Sales Tax Virginia Car

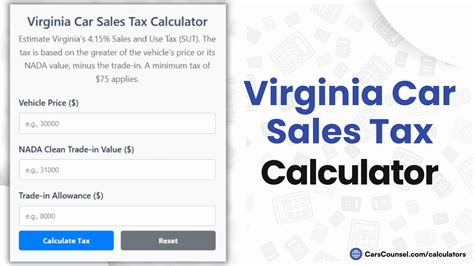

Sales tax on cars in Virginia is an important consideration for both residents and those relocating to the state. Understanding the ins and outs of this tax can help buyers navigate the process more efficiently and ensure they are prepared for the financial aspects of purchasing a vehicle. This comprehensive guide will delve into the specifics of Virginia's car sales tax, providing an in-depth analysis of the rates, exemptions, and strategies to optimize your vehicle purchase.

Understanding Virginia’s Sales Tax on Cars

Virginia imposes a sales and use tax on the purchase of vehicles, including cars, trucks, motorcycles, and recreational vehicles. The tax rate varies depending on the locality where the vehicle is registered and can range from 2% to 8%, with an average rate of 5.3%. However, it’s important to note that the sales tax rate is not uniform across the state; it can differ from one county or city to another. This variation is due to the additional local tax rates that are added to the state’s base sales tax.

For instance, let's consider the city of Richmond. The sales tax rate in Richmond is 5.3%, which includes a 4.3% state tax and an additional 1% local tax. In contrast, the city of Norfolk has a higher sales tax rate of 7.8%, comprising a 4.3% state tax and a 3.5% local tax. These variations can significantly impact the total cost of a vehicle purchase, so it's crucial for buyers to be aware of the specific tax rates in their locality.

| Locality | Sales Tax Rate |

|---|---|

| Arlington | 6% |

| Alexandria | 6% |

| Fairfax County | 6% |

| Loudoun County | 6% |

| Prince William County | 6% |

| Charlottesville | 5.3% |

| Hampton | 7% |

| Lynchburg | 5.3% |

| Norfolk | 7.8% |

| Virginia Beach | 7% |

In addition to the sales tax, Virginia also levies a titling tax of $63.25, which is applied to the purchase price of the vehicle. This titling tax is a one-time fee that is required when registering a vehicle in the state. For instance, if you purchase a car for $25,000, you would pay a titling tax of $63.25, which is calculated as a flat fee rather than a percentage of the purchase price.

Exemptions and Special Cases

While the sales tax on cars is a standard practice in Virginia, there are certain exemptions and special cases to be aware of. These exemptions can provide significant savings for specific groups of individuals or under particular circumstances.

One notable exemption is for military personnel who are Virginia residents. Active-duty military members and their spouses are exempt from paying sales tax on the purchase of a vehicle if they are stationed outside of Virginia and have a valid military address. This exemption can result in substantial savings, especially for those purchasing high-value vehicles.

Additionally, there is an exemption for certain individuals with disabilities. If you have a permanent disability that affects your ability to drive, you may be eligible for a sales tax exemption when purchasing a vehicle equipped with special modifications. These modifications can include hand controls, wheelchair lifts, or other adaptations that enhance accessibility. By applying for this exemption, you can avoid paying sales tax on the vehicle and its modifications, making it more affordable to own a specialized vehicle.

Furthermore, Virginia offers a temporary exemption for certain out-of-state purchases. If you purchase a vehicle from a dealer in another state and bring it into Virginia, you may be eligible for a temporary exemption from sales tax. This exemption is valid for 60 days from the date of purchase, allowing you to avoid paying the higher sales tax rate in Virginia. However, it's important to note that you must register the vehicle in Virginia within this 60-day period to take advantage of this exemption.

Strategies for Optimizing Your Car Purchase

Understanding the sales tax on cars in Virginia is just the first step in making an informed purchase. There are several strategies you can employ to optimize your vehicle acquisition and potentially save money on taxes.

Shop Around and Compare Prices

One of the most effective ways to save money on your car purchase is to shop around and compare prices from different dealerships. Prices for the same vehicle can vary significantly between dealers, so it’s crucial to research and negotiate to get the best deal. By comparing prices, you can identify the dealerships offering the most competitive rates and potentially negotiate further discounts.

When comparing prices, consider not only the vehicle's sticker price but also the total cost, including taxes, fees, and any additional costs such as dealer preparation charges. These additional costs can add up quickly, so be sure to factor them into your calculations. Online tools and websites can be particularly helpful in comparing prices and finding the best deals.

Consider Buying a Used Car

Purchasing a used car can be a cost-effective alternative to buying new. Used cars typically have lower sales tax rates, as they are taxed based on their depreciated value rather than the original purchase price. This can result in significant savings, especially if you’re buying a slightly older model.

When buying a used car, it's essential to conduct thorough research and inspections to ensure the vehicle is in good condition. Consider getting a pre-purchase inspection from a trusted mechanic to identify any potential issues. Additionally, check the vehicle's history report to verify its past ownership, maintenance records, and any accidents or damage. By doing your due diligence, you can find a reliable used car that suits your needs and budget.

Negotiate and Take Advantage of Incentives

Negotiation is a powerful tool when purchasing a car. Many dealerships offer incentives and discounts, such as cash rebates, low-interest financing, or dealer incentives, to encourage sales. By negotiating and combining these incentives with other strategies, you can potentially reduce the overall cost of your vehicle purchase.

When negotiating, approach the process with a clear understanding of your budget and the vehicle's value. Research the average selling price of the car you're interested in and be prepared to walk away if the dealership isn't willing to meet your expectations. Remember, dealerships want to make a sale, so be persistent and don't be afraid to negotiate.

Lease vs. Buy

Another strategy to consider is whether to lease or buy your vehicle. Leasing a car can provide several advantages, such as lower monthly payments, the opportunity to drive a newer model, and the flexibility to switch vehicles more frequently. However, it’s important to note that leasing typically involves higher sales tax rates, as the tax is calculated based on the monthly payment rather than the vehicle’s value.

On the other hand, buying a car allows you to own the vehicle outright and provides more long-term savings. While the initial purchase price may be higher, you avoid the recurring costs associated with leasing, such as excess mileage fees and wear and tear charges. Additionally, owning a car can be more cost-effective in the long run, as you have the option to sell or trade it in when you're ready for an upgrade.

Take Advantage of Tax Breaks

Virginia offers various tax breaks and incentives that can help reduce the overall cost of your vehicle purchase. For instance, if you’re a Virginia resident and purchase a qualifying electric vehicle (EV), you may be eligible for a tax credit of up to $2,500. This credit can significantly offset the cost of the vehicle and encourage the adoption of more environmentally friendly transportation options.

Additionally, Virginia provides a sales tax exemption for the purchase of certain adaptive equipment for individuals with disabilities. This exemption applies to items such as hand controls, wheelchair lifts, and other modifications that enhance accessibility. By taking advantage of these tax breaks and incentives, you can reduce the financial burden of purchasing a vehicle and promote inclusivity and sustainability.

Conclusion: A Comprehensive Guide to Sales Tax on Cars in Virginia

Understanding the sales tax landscape in Virginia is crucial for anyone looking to purchase a car in the state. By familiarizing yourself with the varying sales tax rates, exemptions, and strategies outlined in this guide, you can make informed decisions and potentially save money on your vehicle acquisition. Remember to shop around, consider all your options, and take advantage of the incentives and tax breaks available to you.

Whether you're a Virginia resident or new to the state, this comprehensive guide provides the necessary insights to navigate the sales tax process and make the most of your car purchase. With the right approach and a bit of research, you can ensure a smooth and financially savvy vehicle-buying experience.

What is the average sales tax rate on cars in Virginia?

+The average sales tax rate on cars in Virginia is approximately 5.3%, but it can vary depending on the locality where the vehicle is registered. Some localities have higher tax rates, while others have lower rates.

Are there any exemptions from sales tax on car purchases in Virginia?

+Yes, there are certain exemptions for specific groups or circumstances. These include exemptions for military personnel stationed outside Virginia, individuals with permanent disabilities who require specialized vehicle modifications, and temporary exemptions for out-of-state purchases.

Can I negotiate the sales tax rate on my car purchase in Virginia?

+The sales tax rate is set by law and cannot be negotiated. However, you can negotiate the overall price of the vehicle, which indirectly affects the sales tax amount. By negotiating a lower price, you can reduce the total sales tax you pay.

Are there any incentives or tax breaks available for purchasing an electric vehicle (EV) in Virginia?

+Yes, Virginia offers a tax credit of up to $2,500 for the purchase of a qualifying electric vehicle. This credit can help offset the cost of the EV and encourage the adoption of more sustainable transportation options.

Can I avoid paying sales tax on my car purchase in Virginia by purchasing out of state?

+While you may be able to avoid Virginia’s sales tax by purchasing a car out of state, you will still need to pay the titling tax when registering the vehicle in Virginia. Additionally, you may encounter other fees and requirements, so it’s best to consult with a tax professional or the Virginia Department of Motor Vehicles for specific guidance.