Gwinnett Property Tax

Welcome to an in-depth exploration of the Gwinnett County Property Tax, a key component of the local economy and an important consideration for residents and businesses alike. This comprehensive guide will delve into the intricacies of property taxes in Gwinnett County, offering valuable insights and a detailed analysis to help you navigate this essential aspect of property ownership.

Understanding the Gwinnett County Property Tax Landscape

Gwinnett County, nestled in the heart of Georgia, boasts a vibrant community and a diverse range of properties, from residential homes to commercial spaces. The property tax system in this county plays a vital role in funding essential services, infrastructure, and public facilities. It is a critical aspect of local governance, influencing the financial stability and development of the region.

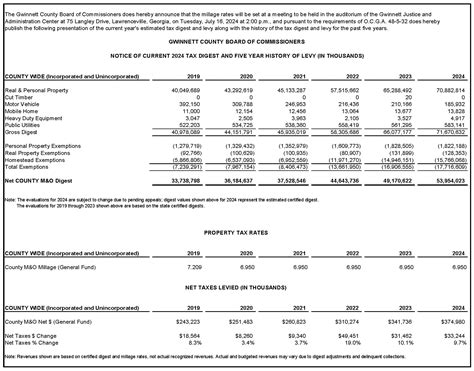

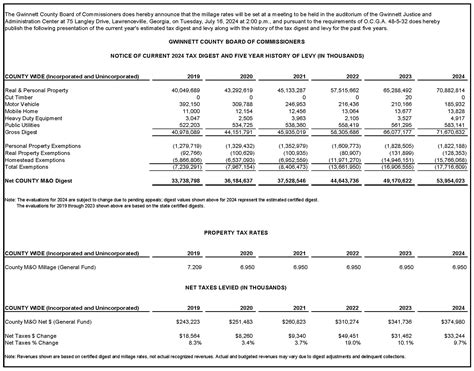

The property tax in Gwinnett County is determined by the assessed value of the property and the corresponding tax rate, which is set annually by the Gwinnett County Board of Commissioners. This tax provides a significant portion of the county's revenue, contributing to schools, public safety, transportation, and other vital services.

Assessed Value and Tax Rates

The assessed value of a property is determined by the Gwinnett County Board of Tax Assessors, who appraise properties based on their fair market value. This value is then used to calculate the property tax liability. The tax rate, on the other hand, is a percentage that is applied to the assessed value to determine the actual tax amount. The tax rate can vary depending on the type of property and its location within the county.

For instance, in 2023, the millage rate for residential properties in Gwinnett County was set at 16.33 mills, while the rate for commercial properties was 26.62 mills. A mill is a unit of measurement for property taxes, with one mill representing $1 of tax for every $1,000 of assessed value.

| Property Type | Millage Rate |

|---|---|

| Residential | 16.33 mills |

| Commercial | 26.62 mills |

Tax Assessment and Appeal Process

Property owners in Gwinnett County have the right to appeal their assessed value if they believe it is inaccurate or unfair. The Gwinnett County Board of Tax Assessors provides an appeal process, which typically involves submitting documentation to support the claimed value. This process ensures transparency and allows property owners to have a say in their tax assessment.

During the appeal process, the Board of Tax Assessors may conduct a physical inspection of the property, review recent sales data, and consider other relevant factors to determine a fair assessed value. If the appeal is successful, the assessed value may be adjusted, leading to a reduction in the property tax liability.

Property Tax Due Dates and Payment Options

Property taxes in Gwinnett County are due in two installments. The first installment is typically due in January, while the second installment is due in July. Property owners have the flexibility to pay their taxes online, by mail, or in person at the Gwinnett County Tax Commissioner’s Office. Late payments may incur penalties and interest, so it is essential to stay informed about the due dates and payment options.

| Installment | Due Date |

|---|---|

| First | January |

| Second | July |

The Gwinnett County Tax Commissioner's Office also offers various payment plans and options to assist property owners who may face financial difficulties. These options include installment plans, online payment arrangements, and even waivers for certain eligible individuals.

Property Tax Exemptions and Relief Programs

Gwinnett County provides several tax exemptions and relief programs to support specific groups of property owners. These programs are designed to ease the tax burden for eligible individuals and promote community development.

- Homestead Exemption: Gwinnett County offers a homestead exemption, which reduces the assessed value of a primary residence for tax purposes. This exemption is available to homeowners who meet certain criteria, such as age, disability, or income limits.

- Senior Citizen Exemption: Seniors who meet certain age and income requirements may be eligible for a tax exemption or a reduction in their property taxes. This exemption aims to provide financial relief to older adults.

- Veterans' Exemption: Gwinnett County recognizes the service of veterans by offering tax exemptions or discounts to eligible veterans and their surviving spouses. This exemption honors their service and contributes to their financial well-being.

- Conservation Use Program: This program encourages the preservation of agricultural and forest lands by providing tax relief to landowners who maintain their property for these purposes. It promotes sustainable land use and supports local agriculture.

The Impact of Gwinnett County Property Taxes

The property taxes collected in Gwinnett County have a substantial impact on the local community and its development. These taxes are a primary source of funding for essential services, and their allocation influences the quality of life for residents.

Funding for Education

A significant portion of the property taxes in Gwinnett County is dedicated to funding the local education system. This includes supporting public schools, providing resources for teachers and students, and maintaining school facilities. The tax revenue ensures that students receive a quality education and have access to the necessary resources for their academic success.

Public Safety and Emergency Services

Property taxes also play a crucial role in funding public safety services, such as police, fire, and emergency medical services. These taxes ensure that the community has access to well-equipped and trained first responders, promoting safety and security for residents and businesses.

Infrastructure and Community Development

The revenue from property taxes is utilized to develop and maintain essential infrastructure, including roads, bridges, and public transportation systems. It also contributes to community development projects, such as parks, recreation centers, and cultural facilities. These investments enhance the overall quality of life and attract businesses and residents to the county.

Economic Growth and Stability

A well-managed property tax system, like the one in Gwinnett County, can contribute to the county’s economic growth and stability. By providing essential services and a favorable business environment, the county can attract new businesses and industries, leading to job creation and economic prosperity. Additionally, a stable and predictable tax system can foster trust and encourage long-term investment in the community.

Future Outlook and Considerations

As Gwinnett County continues to grow and develop, the property tax system will play an even more critical role in shaping the future of the community. Here are some key considerations and potential developments to watch for:

Population Growth and Housing Market

Gwinnett County has experienced significant population growth in recent years, which has led to a corresponding increase in the demand for housing. This growth puts pressure on the property tax system, as it must accommodate a larger tax base and provide services to a growing community.

As the housing market evolves, property values may fluctuate, impacting the assessed values and tax liabilities of homeowners. It is essential for property owners to stay informed about market trends and understand how these changes may affect their tax obligations.

Infrastructure and Community Development Projects

The county’s ongoing and future infrastructure projects, such as road improvements, public transportation expansions, and community development initiatives, will require substantial funding. Property taxes will play a vital role in financing these projects, which are essential for the county’s long-term development and sustainability.

Tax Policy and Reform

The Gwinnett County Board of Commissioners and other local government bodies may consider tax policy reforms to address changing economic conditions, population growth, and community needs. These reforms could include adjustments to tax rates, the introduction of new tax categories, or changes to existing tax exemptions and relief programs.

It is important for property owners to engage with local government and stay informed about potential tax policy changes, as these decisions can have a significant impact on their financial obligations and the overall tax landscape of the county.

Community Engagement and Participation

Active community engagement is crucial for the effective governance of Gwinnett County. Property owners and residents should participate in public meetings, provide feedback on tax policies, and stay informed about local developments. By doing so, they can contribute to the decision-making process and ensure that their voices are heard.

Conclusion

The Gwinnett County Property Tax system is a vital component of the local economy, funding essential services and driving community development. Understanding the assessed value, tax rates, and available exemptions is crucial for property owners to manage their tax obligations effectively. The impact of property taxes extends beyond financial obligations, influencing the quality of life, education, public safety, and the overall prosperity of the county.

As Gwinnett County continues to evolve, the property tax system will play a pivotal role in shaping its future. By staying informed, engaging with local government, and understanding the potential developments and considerations, property owners can actively contribute to the growth and well-being of their community.

How is the assessed value of a property determined in Gwinnett County?

+The assessed value of a property is determined by the Gwinnett County Board of Tax Assessors. They appraise properties based on their fair market value, taking into account various factors such as location, recent sales data, and property characteristics.

What is the appeal process for property tax assessments in Gwinnett County?

+If a property owner believes their assessed value is inaccurate, they can appeal the assessment. The appeal process typically involves submitting documentation to support the claimed value and may include a physical inspection by the Board of Tax Assessors. The Board will review the appeal and make a determination.

Are there any property tax exemptions or relief programs in Gwinnett County?

+Yes, Gwinnett County offers various tax exemptions and relief programs. These include homestead exemptions for primary residences, senior citizen exemptions, veterans’ exemptions, and the Conservation Use Program for agricultural and forest lands. Each program has specific eligibility criteria and application processes.

How can I stay informed about property tax due dates and payment options in Gwinnett County?

+You can stay informed about property tax due dates and payment options by visiting the Gwinnett County Tax Commissioner’s website or by signing up for their mailing list. They provide detailed information on payment deadlines, payment methods, and any available payment plans or options.

What is the role of property taxes in funding essential services in Gwinnett County?

+Property taxes are a primary source of funding for essential services in Gwinnett County. These taxes support public education, public safety, infrastructure development, and community projects. They ensure that residents have access to quality schools, well-equipped first responders, and a well-maintained community.