Nys Estimated Tax Payment

For New York State residents, understanding the process of making estimated tax payments is crucial for effective financial planning. This article aims to provide a comprehensive guide to New York State's estimated tax payment system, offering insights and strategies to navigate this essential financial obligation.

Introduction to New York State Estimated Tax Payments

New York State, much like other states and the federal government, requires individuals and businesses to make estimated tax payments throughout the year to ensure that their tax obligations are met. This system is designed to maintain a steady flow of revenue for the state and to help taxpayers manage their tax liabilities more efficiently. This article will delve into the specifics of New York’s estimated tax payment process, including the methods of calculation, payment options, and the potential penalties for non-compliance.

Understanding the Need for Estimated Tax Payments

Estimated tax payments are typically required when an individual’s tax liability for the year is expected to exceed a certain threshold, often set by the state or federal government. In New York State, these payments are mandatory for taxpayers who have income from sources other than wages, salaries, or pensions that are subject to withholding. This includes self-employment income, investment income, and certain types of business income.

The primary reason for estimated tax payments is to ensure that taxpayers pay their fair share of taxes throughout the year, rather than waiting until the end of the year and potentially facing a large tax bill. This system also helps the state budget more effectively, as it receives tax revenue in a more consistent manner.

Who Needs to Make Estimated Tax Payments in New York State?

The obligation to make estimated tax payments typically falls on individuals whose income is not subject to regular withholding. This includes:

- Self-employed individuals, such as contractors, freelancers, and small business owners.

- Investors with substantial capital gains or dividends.

- Those with income from rental properties or other passive investments.

- Authors, artists, or musicians with royalties.

- Individuals with significant income from sources outside the United States.

Calculating Your Estimated Tax Payment

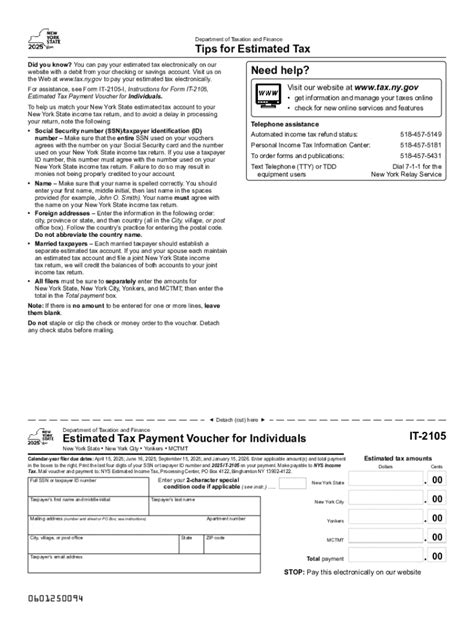

Calculating your estimated tax payment is a critical step in the process. The New York State Department of Taxation and Finance provides a workbook that helps taxpayers determine their estimated tax liability. This workbook takes into account various sources of income, deductions, and credits to arrive at an estimated tax amount.

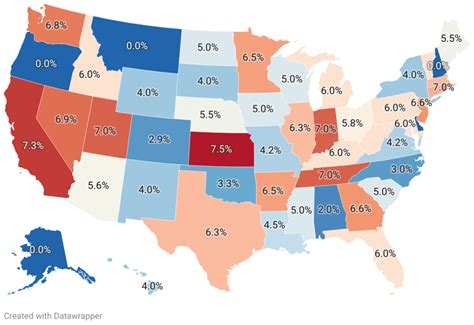

The basic formula for calculating estimated tax payments involves estimating your income, deductions, and credits for the year, and then applying the appropriate tax rates. The New York State Tax Rate Schedule provides the applicable tax rates based on income brackets. It's important to note that the tax rates and brackets may change from year to year, so it's essential to use the most up-to-date information.

Considerations for Income Estimation

When estimating your income, it’s crucial to consider all sources of income, not just the obvious ones. This may include:

- Earnings from self-employment or business activities.

- Dividends, interest, and capital gains from investments.

- Rental income.

- Gifts or inheritances that are subject to tax.

- Any other income not subject to withholding.

It's important to be as accurate as possible in your income estimation to avoid penalties for underpayment.

Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Some common deductions and credits that may apply to estimated tax payments include:

- Standard deductions or itemized deductions, such as mortgage interest, property taxes, and charitable contributions.

- Personal exemptions for yourself, your spouse, and dependents.

- Education credits, such as the American Opportunity Credit or Lifetime Learning Credit.

- Child and dependent care credits.

- Credit for the elderly or disabled.

Be sure to consult with a tax professional or use reputable tax software to ensure you're taking advantage of all the deductions and credits you're eligible for.

Payment Options and Deadlines

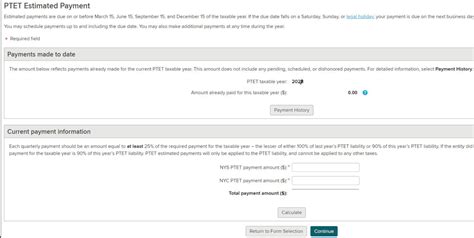

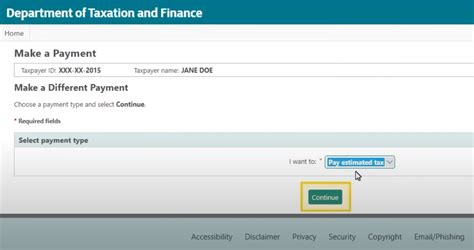

New York State offers several convenient methods for making estimated tax payments, including online payments, direct bank transfers, and traditional check or money order payments. The state’s Pay Your Taxes Online portal provides a secure and efficient way to make payments.

Payment Deadlines

Estimated tax payments in New York State are due on specific dates throughout the year. There are typically four payment periods, with payments due on:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

It's important to note that these dates are the deadlines for payment, but it's recommended to make payments as early as possible to avoid potential penalties and to ensure that your payments are aligned with your income throughout the year.

Penalty for Underpayment

If you underpay your estimated taxes, you may be subject to a penalty. The penalty for underpayment is calculated based on the difference between the amount you should have paid and the amount you actually paid, taking into account any exceptions or waivers that may apply. It’s crucial to make accurate estimated tax payments to avoid these penalties.

Strategies for Effective Estimated Tax Payment Management

Managing your estimated tax payments effectively can help you avoid penalties and ensure that you’re not overpaying. Here are some strategies to consider:

1. Accurate Income Tracking

Keep meticulous records of your income throughout the year. This will help you make more accurate estimated tax payments and will also simplify the process of filing your annual tax return.

2. Regular Review of Deductions and Credits

Tax laws and regulations can change from year to year, and so can your personal circumstances. Regularly review your deductions and credits to ensure you’re taking advantage of all the tax benefits you’re eligible for.

3. Payment Timing

Consider making your estimated tax payments early, especially if your income is not consistent throughout the year. This can help you avoid underpayment penalties and ensure that you’re not hit with a large tax bill at the end of the year.

4. Consult with a Tax Professional

If you’re unsure about any aspect of estimated tax payments or have a complex financial situation, consider consulting with a tax professional. They can provide personalized advice and ensure that you’re complying with all the necessary regulations.

Resources and Further Reading

For more information on estimated tax payments in New York State, the following resources can be valuable:

- New York State Department of Taxation and Finance: Estimated Tax Payment Workbook

- New York State Tax Guide for Individuals

- IRS: Tax Withholding and Estimated Tax

These resources provide detailed information on estimated tax payments, tax rates, and other relevant topics to help you navigate the process effectively.

Conclusion

Estimated tax payments are a necessary part of being a taxpayer in New York State. By understanding the process, calculating your estimated tax payments accurately, and staying up-to-date with payment deadlines, you can effectively manage your tax obligations. Remember, accurate record-keeping, timely payments, and staying informed about tax laws are key to a smooth tax experience.

What happens if I don’t make estimated tax payments in New York State?

+If you fail to make estimated tax payments or underpay, you may be subject to penalties and interest. The penalty for underpayment is calculated based on the difference between the amount you should have paid and the amount you actually paid. It’s important to stay compliant to avoid these additional costs.

Are there any exceptions to the estimated tax payment requirements in New York State?

+Yes, there are certain exceptions and waivers that may apply. For example, if you’re a first-time filer or if your income is significantly lower than in previous years, you may be eligible for a waiver of the estimated tax payment requirement. It’s important to check with the New York State Department of Taxation and Finance or a tax professional to determine if you qualify for any exceptions.

Can I pay my estimated taxes online in New York State?

+Yes, New York State offers online payment options through their Pay Your Taxes Online portal. This provides a secure and convenient way to make your estimated tax payments. You can also pay by direct bank transfer, check, or money order.