Forsyth County Tax Commissioner

Welcome to the comprehensive guide to the Forsyth County Tax Commissioner's Office, a vital administrative body in Georgia's Forsyth County. This office plays a crucial role in managing and collecting various taxes, ensuring the efficient functioning of the county's government and public services. In this article, we will delve into the responsibilities, services, and impact of the Forsyth County Tax Commissioner, shedding light on its operations and the benefits it brings to the community.

Understanding the Role of the Forsyth County Tax Commissioner

The Forsyth County Tax Commissioner’s Office is a critical link between the county’s residents and the local government, responsible for administering and collecting taxes that fund essential public services. Led by the elected Tax Commissioner, this office ensures a transparent and efficient tax collection process, maintaining the financial stability of the county.

The Tax Commissioner's primary responsibilities include:

- Assessing and collecting ad valorem taxes on real and personal property.

- Managing the registration and titling of motor vehicles, including issuing tags and titles.

- Overseeing the collection of various other taxes and fees, such as occupational tax and business license fees.

- Providing accurate and timely information to taxpayers regarding their tax obligations.

- Ensuring compliance with state and local tax laws and regulations.

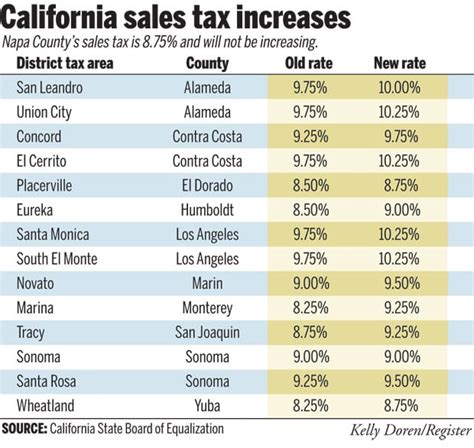

Ad Valorem Taxes: A Key Focus

One of the primary functions of the Tax Commissioner's Office is the assessment and collection of ad valorem taxes. These taxes are levied on the value of real estate and personal property, forming a significant portion of the county's revenue stream.

| Tax Type | Description |

|---|---|

| Real Property Tax | Taxes on land and buildings, calculated based on assessed value. |

| Personal Property Tax | Taxes on assets like vehicles, boats, and business equipment. |

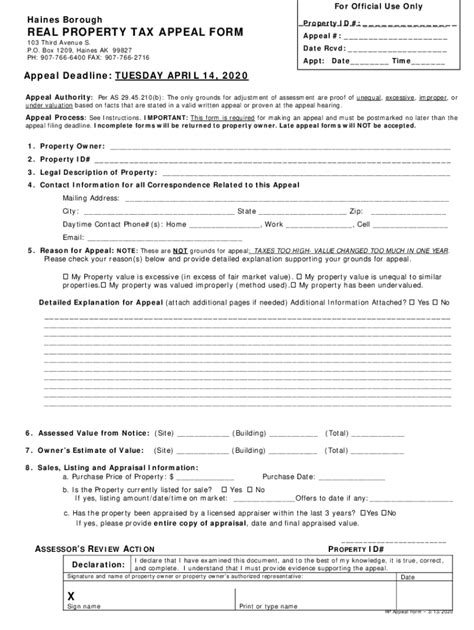

The Tax Commissioner's Office ensures that property owners receive accurate tax bills and provides a platform for appeals if needed. By managing this process efficiently, the office contributes significantly to the county's financial health.

Motor Vehicle Registration and Titling

Another vital service offered by the Forsyth County Tax Commissioner is the registration and titling of motor vehicles. This process involves:

- Issuing vehicle registrations and titles to owners.

- Collecting title transfer fees and other related taxes.

- Ensuring compliance with state regulations for vehicle ownership.

- Providing convenient services for vehicle registration renewals.

The Tax Commissioner's Office often serves as the primary point of contact for vehicle owners, making the registration and titling process more accessible and efficient.

Services and Impact on the Community

The Forsyth County Tax Commissioner’s Office offers a range of services that directly impact the lives of residents and businesses within the county.

Tax Payment Options

Taxpayers have multiple options for paying their taxes, including online payments, in-person payments at the Tax Commissioner’s Office, and secure drop boxes for after-hours payments. This flexibility ensures that taxpayers can choose the most convenient method, reducing the barriers to timely tax payments.

Tax Exemptions and Discounts

The Tax Commissioner’s Office also administers various tax exemption programs, providing relief to eligible taxpayers. These programs may include senior citizen discounts, military exemptions, and other special considerations. By offering these exemptions, the office helps reduce the tax burden for specific segments of the community.

Efficient Tax Collection

The efficient tax collection processes implemented by the Tax Commissioner’s Office ensure that the county receives its revenue in a timely manner. This financial stability is crucial for maintaining and improving public services, including education, infrastructure, and public safety.

Community Engagement

Beyond tax collection, the Tax Commissioner’s Office actively engages with the community. This includes hosting educational events to inform taxpayers about their rights and responsibilities, as well as participating in community initiatives to promote financial literacy and responsible tax management.

A Transparent and Accountable Process

The Forsyth County Tax Commissioner’s Office operates under strict guidelines to maintain transparency and accountability. This includes adhering to state and local tax laws, providing clear and concise information to taxpayers, and ensuring that all tax revenues are appropriately allocated and accounted for.

The Tax Commissioner's Office also maintains a robust system of checks and balances to prevent fraud and ensure the integrity of the tax collection process. This commitment to transparency fosters trust between the Tax Commissioner's Office and the community it serves.

Public Records and Transparency

The Tax Commissioner’s Office maintains public records, including tax assessment data and tax payment records. These records are accessible to the public, allowing for scrutiny and ensuring that the tax collection process remains fair and unbiased.

The Future of Tax Administration in Forsyth County

Looking ahead, the Forsyth County Tax Commissioner’s Office is committed to leveraging technology to enhance its services. This includes implementing digital platforms for tax payments and records management, as well as exploring blockchain and other innovative technologies to further improve efficiency and security.

Additionally, the Tax Commissioner's Office aims to foster a culture of financial literacy within the community. By educating taxpayers about their rights, responsibilities, and the impact of taxes on public services, the office aims to create a more engaged and informed citizenry.

Continuous Improvement

The Tax Commissioner’s Office is dedicated to continuous improvement, regularly seeking feedback from taxpayers and stakeholders to identify areas for enhancement. This commitment to feedback and adaptation ensures that the office remains responsive to the evolving needs of the community.

Community Partnerships

Building partnerships with local businesses, community organizations, and government agencies is another key focus. These collaborations can lead to more efficient tax collection processes, better taxpayer services, and a stronger financial foundation for the county.

Conclusion: A Critical Pillar of Forsyth County’s Administration

The Forsyth County Tax Commissioner’s Office is an essential component of the county’s administrative structure, playing a pivotal role in tax collection, vehicle registration, and community engagement. By efficiently managing these processes, the office ensures the financial stability and prosperity of Forsyth County, Georgia.

Through its commitment to transparency, accountability, and continuous improvement, the Tax Commissioner's Office sets a high standard for public service. As it embraces technological advancements and community partnerships, the office is well-positioned to meet the evolving needs of Forsyth County residents and businesses.

What is the role of the Forsyth County Tax Commissioner?

+The Forsyth County Tax Commissioner is responsible for assessing and collecting various taxes, including ad valorem taxes on real and personal property, and managing the registration and titling of motor vehicles. They also oversee the collection of other taxes and fees, provide taxpayer information, and ensure compliance with tax laws.

How can I pay my taxes in Forsyth County?

+You can pay your taxes through online payments, in-person at the Tax Commissioner’s Office, or by using secure drop boxes for after-hours payments. The Tax Commissioner’s Office provides various payment options to ensure convenience and accessibility for taxpayers.

Are there any tax exemptions or discounts available in Forsyth County?

+Yes, the Tax Commissioner’s Office administers tax exemption programs for eligible taxpayers, including senior citizen discounts, military exemptions, and other special considerations. These programs aim to reduce the tax burden for specific segments of the community.