transcripts?

+The IRS generally provides tax transcripts for the current tax year and the three previous tax years. However, in certain circumstances, you may be able to request transcripts for older tax years. The availability of older transcripts depends on the IRS’s record retention policies.