7 Expert Tips to Maximize Your Experience with PNC Houston

As someone who’s always been fascinated by seamless banking experiences, I’ve noticed that understanding how to maximize my interactions with PNC Houston can truly make a difference. From what I’ve seen, many people dive into their banking without exploring all the personalized tools and tips available. Especially in a vibrant city like Houston, where the economy is thriving and lifestyle is fast-paced, knowing how to leverage PNC’s resources becomes essential. I’ve tried different approaches myself—like utilizing mobile apps and customizing account alerts—and it’s honestly transformed my banking routine. If you’re like me, eager to get the most out of your banking experience in Houston, these seven expert tips will be a game-changer.

- Maximize convenience with digital tools and personalized alerts.

- Enhance security by understanding fraud prevention options.

- Optimize account management through customized services and local branches.

- Build financial resilience with expert advice and planning resources.

- Stay informed about PNC Houston’s special programs and seasonal offers.

1. Leverage PNC Mobile and Online Banking Features

Making banking on the go effortless in Houston

One thing I love about PNC Houston is their robust mobile app. I’ve noticed that by downloading the app and linking my accounts, I can check balances, transfer funds, and even deposit checks without heading to the branch. With Houston’s busy lifestyle, convenience is king. The app’s intuitive design makes it easy to navigate multiple accounts, and I’ve set up automatic alerts for low balances—saving me surprises during busy weeks. Plus, I’ve tried customizing my notifications for bill due dates and transaction alerts, which help me stay on top of my financial game.

2. Utilize PNC Houston’s Local Branch Services

Personalized support tailored to Houston’s unique needs

From what I’ve seen, many people overlook the advantage of visiting local branches in Houston. I’ve visited the Heights and Galleria branches, and the personalized service truly makes a difference. Staff are knowledgeable about local economic trends and can suggest tailored advice for small business owners or savers. In my experience, scheduling a one-on-one with a financial advisor at local branches has helped me plan for future expenses—like property down payments or college funds.

- Schedule appointments for personalized financial plans.

- Utilize in-branch seminars on wealth management and home buying.

- Ask about community-specific financial programs or grants.

3. Take Advantage of PNC Houston’s Special Offers and Seasonal Promotions

Staying ahead with current deals and incentives

I’ve noticed that PNC Houston often runs special promotions, especially around the holidays and tax season. From cashback offers on certain accounts to limited-time savings bonuses, staying informed can help you capitalize on extra benefits. For example, last year, I signed up for their promotional certificates of deposit (CDs), which offered a higher interest rate—helping my savings grow faster. I recommend visiting their website regularly or subscribing to their newsletter to catch upcoming deals.

- Check for limited-time bonus savings or cashback deals.

- Participate in seasonal financial health webinars hosted locally.

- Explore referral bonuses if you recommend PNC to friends or family.

4. Set Up Customized Alerts for Your Accounts

Stay in control with real-time updates

One thing I’ve noticed in my experience is that alerts can prevent overdrafts and help track spending patterns. I’ve tried customizing alerts based on my typical expenses—like rent or utility bills—and it’s been a lifesaver during hectic weeks. PNC Houston allows you to set thresholds for balances, transaction activity, and even scheduled payments. Tailoring these helps me feel more confident that my finances are under control without constantly logging in.

- Receive alerts for large transactions or suspicious activity.

- Set reminders for upcoming bill payments or dues.

- Customize alerts for specific account activities.

5. Explore PNC’s Wealth Management and Investment Resources

Building long-term wealth in Houston’s dynamic economy

If you’re like me, thinking beyond the basics is key. I’ve seen that PNC Houston offers a range of wealth management services, from investment advice to estate planning. Their advisors are well-versed in Houston’s booming energy, healthcare, and tech sectors. I’ve even tried their online planning tools, which help visualize goals and forecast different scenarios. These resources are perfect for anyone looking to grow their wealth or prepare for retirement in this thriving city.

- Schedule a consultation with a local PNC financial advisor.

- Use online calculators to plan for college funding or retirement.

- Attend free workshops on investment strategies held in Houston.

6. Stay Updated with PNC Houston’s Community Initiatives

Supporting local growth while managing your finances

From what I’ve seen, PNC Houston actively participates in community development initiatives—like supporting small businesses and nonprofit projects. I’ve attended events sponsored by PNC that focus on financial literacy, which offered practical tips I still use today. Engaging with these programs not only helps strengthen my connection to Houston but also broadens my financial knowledge.

- Subscribe to newsletters for local community events.

- Participate in financial literacy seminars or webinars.

- Volunteer or support local initiatives through PNC partnerships.

7. Keep an Eye on Seasonal Trends and City Events

Matching your financial planning with the city’s rhythm

Living in Houston means navigating a city full of festivals, sporting events, and seasonal sales. I’ve tried adapting my finances based on these trends—like budgeting extra during rodeo season or planning for tax season in spring. Plus, visual content like charts and infographics about city-specific economic trends can be a handy reference, especially during busy months. This approach helps me feel connected and prepared for Houston’s unique rhythm while getting the most out of my banking services.

Frequently Asked Questions

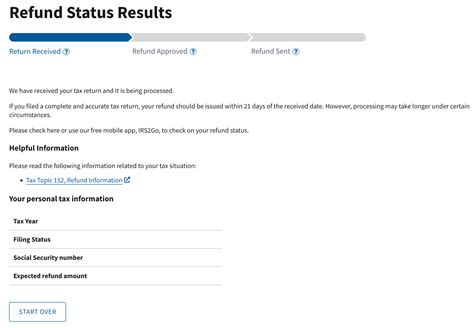

How can I set up custom account alerts in PNC Houston?

+Log into your online banking account, navigate to the alerts section, and choose the specific activities or thresholds you’d like notifications for. Customize how and when you receive these alerts for maximum control.

What special offers are available for new PNC customers in Houston?

+PNC Houston often provides introductory bonuses on savings accounts, CDs, or credit cards. Check their current promotions online or visit your local branch to see the latest deals.

Can I access financial planning resources online with PNC Houston?

+Absolutely. PNC offers various online tools, webinars, and virtual consultations that help you plan for the future from your home or smartphone, making financial management more flexible and accessible.