Tax Rate In San Diego California

In the vibrant city of San Diego, California, tax rates play a significant role in shaping the economic landscape and impacting residents' financial well-being. From property taxes to sales taxes, understanding these rates is crucial for both individuals and businesses. In this comprehensive guide, we delve into the specifics of tax rates in San Diego, exploring the various categories, their implications, and how they compare to other regions.

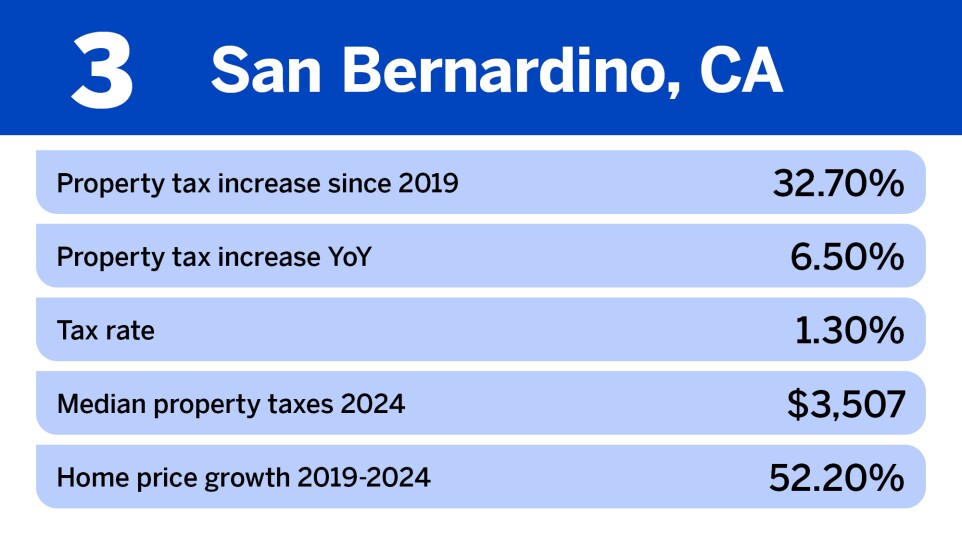

Property Taxes: A Snapshot of San Diego’s Rates

Property taxes are a fundamental aspect of local government revenue, and San Diego, like many other cities, relies on these taxes to fund essential services and infrastructure. The property tax rate in San Diego is determined by a combination of factors, including the assessed value of the property and the applicable tax rate.

The assessed value of a property is based on its fair market value, which is determined by the San Diego County Assessor's Office. This value is then multiplied by the tax rate to calculate the annual property tax liability. The tax rate itself is set by various taxing authorities, including the city, county, and special districts, each with their own specific rates.

Residential Property Tax Rates

For residential properties in San Diego, the tax rate varies depending on the location and specific characteristics of the property. On average, the tax rate for residential properties in the city of San Diego is approximately 1.15% of the assessed value. This rate includes the city’s base tax rate and any additional assessments or special levies.

Here's a breakdown of the tax rates for residential properties in San Diego, based on recent data:

| Taxing Authority | Tax Rate |

|---|---|

| City of San Diego | 1.04% |

| San Diego County | 0.08% |

| Special Districts | Varies by district |

Special districts in San Diego, such as school districts or fire protection districts, may have their own tax rates, which can add to the overall property tax liability. These rates can vary significantly depending on the services provided and the financial needs of the district.

Commercial Property Tax Rates

Commercial properties in San Diego face a slightly different tax landscape. The tax rate for commercial properties is typically higher than that of residential properties, reflecting the different needs and services required for businesses.

On average, the tax rate for commercial properties in San Diego is approximately 1.35% of the assessed value. This rate includes the city's base tax rate, which is higher for commercial properties, and any additional assessments or levies.

Here's a breakdown of the tax rates for commercial properties in San Diego:

| Taxing Authority | Tax Rate |

|---|---|

| City of San Diego | 1.28% |

| San Diego County | 0.08% |

| Special Districts | Varies by district |

As with residential properties, special districts in San Diego can impose additional tax rates on commercial properties, leading to a higher overall tax liability.

Sales and Use Taxes: San Diego’s Retail Climate

Sales and use taxes are another critical component of San Diego’s tax landscape. These taxes are levied on the sale or use of goods and services within the city and county, contributing to local government revenues.

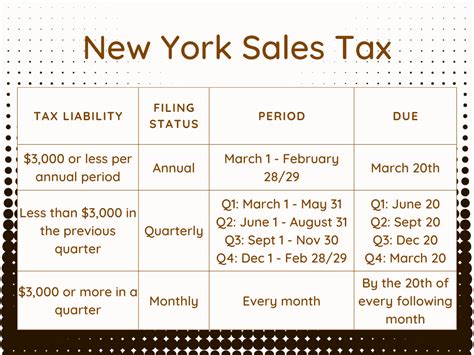

Sales Tax Rates

In San Diego, the sales tax rate is composed of both state and local components. The state of California imposes a base sales tax rate of 7.25%, which is applicable across the state. On top of this base rate, local jurisdictions, including cities and counties, can add their own local sales tax rates.

The city of San Diego currently imposes an additional 0.50% sales tax, bringing the total sales tax rate within the city to 7.75%. This rate is applicable to most retail sales, including goods, services, and certain entertainment activities.

It's important to note that sales tax rates can vary within San Diego County. Some areas, such as the city of Chula Vista, have additional local sales tax rates, resulting in a higher total sales tax.

Use Tax Rates

Use taxes are imposed on the storage, use, or consumption of goods and services purchased from out-of-state vendors or online retailers. These taxes ensure that businesses and individuals pay their fair share of taxes, even if they make purchases outside of San Diego.

The use tax rate in San Diego mirrors the sales tax rate, including both the state and local components. Therefore, the use tax rate in San Diego is currently 7.75%, which applies to eligible transactions.

Income Taxes: Navigating San Diego’s Tax System

Income taxes in San Diego are governed by both state and federal regulations. While San Diego itself does not impose a city income tax, residents and businesses still need to navigate the complex world of state and federal income tax regulations.

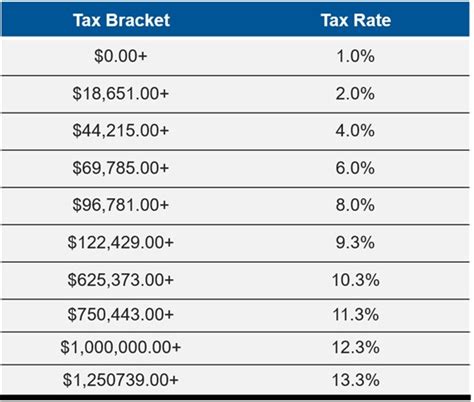

State Income Tax Rates

California’s state income tax system is progressive, meaning that higher incomes are taxed at higher rates. The state income tax rates in California range from 1% to 12.3%, depending on the taxpayer’s income level.

For residents of San Diego, the applicable state income tax rate depends on their taxable income and filing status. It's important to note that California's income tax rates are some of the highest in the nation, and residents should carefully consider their tax obligations.

Federal Income Tax Rates

Federal income taxes are determined by the Internal Revenue Service (IRS) and apply to all US taxpayers, including those in San Diego. The federal income tax system is also progressive, with rates ranging from 10% to 37%, depending on taxable income and filing status.

San Diego residents, like all US taxpayers, must comply with federal income tax laws and file their tax returns annually. The specific tax rate they fall under depends on their total taxable income and other factors such as deductions and credits.

Business Taxes: San Diego’s Business Climate

For businesses operating in San Diego, understanding the tax landscape is crucial for financial planning and compliance. The city and county of San Diego impose various taxes on businesses, each serving a specific purpose and contributing to local government revenues.

Business and Occupation (B&O) Taxes

San Diego County imposes a Business and Occupation (B&O) tax on certain types of businesses, such as retailers, wholesalers, and service providers. This tax is based on the gross receipts or sales of the business and is calculated as a percentage of the business’s income.

The B&O tax rate in San Diego County varies depending on the business activity and can range from 0.14% to 1.12% of the business's gross receipts. Businesses must register for and pay the B&O tax annually or quarterly, depending on their income level.

Other Business Taxes

In addition to the B&O tax, businesses in San Diego may be subject to other taxes, such as:

- Hotel Occupancy Tax: Applicable to hotels, motels, and other lodging establishments.

- Transient Occupancy Tax: Imposed on short-term rentals, such as Airbnb or vacation rentals.

- Special District Taxes: Certain special districts in San Diego may impose additional taxes on businesses within their jurisdiction.

Businesses should carefully review their specific circumstances and consult with tax professionals to ensure they are complying with all applicable business taxes in San Diego.

Conclusion: San Diego’s Tax Landscape

San Diego’s tax landscape is diverse and complex, encompassing a range of taxes that impact both residents and businesses. From property taxes to sales taxes and income taxes, understanding these rates is essential for financial planning and compliance.

By exploring the specifics of San Diego's tax rates, residents and businesses can make informed decisions and navigate the city's tax system effectively. Whether it's calculating property tax liabilities, budgeting for sales taxes, or understanding income tax obligations, knowledge is power when it comes to taxes.

Stay tuned for future updates on San Diego's tax landscape, as rates and regulations can change over time. Stay informed, consult with tax professionals, and ensure you're on top of your tax obligations to maintain a healthy financial standing in the vibrant city of San Diego.

What is the average property tax rate in San Diego for residential properties?

+The average property tax rate for residential properties in San Diego is approximately 1.15% of the assessed value. This rate includes the city’s base tax rate and any additional assessments or special levies.

How does the sales tax rate in San Diego compare to other cities in California?

+The sales tax rate in San Diego (7.75%) is slightly higher than the average sales tax rate in California (7.25%). Some other cities in California, such as Los Angeles and San Francisco, have even higher sales tax rates due to additional local taxes.

Are there any tax incentives or programs available for businesses in San Diego?

+Yes, San Diego offers various tax incentives and programs to attract and support businesses. These include tax credits, grants, and incentives for specific industries or business activities. It’s recommended to consult with local economic development agencies or tax professionals for more information.