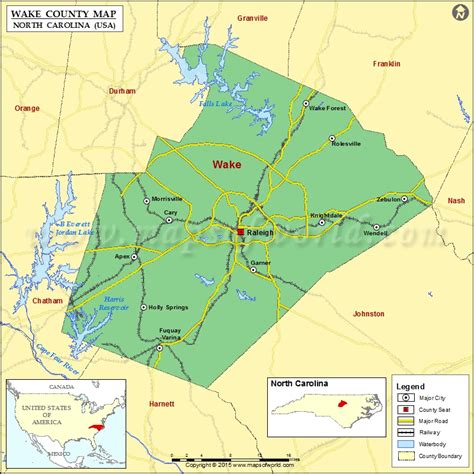

Wake County Nc Property Tax

Property taxes are an essential aspect of local government revenue, funding various services and infrastructure within a community. In Wake County, North Carolina, property taxes play a significant role in supporting the county's operations and development. This article aims to provide an in-depth analysis of Wake County's property tax system, shedding light on its workings, rates, assessment processes, and their impact on the community.

Understanding Wake County’s Property Tax System

The property tax system in Wake County is designed to generate revenue for the county’s general fund, which finances critical services such as education, public safety, transportation, and other essential government functions. Property taxes are levied on both real estate and personal property owned within the county’s jurisdiction.

The property tax rate in Wake County is determined annually by the Wake County Board of Commissioners, taking into consideration the revenue needs of the county and the impact on taxpayers. The tax rate is expressed as a percentage and is applied to the assessed value of the property. For the fiscal year 2023-2024, the property tax rate in Wake County is set at 0.7388 cents per $100 of assessed value.

It's important to note that Wake County operates on a calendar-year assessment cycle, meaning property values are reassessed every year as of January 1st. This annual reassessment ensures that property taxes remain fair and equitable, reflecting the current market value of properties.

Property Assessment Process

The Wake County Property Tax Office is responsible for assessing the value of all properties within the county. This includes both residential and commercial properties. The assessment process involves evaluating various factors, such as:

- Market Value: The county determines the fair market value of a property based on recent sales of similar properties in the area.

- Property Characteristics: Factors like size, location, age, and condition of the property are considered in the assessment.

- Neighborhood Analysis: The surrounding area's influence on property values is taken into account.

- Economic Factors: The overall economic climate and its impact on property values are also considered.

Once the assessment is complete, property owners receive a Notice of Appraised Value, which outlines the estimated value of their property for tax purposes. Property owners have the right to appeal the assessed value if they believe it is inaccurate or unfair.

Property Tax Exemptions and Relief Programs

Wake County offers several tax relief programs and exemptions to eligible property owners. These programs aim to provide financial assistance to specific groups and promote affordable homeownership.

| Exemption/Relief Program | Eligibility Criteria |

|---|---|

| Homestead Exemption | Property owners who use their home as their primary residence can apply for this exemption, which reduces the taxable value of their property. |

| Disabled Veterans Exemption | Veterans with service-connected disabilities may be eligible for a partial or full exemption on their property taxes. |

| Agricultural and Forestland Tax Relief | Owners of land used for agricultural or forest purposes may qualify for lower tax rates, encouraging land preservation. |

| Senior Citizen Tax Relief | Elderly residents with limited incomes may receive a reduction in their property taxes or qualify for deferred payment plans. |

These programs aim to ensure that property taxes remain manageable for different segments of the community, promoting stability and financial security.

Impact of Property Taxes on Wake County Residents

Property taxes in Wake County play a crucial role in funding public services that directly impact the community’s quality of life. Here are some key areas where property tax revenue is allocated:

Education

A significant portion of property tax revenue is dedicated to supporting the Wake County Public School System. This funding ensures that schools have the resources necessary for student success, including teacher salaries, classroom supplies, and infrastructure improvements.

Public Safety

Property taxes contribute to maintaining a robust public safety system in Wake County. The revenue supports law enforcement agencies, fire departments, and emergency response services, ensuring the safety and security of residents.

Infrastructure Development

Property taxes are instrumental in financing infrastructure projects, such as road improvements, bridge repairs, and the development of public parks and recreational facilities. These investments enhance the county’s overall infrastructure and improve residents’ daily lives.

Community Services

The county’s property tax revenue also supports various community services, including libraries, cultural centers, and social services. These services aim to enrich the lives of residents and promote a sense of community.

Tax Burden and Affordability

While property taxes are essential for funding critical services, they can also present challenges for some residents. Rising property values can lead to increased tax burdens, particularly for homeowners on fixed incomes. Wake County is committed to striking a balance between generating sufficient revenue and ensuring property taxes remain affordable for all residents.

Future Implications and Ongoing Initiatives

Wake County is continuously exploring ways to enhance its property tax system and ensure its fairness and efficiency. Some of the key initiatives and considerations for the future include:

- Fair Assessment Practices: The county aims to maintain consistent and accurate property assessments, ensuring that all property owners pay their fair share of taxes.

- Tax Relief Expansion: There are ongoing discussions to expand tax relief programs to support a broader range of residents, particularly those with low and moderate incomes.

- Community Engagement: Wake County recognizes the importance of community input in shaping its tax policies. The county actively engages with residents through public meetings and surveys to understand their concerns and priorities.

- Efficient Tax Collection: The county is exploring technological advancements to streamline the tax collection process, making it more efficient and convenient for taxpayers.

By implementing these initiatives, Wake County aims to maintain a robust and fair property tax system that supports the community's growth and development while ensuring the financial well-being of its residents.

Frequently Asked Questions

How often are property values reassessed in Wake County?

+Property values in Wake County are reassessed annually as of January 1st. This annual reassessment ensures that property taxes reflect the current market value of properties.

What is the process for appealing a property assessment?

+If you believe your property’s assessed value is inaccurate, you can appeal the assessment. The process typically involves submitting an appeal to the Wake County Board of Equalization and Review, providing evidence to support your claim. The board will then review your case and make a determination.

Are there any property tax relief programs for seniors in Wake County?

+Yes, Wake County offers the Senior Citizen Tax Relief program, which provides eligible senior citizens with a reduction in their property taxes or the option to defer payment. The program aims to ensure that seniors can afford to stay in their homes.

How does Wake County determine the property tax rate each year?

+The Wake County Board of Commissioners determines the property tax rate annually. They consider the county’s revenue needs, the impact on taxpayers, and the assessed values of properties to set a rate that generates sufficient revenue while remaining fair and manageable.

What happens if I don’t pay my property taxes on time in Wake County?

+Unpaid property taxes in Wake County may result in penalties, interest, and potential legal consequences. It’s important to stay current with your tax payments to avoid these issues. The county offers payment plans and assistance programs for those facing financial difficulties.