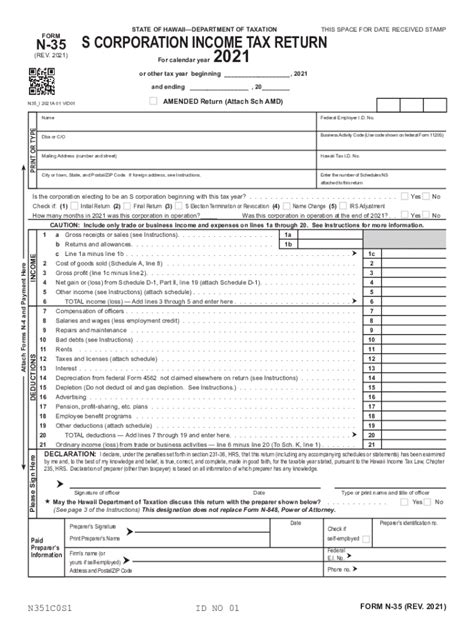

Hawaii Tax Forms

The beautiful state of Hawaii, known for its stunning landscapes and vibrant culture, also has a unique tax system that residents and businesses need to navigate. Understanding the Hawaii tax forms and processes is crucial for ensuring compliance and making the most of available deductions and credits. This comprehensive guide will delve into the world of Hawaii tax forms, providing an in-depth analysis of the key forms, their requirements, and the benefits they offer.

Unraveling the Complexity of Hawaii Tax Forms

Hawaii’s tax system is a complex interplay of various forms and regulations, designed to support the state’s economic growth and sustainability. The forms themselves serve as the foundation for accurate tax reporting and compliance, ensuring that individuals and businesses contribute their fair share to the state’s revenue. Let’s explore the essential forms and their significance.

Form N-11: Individual Income Tax Return

One of the cornerstone tax forms in Hawaii is the Form N-11, which is the individual income tax return. This form is mandatory for all Hawaii residents who have taxable income, including wages, salaries, investments, and business income. It allows individuals to calculate their tax liability and claim deductions and credits specific to Hawaii.

| Form N-11 Details | Description |

|---|---|

| Filing Deadline | April 20th (or the next business day if it falls on a weekend) |

| Payment Options | Electronic funds transfer, credit/debit card, check, or money order |

| Required Attachments | W-2 forms, 1099 forms, and other relevant tax documents |

Key deductions and credits available on Form N-11 include the Hawaii Earned Income Tax Credit, which provides a boost for low- to moderate-income taxpayers, and the Hawaii Property Tax Credit, which offers relief for homeowners.

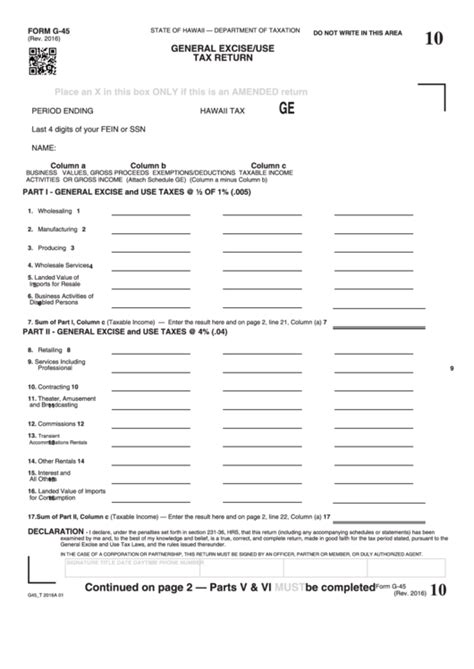

Form G-49: General Excise Tax Return

For businesses operating in Hawaii, the Form G-49 is an essential form. It is used to report and pay the General Excise Tax, which is a broad-based tax imposed on the privilege of doing business in Hawaii. The tax is levied on the gross income derived from business activities and is often passed on to consumers as a component of the sale price.

| Form G-49 Details | Description |

|---|---|

| Filing Frequency | Monthly, quarterly, or annually, depending on the business's tax liability |

| Tax Rate | 4% base rate, with additional county-specific surcharges |

| Registration | Businesses must register for a General Excise Tax account with the Department of Taxation |

The General Excise Tax is a critical revenue source for the state, funding various public services and infrastructure projects. Businesses can also opt for the Simplified Tax Reporting option, which simplifies the tax calculation and filing process for certain qualifying businesses.

Form N-58: Resident Withholding Tax Return

Employers in Hawaii are required to withhold income tax from their employees’ wages and file the Form N-58 to report and remit these withholdings to the state. This form ensures that employees’ tax obligations are met and that the state receives its share of income tax.

| Form N-58 Details | Description |

|---|---|

| Filing Frequency | Monthly or quarterly, depending on the employer's tax liability |

| Withholding Rates | Based on the employee's Hawaii income tax withholding rate and federal income tax withholding rate |

| W-2 Reporting | Employers must also provide W-2 forms to their employees, reporting their wages and withheld taxes |

Form N-58 ensures compliance with Hawaii's income tax laws and helps the state maintain a stable revenue stream. It also contributes to the overall efficiency of the tax system by simplifying the process for both employers and employees.

Form W-7: Hawaii State Taxpayer Identification Number Application

For individuals and businesses who need to obtain a Hawaii state taxpayer identification number (TIN), the Form W-7 is the designated application form. A TIN is required for various tax-related purposes, such as filing tax returns, opening a business account, or registering for certain state licenses.

| Form W-7 Details | Description |

|---|---|

| Eligibility | Available to both residents and non-residents who have tax obligations in Hawaii |

| Processing Time | Typically takes 4-6 weeks to receive a Hawaii TIN |

| Documentation | Requires proof of identity and residency/business activity in Hawaii |

The Hawaii TIN is unique to each taxpayer and serves as a crucial identifier in the state's tax system. It is essential for proper tax reporting and helps the state maintain accurate records for individuals and businesses.

The Benefits of Accurate Tax Form Completion

Completing Hawaii tax forms accurately and on time offers several advantages for taxpayers. Firstly, it ensures compliance with state laws, avoiding potential penalties and legal issues. Secondly, it allows taxpayers to maximize their deductions and credits, reducing their overall tax liability. Lastly, accurate tax reporting contributes to the overall efficiency of Hawaii’s tax system, benefiting the state and its residents.

Maximizing Deductions and Credits

Hawaii offers a range of deductions and credits that can significantly reduce taxpayers’ liability. By understanding and utilizing these benefits, individuals and businesses can keep more of their hard-earned money. Some key deductions and credits include:

- Hawaii Resident Credit: A non-refundable credit for Hawaii residents based on their federal income tax liability.

- Child and Dependent Care Credit: Helps offset the cost of childcare expenses for working parents.

- Property Tax Credit: Provides relief for homeowners by reducing their property tax burden.

- Military Spouse Deduction: Allows eligible military spouses to deduct a portion of their income.

- Student Loan Interest Deduction: Reduces tax liability for individuals paying off student loans.

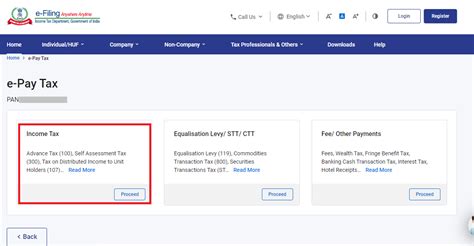

Online Filing and Payment Options

Hawaii offers convenient online filing and payment options for taxpayers. The e-Filing system allows individuals and businesses to submit their tax returns electronically, ensuring faster processing and reducing the risk of errors. Online payment options include electronic funds transfer, credit/debit card, and e-check, making it easier and more secure to remit tax payments.

Taxpayer Assistance and Resources

The Hawaii Department of Taxation provides extensive resources and assistance to taxpayers. This includes an online Taxpayer Information Center with FAQs, guides, and forms, as well as a Taxpayer Advocate program to help resolve tax-related issues. Taxpayers can also access free tax preparation assistance through the Volunteer Income Tax Assistance (VITA) program.

Future Implications and Potential Changes

As Hawaii’s economy evolves and tax laws are subject to ongoing revisions, it is crucial to stay informed about potential changes to tax forms and regulations. Here are some key considerations for the future:

- Potential tax reform: Hawaii's legislature may consider tax reform measures to simplify the tax system, reduce rates, or expand deductions and credits.

- Technology advancements: The Department of Taxation may further enhance its online systems, offering improved security, convenience, and efficiency for taxpayers.

- Economic impact studies: Research and analysis of Hawaii's tax system may lead to adjustments in tax policies to support economic growth and fairness.

Staying engaged with Hawaii's tax landscape ensures taxpayers can adapt to any changes and continue to navigate the tax system effectively.

What is the deadline for filing Hawaii tax returns?

+The deadline for filing Hawaii tax returns is April 20th each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day.

Can I e-file my Hawaii tax return?

+Yes, Hawaii offers an e-filing system for both individual and business tax returns. This system is secure, efficient, and reduces the risk of errors.

Are there any tax incentives for renewable energy projects in Hawaii?

+Yes, Hawaii provides tax credits for renewable energy systems and energy-efficient improvements. These incentives aim to encourage the adoption of clean energy technologies.

How can I obtain a Hawaii state taxpayer identification number (TIN) if I’m a non-resident?

+Non-residents can apply for a Hawaii TIN by completing Form W-7 and providing proof of identity and their tax obligations in Hawaii.