Teresa Giudice Luis Ruelas Tax Debt

The name Teresa Giudice has become synonymous with reality television, specifically the hit series "The Real Housewives of New Jersey." Teresa, a fan favorite and one of the show's original cast members, has been an integral part of the show's success and has captured the hearts of viewers with her bold personality and dramatic storylines. However, beyond the glitz and glamour of reality TV, Teresa Giudice has also faced her fair share of challenges, both personally and financially.

One of the most prominent financial issues that have plagued Teresa and her family is their ongoing struggle with tax debt. This issue has been a recurring storyline on the show and has shed light on the financial pressures that many Americans face. Teresa's journey with tax debt and her recent engagement to Luis Ruelas has sparked curiosity among fans and the media alike, leading to a deeper exploration of their financial situation.

Teresa Giudice and Luis Ruelas: A Love Story Amidst Financial Turmoil

Teresa Giudice and Luis Ruelas’s relationship blossomed amidst the backdrop of Teresa’s legal and financial troubles. The couple’s journey has been a testament to their resilience and commitment to each other. Luis, a successful entrepreneur and a supportive partner, has stood by Teresa’s side through the ups and downs of her life.

Teresa and Luis's relationship began in 2020, shortly after Teresa's divorce from her ex-husband Joe Giudice. Their romance has been a refreshing storyline on the show, offering a glimpse of hope and happiness for Teresa after a tumultuous few years. However, their journey hasn't been without its challenges, particularly when it comes to managing their financial affairs.

The Giudice Family’s Financial Struggles: A Brief History

The Giudice family’s financial troubles can be traced back to several factors, including business ventures, legal issues, and, most notably, their tax debt. In 2014, Teresa and her ex-husband Joe Giudice were indicted on multiple counts of fraud, including bankruptcy fraud, mail and wire fraud, and making false statements on loan applications. This legal battle resulted in a 15-month prison sentence for Teresa and a 41-month sentence for Joe.

In addition to the legal consequences, the Giudices faced significant financial penalties. The IRS filed a lien against the couple for unpaid taxes, amounting to millions of dollars. This tax debt has been a persistent issue for the Giudice family, with Teresa and Joe struggling to manage their finances and navigate the complex world of tax liabilities.

Despite these challenges, Teresa has remained resilient and determined to turn her life around. Her engagement to Luis Ruelas in October 2021 marked a new chapter in her life, offering a fresh start and a supportive partner to tackle their financial woes together.

Luis Ruelas: A Financial Savior or a Co-Pilot on the Journey?

Luis Ruelas, a successful businessman and CEO of a digital media company, has brought a sense of stability and financial expertise to Teresa’s life. With his business acumen and entrepreneurial spirit, Luis has been instrumental in helping Teresa navigate her financial struggles.

While Luis's financial support and guidance have been invaluable, it's important to note that he is not solely responsible for resolving the Giudice family's tax debt. Teresa and Luis are in this together, facing the challenges as a united front. Their journey is a testament to the power of partnership and the belief that financial difficulties can be overcome with determination and the right support system.

The Complex World of Tax Debt: A Deep Dive

Tax debt is a serious issue that affects individuals and families across the globe. It can arise from various circumstances, including business losses, underpayment of taxes, or even simple mistakes on tax returns. For celebrities and public figures like Teresa Giudice, the spotlight on their financial affairs can intensify the pressure and scrutiny they face.

The Giudice family's tax debt is a complex web of liabilities, penalties, and interest accrued over the years. According to reports, the IRS lien against Teresa and her ex-husband Joe Giudice amounted to over $13 million. This staggering sum is a result of accumulated tax debts from several years, including unpaid federal income taxes and payroll taxes for their businesses.

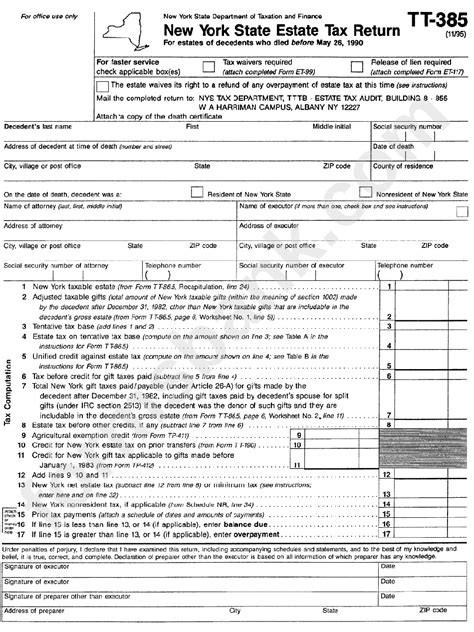

| Year | Tax Debt Amount |

|---|---|

| 2004-2007 | $3.8 million |

| 2008-2009 | $1.1 million |

| 2010-2012 | $5.5 million |

| Total Debt | $13.1 million |

The table above provides a breakdown of the Giudice family's tax debt, showcasing the significant financial burden they have been carrying. It's important to note that tax debt can grow exponentially due to penalties and interest, making it a challenging issue to resolve.

Strategies for Managing Tax Debt: A Financial Expert’s Perspective

Managing tax debt is a delicate process that requires expert guidance and a tailored approach. Here are some strategies that individuals facing tax debt can consider, inspired by financial experts in the field:

- Seek Professional Help: Engaging a qualified tax attorney or accountant who specializes in tax resolution can be crucial. These professionals can provide expert advice, negotiate with the IRS on your behalf, and help develop a realistic repayment plan.

- Understand Your Options: There are various programs and options available to resolve tax debt, such as installment agreements, offers in compromise, or penalty abatements. Understanding these options and their requirements is essential for developing a successful strategy.

- Prioritize and Negotiate: Tax debt often involves multiple liabilities, so prioritizing which debts to tackle first is important. Negotiating with the IRS or other tax authorities can lead to reduced penalties, extended payment plans, or even settlements.

- Consider Debt Relief Programs: The IRS and state tax agencies offer debt relief programs for qualifying individuals. These programs can provide relief through tax forgiveness, penalty waivers, or temporary hold on collection actions.

- Stay Current on Future Tax Obligations: While managing existing tax debt, it's crucial to stay up-to-date with current tax obligations. Avoiding further penalties and interest by filing accurate tax returns and making timely payments can help prevent the accumulation of additional debt.

These strategies provide a starting point for individuals navigating tax debt. However, it's important to remember that each case is unique, and seeking personalized advice from a qualified professional is essential for developing a successful plan.

The Impact of Tax Debt on Teresa Giudice’s Financial Future

Teresa Giudice’s tax debt has undoubtedly had a significant impact on her financial well-being and future prospects. The outstanding tax liabilities have likely affected her credit score, making it challenging to obtain loans or access credit. This could impact her ability to make major purchases, such as buying a home or starting new business ventures.

Furthermore, the public nature of Teresa's financial struggles has brought added scrutiny and pressure. As a public figure, her financial affairs are often discussed and analyzed by the media and the public. This scrutiny can make it difficult to negotiate with creditors or tax authorities, as any resolution or settlement may be subject to intense public interest and criticism.

Despite these challenges, Teresa has shown determination and resilience in her journey towards financial stability. With the support of Luis Ruelas and her family, she continues to navigate the complex world of tax debt, aiming to secure a brighter financial future.

A Look into the Future: Teresa’s Financial Recovery and Long-Term Strategies

As Teresa Giudice embarks on her journey towards financial recovery, it’s essential to consider the long-term strategies she can implement to secure her financial future. Here are some key considerations and potential steps she might take:

- Developing a Comprehensive Financial Plan: Working with financial advisors and tax professionals to create a detailed financial plan can be a powerful tool. This plan should outline short-term and long-term goals, including strategies to reduce tax liabilities, manage debt, and build wealth.

- Diversifying Income Streams: Teresa has successfully leveraged her reality TV fame into various income streams, including brand endorsements, appearances, and business ventures. Diversifying her income sources can provide financial stability and reduce reliance on a single source of income.

- Focus on Wealth Building: Building wealth is crucial for long-term financial security. Teresa can explore investment opportunities, such as real estate, stocks, or other assets, to grow her net worth and secure her financial future.

- Managing Tax Obligations: Staying current on tax obligations is essential to avoid further penalties and interest. Teresa can work closely with tax professionals to ensure accurate tax filings and timely payments, minimizing the risk of future tax issues.

- Education and Financial Literacy: Financial education is a powerful tool for individuals to take control of their finances. Teresa can invest time in learning about personal finance, budgeting, and investment strategies, empowering herself to make informed financial decisions.

These strategies, combined with the support of her partner Luis Ruelas and her financial advisors, can help Teresa Giudice navigate her financial journey successfully. While tax debt can be a daunting challenge, with the right approach and determination, it is possible to overcome these obstacles and secure a stable financial future.

The Media’s Role: A Double-Edged Sword

The media’s coverage of Teresa Giudice’s tax debt and financial struggles has been a double-edged sword. On one hand, the media attention has provided a platform for Teresa to share her story and raise awareness about the challenges many Americans face. It has sparked important conversations about financial literacy, debt management, and the impact of tax liabilities on individuals and families.

However, the intense media scrutiny can also be detrimental. The public nature of Teresa's financial affairs has subjected her to criticism and judgment, making it difficult to navigate her journey towards financial recovery. The constant media coverage can create a distorted perception of her financial situation, overlooking the complex factors and challenges she faces.

Despite the challenges, Teresa has used her platform to advocate for financial responsibility and transparency. Her openness about her struggles has encouraged others to seek help and guidance when facing similar issues. It has also inspired a dialogue about the importance of financial education and the need for support systems for individuals facing financial difficulties.

A Call for Financial Literacy and Support: Teresa’s Impact Beyond the Headlines

Teresa Giudice’s journey with tax debt and financial struggles has highlighted the need for improved financial literacy and support systems. Her story serves as a powerful reminder that financial challenges can affect anyone, regardless of their fame or success.

By sharing her experiences, Teresa has become an inadvertent advocate for financial education. Her willingness to discuss her struggles openly has encouraged others to seek help and learn from her mistakes. It has also sparked a broader conversation about the importance of financial planning, budgeting, and seeking professional advice when facing complex financial issues.

Teresa's journey also underscores the value of a supportive partner and a strong support system. Luis Ruelas's role in providing emotional and financial support is a testament to the power of having a reliable partner during challenging times. It emphasizes the importance of building a network of trusted advisors, whether financial experts, legal professionals, or supportive friends and family, to navigate the complexities of financial affairs.

In conclusion, Teresa Giudice's journey with tax debt and her engagement to Luis Ruelas has shed light on the financial struggles that many individuals face. Their story is a powerful reminder that financial challenges are not exclusive to a specific demographic or industry. It highlights the importance of financial literacy, support systems, and the resilience required to overcome financial hurdles.

As Teresa continues her journey towards financial recovery, her story serves as an inspiration to others facing similar struggles. It demonstrates that with determination, support, and expert guidance, it is possible to navigate the complex world of tax debt and secure a brighter financial future.

How much is Teresa Giudice’s tax debt?

+

Teresa Giudice’s tax debt is reported to be over $13 million, including unpaid federal income taxes and payroll taxes for her businesses.

What is Luis Ruelas’s role in Teresa’s financial affairs?

+

Luis Ruelas, Teresa’s fiancé, provides financial support and guidance. His business expertise and entrepreneurial spirit have been instrumental in helping Teresa navigate her financial struggles.

What strategies can individuals use to manage tax debt?

+

Individuals facing tax debt can seek professional help, understand their options (installment agreements, offers in compromise), prioritize and negotiate with tax authorities, and consider debt relief programs.

How has Teresa Giudice’s tax debt impacted her financial future?

+

Teresa’s tax debt has likely affected her credit score, making it challenging to obtain loans or access credit. The public nature of her financial struggles has also brought added scrutiny and pressure.

What can Teresa Giudice do to secure her financial future?

+

Teresa can develop a comprehensive financial plan, diversify her income streams, focus on wealth building, manage tax obligations, and invest in financial education to secure her financial future.