Tax Abatement Meaning

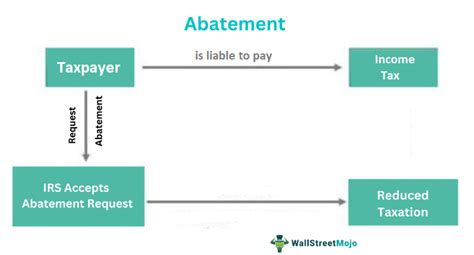

Tax abatement is a strategic tool employed by governments to stimulate economic growth, attract businesses, and incentivize investments within their jurisdictions. By temporarily reducing or eliminating certain taxes, authorities aim to foster development, create jobs, and enhance overall prosperity. This practice is particularly prevalent in the United States, where various tax abatement programs have been implemented to address specific economic challenges and promote targeted growth.

The Essence of Tax Abatement

At its core, tax abatement represents a deliberate reduction in the tax liability of businesses or individuals for a defined period. This reduction can apply to various taxes, including property taxes, income taxes, sales taxes, or a combination thereof. The primary objective is to encourage economic activities that might otherwise be hindered by the burden of taxation.

For instance, consider a scenario where a city is aiming to revitalize its downtown area. The local government might implement a tax abatement program that reduces property taxes for businesses that relocate or expand within the targeted district. This incentive could prove crucial in attracting new businesses, fostering urban regeneration, and creating a vibrant economic hub.

Types of Tax Abatement

Tax abatement programs can take several forms, each designed to address specific economic needs:

- Full Abatement: This involves a complete waiver of taxes for a specified period, often granted to attract new businesses or incentivize significant investments.

- Partial Abatement: Here, a portion of the tax liability is reduced, typically applied to promote smaller-scale projects or to support existing businesses.

- Progressive Abatement: The tax reduction varies based on factors like the amount of investment, the number of jobs created, or the economic impact of the project.

- Conditional Abatement: This type of abatement is contingent upon certain conditions, such as maintaining a minimum number of employees or meeting specific environmental standards.

Benefits and Considerations

Tax abatement offers several advantages, including:

- Economic Development: By reducing the tax burden, governments can encourage investment, job creation, and business growth, particularly in economically depressed areas.

- Competitive Advantage: Tax abatement programs can make a region more attractive to businesses, fostering competition and potentially leading to lower prices for consumers.

- Urban Regeneration: In the case of property tax abatements, these measures can spur redevelopment in dilapidated areas, improving the overall quality of life and the local environment.

However, tax abatement also carries certain considerations:

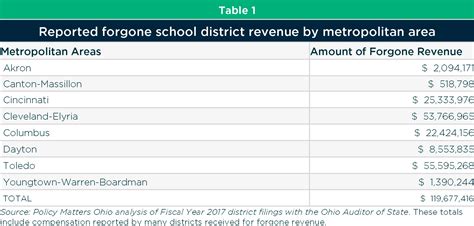

- Revenue Loss: Governments must carefully balance the potential benefits of tax abatement against the revenue loss, which can impact public services and infrastructure development.

- Equity Concerns: Tax abatement programs may disproportionately benefit larger businesses or wealthier individuals, potentially exacerbating income inequality.

- Administrative Complexity: Designing and implementing tax abatement programs can be complex, requiring careful planning and ongoing evaluation to ensure effectiveness.

Case Studies: Successful Tax Abatement Programs

Numerous cities and states have implemented tax abatement programs with notable success. For example:

The New Markets Tax Credit Program

This federal program offers a tax credit to private investors who invest in low-income communities. By providing a financial incentive, this program has stimulated over $100 billion in investments, creating jobs and revitalizing economically distressed areas.

New Jersey’s Economic Development Authority

New Jersey’s EDA offers various tax abatement programs, including the Grow NJ Assistance Program, which has successfully attracted numerous businesses, creating thousands of jobs and generating significant economic impact.

Tax Increment Financing (TIF)

TIF is a common tool used by municipalities to fund public improvements by redirecting future property tax revenues. By investing in infrastructure and public amenities, TIF programs have catalyzed development and improved the quality of life in many communities.

Future Outlook

Tax abatement programs will likely continue to play a pivotal role in economic development strategies, particularly as governments seek innovative ways to attract investment and stimulate growth. However, the success of these programs hinges on careful planning, effective implementation, and ongoing evaluation to ensure they achieve their intended goals without creating unintended consequences.

As governments navigate the complexities of economic development, tax abatement will remain a valuable tool in their arsenal, offering the potential for significant economic transformation and community uplift.

| Tax Abatement Program | Key Metrics |

|---|---|

| New Markets Tax Credit | $100 billion in investments, over 500,000 jobs created |

| Grow NJ Assistance Program | Over 100,000 jobs created, $2 billion in investment |

| Tax Increment Financing (TIF) | Varies by project, but often leads to significant property value increases and improved community amenities |

What is the primary objective of tax abatement programs?

+Tax abatement programs aim to stimulate economic growth, attract businesses, and incentivize investments by temporarily reducing or eliminating certain taxes.

How do tax abatement programs benefit local economies?

+These programs can encourage investment, job creation, urban regeneration, and overall economic development, particularly in economically challenged areas.

What are some potential drawbacks of tax abatement programs?

+They may lead to revenue loss for governments, potentially impacting public services, and could exacerbate income inequality if not carefully designed and implemented.