Tax Advocate Number

In the intricate world of tax law and financial regulations, a unique identifier known as the Tax Advocate Number (TAN) plays a pivotal role. This article delves into the intricacies of the TAN, exploring its purpose, its significance, and its impact on various aspects of tax advocacy and compliance. As we navigate the complex landscape of tax advocacy, we uncover the essential role this number plays in facilitating effective representation and ensuring compliance with tax regulations.

Understanding the Tax Advocate Number (TAN)

The Tax Advocate Number is a distinctive identifier assigned to individuals and entities engaged in tax advocacy, specifically those who represent taxpayers before various tax authorities. It serves as a crucial tool for tax professionals, enabling them to provide efficient and legitimate representation to their clients. Obtaining a TAN is a mandatory requirement for tax advocates, ensuring that they operate within the legal framework and adhere to the necessary standards of practice.

The TAN system is an integral part of the tax infrastructure, providing a structured approach to managing tax advocacy services. It ensures that tax advocates are qualified, competent, and accountable for their actions. By assigning a unique number to each advocate, tax authorities can effectively monitor and regulate the industry, maintaining high standards of professionalism and ethical conduct.

The History and Evolution of TAN

The concept of a dedicated number for tax advocates has its roots in the early 20th century when tax laws became increasingly complex. As tax regulations evolved, so did the need for specialized professionals to assist taxpayers in navigating the intricate tax system. The introduction of the Tax Advocate Number was a strategic move to organize and regulate this growing industry, ensuring a standardized approach to tax advocacy.

Over the years, the TAN system has undergone significant refinements. Initially, the process of obtaining a TAN was relatively simple, with basic requirements for education and experience. However, as tax laws became more intricate and the demand for specialized tax services grew, the criteria for obtaining a TAN became more stringent. Today, tax advocates must meet rigorous educational, ethical, and practical standards to acquire and maintain their TAN, ensuring a high level of expertise and integrity in the field.

The Importance of TAN in Tax Advocacy

The Tax Advocate Number holds immense significance in the realm of tax advocacy for several key reasons:

- Legitimacy and Professionalism: A TAN serves as a stamp of approval, indicating that the tax advocate has met the necessary qualifications and adheres to the standards set by tax authorities. It instills confidence in taxpayers, assuring them of the advocate's competence and ethical conduct.

- Accountability and Traceability: With a unique TAN, tax advocates can be easily identified and held accountable for their actions. This enhances transparency and ensures that tax authorities can effectively monitor and regulate the industry.

- Streamlined Tax Representation: The TAN system provides a structured framework for tax advocacy, making it easier for taxpayers to identify qualified professionals. It simplifies the process of finding suitable representation, saving time and effort for both taxpayers and tax authorities.

- Compliance and Enforcement: TANs play a crucial role in tax compliance and enforcement. Tax authorities can use TANs to track the activities of tax advocates, ensuring that they operate within the boundaries of the law and maintain the integrity of the tax system.

The Application and Registration Process

Obtaining a Tax Advocate Number is a meticulous process, designed to ensure that only qualified and competent individuals enter the field of tax advocacy. The registration process involves several critical steps, each aimed at verifying the applicant’s eligibility and suitability.

Eligibility Criteria

To be eligible for a TAN, applicants must meet specific educational and professional requirements. Typically, these include:

- A bachelor's degree in a relevant field such as accounting, finance, or law.

- Completion of a recognized tax advocacy program or equivalent training.

- Extensive experience in tax preparation, auditing, or advocacy, often requiring a minimum number of years in practice.

- Maintenance of a clean disciplinary record, ensuring no history of professional misconduct.

These criteria ensure that only well-educated and experienced professionals enter the tax advocacy field, maintaining high standards of expertise and integrity.

Application and Documentation

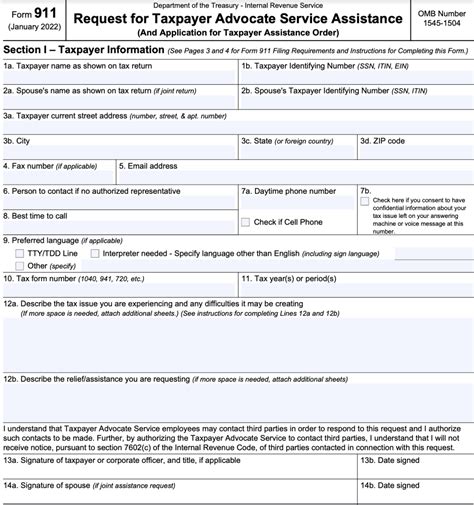

The application process for a TAN involves the submission of a comprehensive package of documents, which may include:

- A completed application form, providing personal and professional details.

- Proof of educational qualifications, such as transcripts and degree certificates.

- Detailed work experience documentation, including letters of reference from previous employers or clients.

- A statement of professional conduct, outlining the applicant's commitment to ethical practices.

- Payment of the application fee, which varies depending on the jurisdiction.

Once the application is submitted, it undergoes a rigorous review process to ensure compliance with the eligibility criteria. This process may take several weeks, during which the applicant's qualifications and experience are thoroughly examined.

Background Checks and Professional References

As part of the TAN registration process, applicants are subjected to thorough background checks. These checks aim to verify the applicant’s professional conduct, ensuring they have no history of misconduct or disciplinary action. Additionally, tax authorities may contact professional references provided by the applicant to validate their work experience and reputation.

Training and Examination

In some jurisdictions, applicants for a TAN may be required to undergo additional training or pass an examination to demonstrate their understanding of tax laws and advocacy practices. These requirements ensure that tax advocates are well-versed in the latest tax regulations and can provide up-to-date and accurate advice to their clients.

TAN Renewal and Continuing Education

Maintaining a Tax Advocate Number is an ongoing commitment to professionalism and expertise. To ensure that tax advocates stay up-to-date with the ever-changing tax landscape, TAN renewal often comes with continuing education requirements.

Continuing Education (CE) Requirements

Continuing education is a critical aspect of TAN renewal. Tax advocates are typically required to complete a certain number of CE hours annually or biannually, depending on the jurisdiction. These CE hours ensure that tax advocates stay informed about the latest tax laws, regulations, and industry developments. Common CE activities include attending seminars, workshops, and conferences, as well as completing online courses and self-study programs.

Renewal Process

The TAN renewal process is similar to the initial application process but with a focus on demonstrating continued competence and compliance with ethical standards. Tax advocates must submit a renewal application, along with documentation of their CE hours and a statement of professional conduct. The renewal application fee may be lower than the initial application fee, but it is still a necessary investment to maintain the TAN.

Failure to Renew

Failure to renew a TAN can have serious consequences for tax advocates. It not only results in the loss of the TAN but also may lead to disciplinary action, including fines and a temporary or permanent ban from practicing tax advocacy. Therefore, tax advocates must prioritize the renewal process to maintain their professional status and continue serving their clients effectively.

The Impact of TAN on Taxpayer Experience

The introduction and implementation of the Tax Advocate Number have had a significant impact on the taxpayer experience. By establishing a structured and regulated system for tax advocacy, TANs have contributed to a more efficient and reliable tax representation process.

Improved Taxpayer Confidence

The TAN system has instilled confidence in taxpayers, providing a clear indication of the qualifications and competence of their tax advocates. Taxpayers can now easily identify legitimate tax professionals, reducing the risk of falling victim to unscrupulous or unqualified practitioners. This increased confidence has led to a more positive taxpayer experience, with individuals feeling more secure and informed about their tax obligations and representation.

Enhanced Tax Compliance

TANs have played a pivotal role in enhancing tax compliance. With a regulated system in place, tax authorities can effectively monitor tax advocacy activities, ensuring that tax professionals operate within the boundaries of the law. This has led to a reduction in tax evasion and non-compliance, as tax advocates are held accountable for their actions and the advice they provide to clients. As a result, taxpayers are more likely to adhere to tax regulations, leading to a more equitable and efficient tax system.

Efficient Resolution of Tax Disputes

In cases of tax disputes or audits, the presence of a TAN-holding tax advocate can significantly streamline the resolution process. Tax authorities are more likely to engage with qualified and regulated professionals, leading to faster and more satisfactory outcomes for taxpayers. TANs provide a level of credibility and expertise that can help expedite the dispute resolution process, ultimately saving taxpayers time, effort, and potential financial penalties.

The Future of Tax Advocacy: TAN and Beyond

As the tax landscape continues to evolve, the role of the Tax Advocate Number is expected to remain a cornerstone of tax advocacy. However, emerging trends and technological advancements are likely to shape the future of tax advocacy, influencing the TAN system and its application.

Technological Advancements

The integration of technology into tax advocacy practices is an inevitable trend. Tax advocates are increasingly leveraging digital tools and platforms to enhance their services. From online tax preparation software to AI-powered tax advisory systems, technology is transforming the way tax advocates work and interact with taxpayers. The TAN system will need to adapt to accommodate these technological advancements, ensuring that tax advocates can utilize innovative tools while maintaining compliance and professionalism.

Specialization and Niche Services

The tax advocacy field is becoming increasingly specialized, with tax advocates focusing on specific areas such as international tax, estate planning, or tax litigation. As the tax landscape becomes more complex, taxpayers are seeking experts who can provide specialized advice and representation. The TAN system may evolve to accommodate this specialization, allowing tax advocates to showcase their expertise in specific areas and better serve the diverse needs of taxpayers.

Global Tax Harmonization

With the increasing globalization of business and finance, there is a growing movement towards harmonizing tax laws and regulations across borders. As tax advocacy becomes more international in scope, the TAN system may need to adapt to facilitate cross-border tax representation. This could involve the development of international TANs or the establishment of reciprocal agreements between different tax jurisdictions, ensuring that tax advocates can provide seamless services to clients with global operations.

Frequently Asked Questions

What is the purpose of a Tax Advocate Number (TAN)?

+A TAN is a unique identifier assigned to tax advocates, ensuring their legitimacy and professionalism. It helps taxpayers identify qualified tax professionals and allows tax authorities to monitor and regulate the industry effectively.

How do I obtain a TAN?

+Obtaining a TAN involves meeting educational and professional requirements, submitting an application with supporting documents, and undergoing background checks. The process may vary depending on the jurisdiction.

Are there continuing education requirements for TAN renewal?

+Yes, continuing education is often a requirement for TAN renewal. Tax advocates must complete a certain number of CE hours to stay up-to-date with tax laws and industry developments.

How does the TAN system impact taxpayers?

+The TAN system improves taxpayer confidence by ensuring the qualifications of tax advocates. It also enhances tax compliance and facilitates efficient resolution of tax disputes, leading to a more positive taxpayer experience.