Tax And Gratuity Calculator

Welcome to an in-depth exploration of the Tax and Gratuity Calculator, a tool designed to simplify the complex world of tax computations and gratuity calculations. In today's fast-paced financial landscape, accurate and efficient tax management is essential for both individuals and businesses. This article aims to provide a comprehensive guide to understanding the significance, functionality, and impact of such calculators, offering valuable insights into the world of taxation and gratuity planning.

The Significance of Tax and Gratuity Calculators

Tax and gratuity calculations are intricate processes that require precision and a deep understanding of ever-evolving tax laws and regulations. For individuals, especially those with varying income sources and financial goals, these calculators offer a streamlined approach to managing tax obligations. They empower users to make informed financial decisions, plan for the future, and ensure compliance with tax authorities.

From a business perspective, the accurate calculation of taxes and gratuities is critical for maintaining financial health and reputation. Businesses rely on these calculators to determine their tax liabilities, manage payroll effectively, and ensure compliance with employment laws regarding gratuities and other employee benefits. By utilizing advanced tax and gratuity calculators, organizations can optimize their financial strategies, minimize risks, and focus on their core operations.

Unveiling the Features and Functionality

The Tax and Gratuity Calculator is an innovative tool designed with a user-friendly interface, making it accessible to a wide range of users, from financial experts to those new to tax calculations. Here’s a breakdown of its key features and how they contribute to efficient tax and gratuity management:

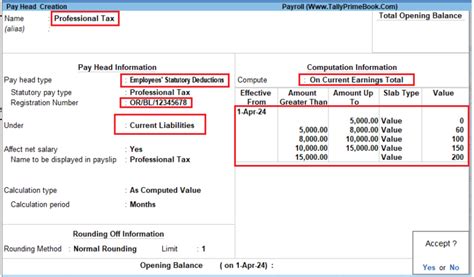

Income Assessment and Tax Computation

The calculator begins by guiding users through a step-by-step process of inputting their income details. This includes salary, investments, business income, and any other relevant sources. Based on this information, the calculator applies the latest tax slabs and rates to compute the user’s tax liability accurately. It takes into account various deductions and exemptions, ensuring a comprehensive tax assessment.

Gratuity Calculation for Employees

For businesses, the calculator offers a dedicated gratuity calculation module. Gratuity, a significant employee benefit, is calculated based on factors like years of service, basic pay, and applicable gratuity laws. The calculator simplifies this process, providing accurate gratuity estimates for employees, ensuring compliance with labor regulations, and facilitating efficient payroll management.

Advanced Tax Planning Strategies

Beyond basic tax computation, the Tax and Gratuity Calculator offers advanced tax planning tools. These features help users explore tax-saving opportunities, such as investing in tax-efficient schemes, claiming deductions for specific expenses, and optimizing their financial portfolio to minimize tax liabilities. By providing these insights, the calculator empowers users to make strategic financial decisions.

Real-Time Updates and Compliance

One of the standout features of this calculator is its ability to stay updated with the latest tax laws and regulations. It ensures that calculations are always in line with current tax policies, avoiding potential compliance issues. Whether it’s changes in tax slabs, new deductions, or updated employment laws, the calculator adapts to provide accurate and reliable results, giving users peace of mind.

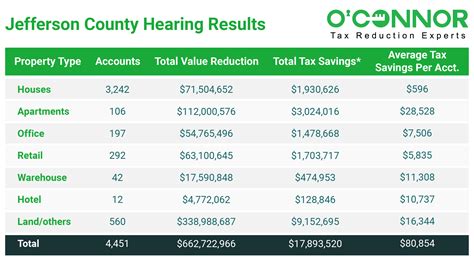

Performance Analysis and Case Studies

To illustrate the impact and effectiveness of the Tax and Gratuity Calculator, let’s explore a few real-world scenarios and success stories:

Scenario 1: Individual Tax Planning

Mr. Smith, a young professional with multiple sources of income, used the calculator to assess his tax liability for the year. The calculator not only provided an accurate tax estimate but also suggested tax-saving strategies, helping Mr. Smith optimize his investments and reduce his overall tax burden. This resulted in significant savings and a better understanding of his financial position.

Scenario 2: Business Gratuity Management

ABC Inc., a thriving tech startup, utilized the calculator’s gratuity module to manage employee gratuities efficiently. With a growing workforce, ABC Inc. found the calculator’s ability to calculate gratuities based on individual employee data invaluable. It streamlined their payroll process, ensured compliance with employment laws, and built trust with their employees by providing transparent gratuity calculations.

Scenario 3: Tax Strategy Optimization

Ms. Johnson, a financial advisor, incorporated the Tax and Gratuity Calculator into her practice. She used it to provide her clients with personalized tax planning advice. By leveraging the calculator’s advanced features, Ms. Johnson could offer strategic insights, helping clients maximize their tax savings and achieve their financial goals. This enhanced her advisory services and built stronger client relationships.

Future Implications and Innovations

As technology continues to advance, the future of tax and gratuity calculators looks promising. Here’s a glimpse into potential developments and their impact:

Artificial Intelligence Integration

Incorporating AI into tax and gratuity calculators can revolutionize the accuracy and efficiency of these tools. AI-powered calculators could learn from user behavior, adapt to individual financial patterns, and provide even more personalized tax planning recommendations. This integration could enhance the user experience and make tax management even more accessible.

Blockchain for Secure Data Management

Utilizing blockchain technology for secure data storage and transfer can address concerns related to data privacy and security. By leveraging blockchain, tax and gratuity calculators can ensure that sensitive financial information remains secure and accessible only to authorized users. This could enhance trust in digital tax management solutions.

Integration with Financial Institutions

Collaborations between tax calculator developers and financial institutions could lead to seamless integration of these tools into existing financial platforms. Users could access tax calculators directly from their banking or investment portals, making tax management an integral part of their overall financial planning. This integration could streamline financial processes and provide a holistic view of users’ financial health.

Frequently Asked Questions

How often should I use the Tax and Gratuity Calculator?

+It’s recommended to use the calculator at least once a year, preferably before filing your tax returns. However, for those with dynamic financial situations or multiple income sources, using the calculator more frequently can provide valuable insights and help you stay on top of your tax obligations.

Can the calculator handle complex tax scenarios, such as foreign income or business losses?

+Absolutely! The Tax and Gratuity Calculator is designed to handle a wide range of tax scenarios, including complex situations like foreign income, business losses, and investment gains. It takes into account various tax laws and regulations to provide accurate calculations for these scenarios.

Is my financial data secure when using the calculator?

+Yes, the calculator prioritizes data security. It employs robust encryption protocols to protect your financial information. Additionally, your data is stored securely, and only authorized users can access it. You can rest assured that your financial details are safe and confidential.

How does the calculator stay updated with the latest tax laws and regulations?

+The calculator’s developers maintain a dedicated team that continuously monitors changes in tax laws and regulations. When updates are made, the calculator is promptly adjusted to reflect the latest rules. This ensures that your calculations are always accurate and compliant with the current tax landscape.

Can the calculator provide personalized tax planning advice?

+Yes, the Tax and Gratuity Calculator offers advanced features for personalized tax planning. It analyzes your financial data and provides tailored recommendations to help you optimize your tax strategies. These insights can guide you in making informed decisions to minimize your tax liability and maximize your financial gains.

In conclusion, the Tax and Gratuity Calculator stands as a powerful tool in the realm of financial management. By offering accurate tax computations and gratuity calculations, it empowers individuals and businesses to navigate the complex world of taxation with confidence. As technology advances, we can expect even more innovative features and improvements, further enhancing the user experience and financial planning capabilities.