Arkansas Vehicle Sales Tax

Understanding the intricacies of vehicle sales tax is essential, especially when considering a purchase in a state like Arkansas. This comprehensive guide will delve into the specific details of the Arkansas Vehicle Sales Tax, providing a thorough analysis of the rates, calculations, and implications for buyers.

Arkansas Vehicle Sales Tax: An In-Depth Exploration

The state of Arkansas, known for its diverse landscapes and vibrant communities, also has a unique tax structure when it comes to vehicle sales. This section aims to shed light on the specific nature of this tax, its application, and how it impacts the overall vehicle purchasing experience.

Sales Tax Rates and Their Application

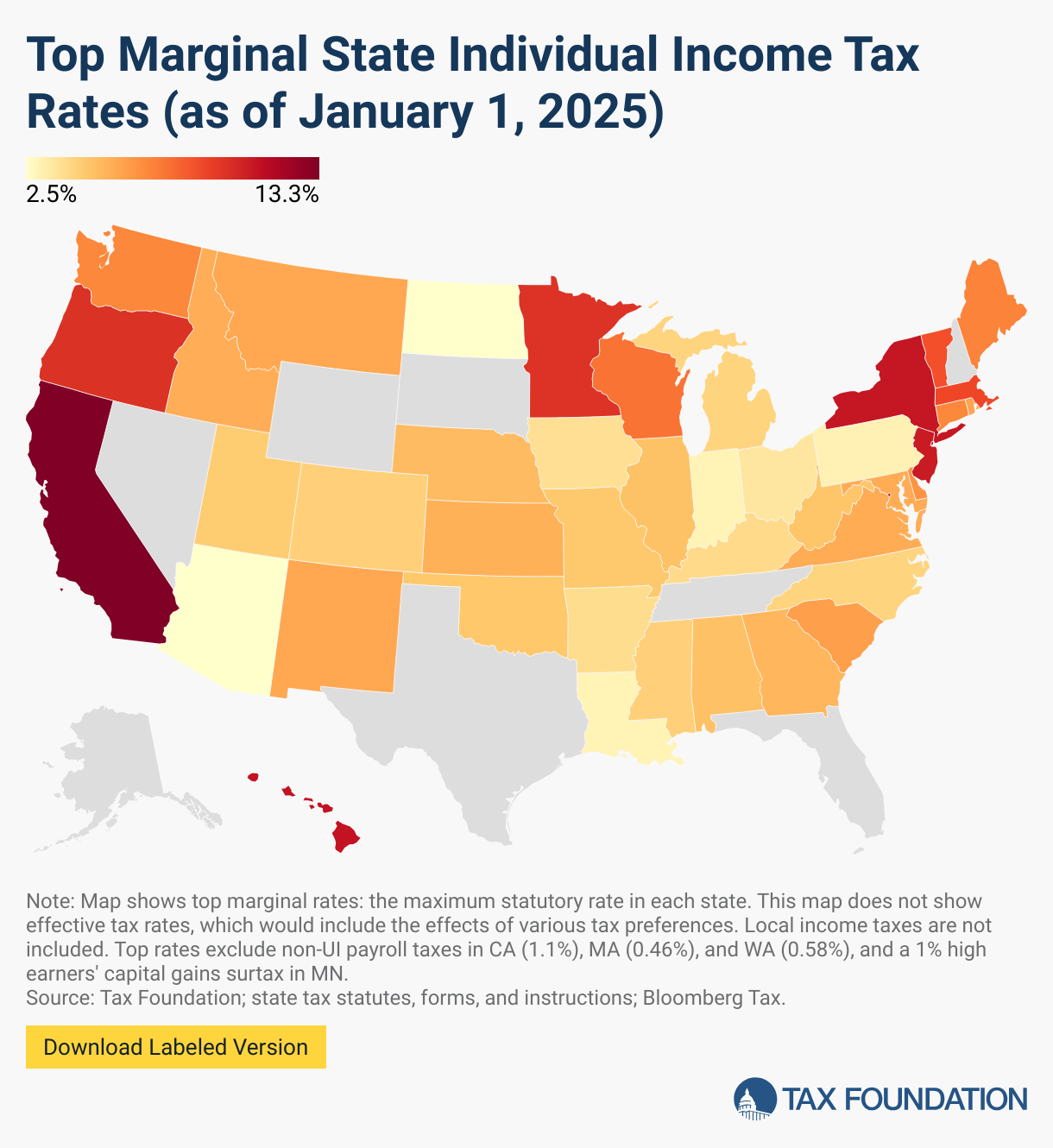

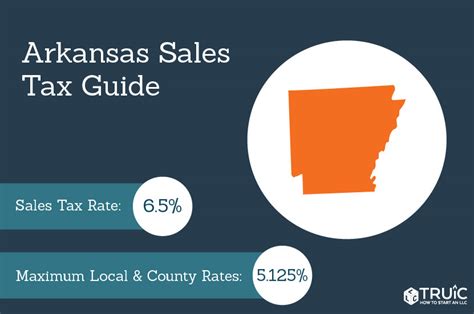

In Arkansas, the sales tax rate for vehicles is determined at the county level, which means the tax rate can vary significantly depending on the location of the purchase. The state's average vehicle sales tax rate hovers around 6.5%, but this can range from as low as 4.25% in some counties to as high as 9.25% in others.

| County | Sales Tax Rate (%) |

|---|---|

| Benton | 9.25 |

| Crawford | 7.5 |

| Pulaski | 6.75 |

| Washington | 6.25 |

| Faulkner | 4.25 |

These rates include both the state and county sales tax. For instance, in Benton County, the rate is made up of a 4.5% state tax and an additional 4.75% county tax. This variation is a key factor for car buyers, as it can significantly impact the overall cost of their vehicle purchase.

How Sales Tax is Calculated for Vehicles

The sales tax on vehicles in Arkansas is calculated based on the purchase price of the vehicle, excluding any trade-in value. This means that if you're trading in your old vehicle as part of the deal, the trade-in value is not considered when determining the tax. Here's a simple formula to understand the calculation:

Sales Tax = Purchase Price × Sales Tax Rate

For example, if you're buying a car in Benton County with a purchase price of $30,000, the sales tax would be calculated as follows:

Sales Tax = $30,000 × 0.0925 (9.25% rate) = $2,775

So, in this case, the sales tax amount would be $2,775, which is a significant addition to the cost of the vehicle.

Special Considerations and Exemptions

Arkansas does offer some exemptions and special considerations when it comes to vehicle sales tax. These include:

- Military Personnel: Active-duty military members are exempt from paying sales tax on vehicles purchased in Arkansas, provided they've been stationed in the state for less than 30 days.

- Trade-Ins: As mentioned earlier, the trade-in value of a vehicle is not included in the purchase price for tax calculation purposes.

- Out-of-State Purchases: If a vehicle is purchased out of state and brought into Arkansas, the owner must pay a use tax, which is based on the same rate as the sales tax. This is to ensure that all vehicle purchases are taxed, regardless of where they were made.

Impact on Buyers: What to Consider

The Arkansas Vehicle Sales Tax can significantly influence a buyer's decision-making process. Here are some key considerations:

- Location Matters: As rates vary by county, buyers should consider the tax rate in their desired county of purchase. A higher tax rate can increase the overall cost of the vehicle significantly.

- Budgeting: It's essential to factor in the sales tax when budgeting for a vehicle purchase. The tax can add a substantial amount to the final cost, especially for higher-priced vehicles.

- Comparison Shopping: Researching multiple dealerships and counties can provide an opportunity for buyers to find the best deal, considering both the vehicle price and the applicable sales tax.

- Financing: When financing a vehicle, the sales tax is typically included in the loan amount, which can impact the overall interest and payments. It's important to understand how the tax affects the financing terms.

The Future of Arkansas Vehicle Sales Tax

The Arkansas Vehicle Sales Tax, like any tax system, is subject to change. While it's difficult to predict future alterations, understanding the current system and its implications can help buyers make informed decisions. Here are some potential future considerations:

- Rate Changes: Counties may adjust their sales tax rates over time, influenced by economic factors and local needs. Staying informed about these changes can benefit both buyers and sellers.

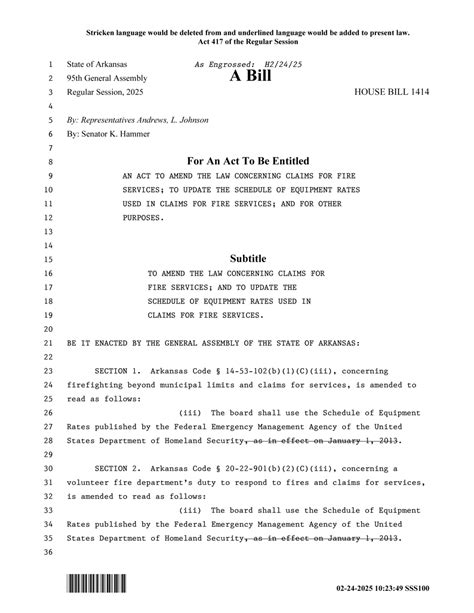

- Legislative Updates: The Arkansas legislature periodically reviews and may modify tax laws. Any changes could impact the vehicle sales tax, so it's essential to stay updated on any legislative activities.

- Economic Impact: The vehicle sales tax contributes significantly to Arkansas's economy. As the state's economy evolves, so might the tax structure, potentially impacting buyers and sellers alike.

Conclusion: Navigating the Arkansas Vehicle Sales Tax Landscape

Understanding the Arkansas Vehicle Sales Tax is a crucial step for anyone considering a vehicle purchase in the state. From varying county rates to the calculation process and special considerations, this guide provides a comprehensive overview. By being aware of these details, buyers can make informed decisions, ensuring a smoother and more cost-effective purchasing experience.

Remember, staying informed about the latest tax rates and regulations is key to a successful vehicle purchase. For more information on Arkansas's tax system and its impact on vehicle sales, consider visiting the official Arkansas Tax and Revenue Office website.

What is the average sales tax rate for vehicles in Arkansas?

+The average sales tax rate for vehicles in Arkansas is approximately 6.5%, but it can vary significantly by county.

Are there any counties in Arkansas with a sales tax rate below 5% for vehicles?

+Yes, Faulkner County in Arkansas has a sales tax rate of 4.25% for vehicles, making it one of the counties with the lowest vehicle sales tax rates in the state.

How is the sales tax calculated for a vehicle purchase in Arkansas?

+The sales tax for a vehicle purchase in Arkansas is calculated by multiplying the purchase price of the vehicle (excluding any trade-in value) by the applicable sales tax rate for the county where the purchase is made.

Are there any exemptions or special considerations for the Arkansas Vehicle Sales Tax?

+Yes, Arkansas offers exemptions for active-duty military personnel and trade-ins. Additionally, out-of-state purchases require the payment of a use tax, ensuring all vehicle purchases are taxed.