Marin Tax Collector

The Marin Tax Collector's office plays a crucial role in the administration of taxes within Marin County, California. It is responsible for the efficient and fair collection of various taxes, ensuring that the county's revenue stream is adequately maintained. This article aims to delve into the functions, services, and impact of the Marin Tax Collector's office, providing an in-depth understanding of its operations and significance.

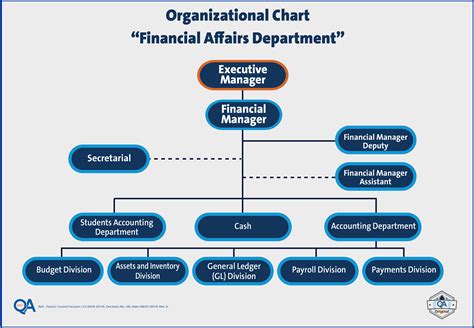

The Role and Responsibilities of the Marin Tax Collector

The Marin Tax Collector, an appointed official, is entrusted with the management and oversight of several key tax functions within the county. These include property taxes, vehicle license fees, and various other revenue sources. The office’s primary objective is to facilitate a smooth and transparent tax payment process for residents and businesses, while also enforcing tax compliance and recovering delinquent payments.

One of the most critical responsibilities of the Marin Tax Collector is the administration of property taxes. This involves calculating and issuing tax bills based on the assessed value of properties within the county. The office ensures that property owners receive accurate and timely tax assessments, facilitating a fair and efficient property tax system. Additionally, the tax collector is responsible for managing the county's Unsecured Property Tax Program, which targets businesses and individuals who own personal property but not real estate within the county.

Vehicle License Fees and Other Revenue Sources

Beyond property taxes, the Marin Tax Collector’s office is also responsible for the collection of vehicle license fees. This includes the annual registration fee for vehicles, which contributes significantly to the county’s revenue. The office ensures that vehicle owners receive the necessary registration documents and that fees are collected in a timely manner. Furthermore, the tax collector oversees the collection of other revenue sources, such as special assessments, environmental fees, and various other charges levied by the county.

To ensure efficient revenue collection, the Marin Tax Collector's office employs a range of payment methods, including online payment portals, walk-in services, and electronic fund transfers. This multi-channel approach ensures that taxpayers have convenient and accessible options for fulfilling their tax obligations.

Enforcement and Recovery of Delinquent Payments

One of the critical aspects of the Marin Tax Collector’s role is the enforcement of tax compliance and the recovery of delinquent payments. When taxpayers fail to meet their tax obligations, the office employs various measures to encourage payment, including penalty charges and the potential for tax liens. The tax collector has the authority to initiate legal proceedings to recover delinquent taxes, ensuring that the county’s revenue stream is not compromised.

In cases where property owners face financial difficulties and are unable to pay their property taxes, the Marin Tax Collector's office offers a Taxpayer Assistance Program. This program provides guidance and support to help taxpayers navigate their financial challenges and explore options such as payment plans or hardship waivers. The office aims to strike a balance between enforcing tax compliance and providing assistance to those in need.

| Tax Type | Collection Responsibilities |

|---|---|

| Property Taxes | Assessment, billing, and collection; management of Unsecured Property Tax Program |

| Vehicle License Fees | Annual registration fee collection |

| Other Revenue Sources | Collection of special assessments, environmental fees, and other county charges |

Community Engagement and Outreach

The Marin Tax Collector’s office recognizes the importance of community engagement and outreach in fostering a positive relationship with taxpayers. The office actively participates in community events, providing information and guidance on tax matters. By engaging with residents and businesses, the tax collector aims to promote tax awareness, educate taxpayers about their rights and responsibilities, and address any concerns or queries they may have.

One of the key initiatives of the Marin Tax Collector's community engagement strategy is the Taxpayer Education Program. This program offers a series of workshops and seminars designed to educate taxpayers about the various tax processes, including property tax assessments, vehicle registration fees, and other revenue sources. By empowering taxpayers with knowledge, the office aims to build trust and promote voluntary tax compliance.

Online Resources and Digital Services

In an effort to enhance accessibility and convenience, the Marin Tax Collector’s office has invested in digital transformation. The office’s website serves as a comprehensive resource hub, providing taxpayers with access to a wealth of information, including tax forms, payment options, and frequently asked questions. The website also features an online payment portal, allowing taxpayers to make secure payments anytime, anywhere.

Furthermore, the Marin Tax Collector's office has embraced mobile technology, offering a dedicated mobile app. The app provides taxpayers with real-time updates on their tax obligations, payment due dates, and the status of their payments. It also offers a convenient way to access tax-related documents and receive important notifications.

Performance Analysis and Future Implications

The Marin Tax Collector’s office has consistently demonstrated its commitment to efficient and effective tax collection. The office’s performance is measured through key metrics such as tax collection rates, taxpayer satisfaction surveys, and the timely resolution of tax-related issues. By analyzing these metrics, the office identifies areas for improvement and develops strategies to enhance its services.

Looking ahead, the Marin Tax Collector's office is focused on leveraging technology to further streamline its operations. This includes the implementation of advanced data analytics to optimize tax assessment processes and the exploration of digital payment solutions to enhance security and efficiency. Additionally, the office is committed to continuing its community engagement initiatives, aiming to build a culture of tax awareness and compliance among residents and businesses.

As Marin County continues to grow and evolve, the Marin Tax Collector's office will play a pivotal role in ensuring the county's financial stability and the equitable distribution of resources. Through its dedicated services, enforcement measures, and community engagement efforts, the office is well-positioned to navigate the challenges and opportunities that lie ahead.

How can I pay my property taxes in Marin County?

+You can pay your property taxes through the Marin Tax Collector’s online payment portal, by mail, or in person at the tax collector’s office. The office accepts various payment methods, including credit cards, e-checks, and cash.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, you will incur late payment penalties. It is important to note that delinquent taxes may result in additional charges and potential tax liens. The Marin Tax Collector’s office encourages taxpayers to contact them to discuss payment options and avoid further penalties.

How can I access my tax information and account details online?

+You can access your tax information and account details through the Marin Tax Collector’s online portal. Simply visit their website, create an account, and log in to view your tax records, payment history, and other relevant information.

What is the Taxpayer Assistance Program, and how can I benefit from it?

+The Taxpayer Assistance Program is designed to support taxpayers who are facing financial difficulties and may be unable to pay their property taxes. The program offers guidance and assistance, including information on payment plans and hardship waivers. To benefit from this program, you can contact the Marin Tax Collector’s office to discuss your situation and explore available options.

How can I stay informed about tax-related events and updates in Marin County?

+To stay informed about tax-related events and updates, you can subscribe to the Marin Tax Collector’s newsletter, follow their social media accounts, and regularly visit their website. These channels provide timely information on tax deadlines, community events, and important announcements.