Va Property Taxes

Understanding Virginia's property taxes is essential for homeowners, prospective buyers, and investors alike. The Commonwealth of Virginia, known for its diverse landscapes and rich history, has a unique property tax system that influences the cost of living and investment opportunities within its borders. This comprehensive guide will delve into the intricacies of Virginia property taxes, exploring the factors that affect assessments, the process of paying taxes, and the various strategies to mitigate financial burdens.

The Basics of Virginia Property Taxes

Property taxes in Virginia are primarily levied by local governments, including cities, counties, and towns. These taxes are a crucial source of revenue for these jurisdictions, funding essential services such as schools, public safety, and infrastructure development. The tax rates and assessment methodologies can vary significantly between localities, making it important for property owners to understand the specific rules and regulations in their area.

Assessment Process

The assessment process in Virginia begins with the determination of a property’s assessed value. This value is not necessarily the same as the market value of the property, but rather it is the value assigned by the local assessor’s office for tax purposes. Assessments are typically based on factors such as location, property size, improvements, and comparable sales in the area. In Virginia, property assessments are conducted on a regular basis, often every few years, to ensure that tax liabilities are in line with current market conditions.

It's important to note that Virginia has a use-value assessment for agricultural and horticultural lands. This means that these properties are assessed based on their current use, which can result in lower tax bills for landowners who actively use their property for farming or similar activities. However, if the property's use changes, the assessment may be adjusted accordingly.

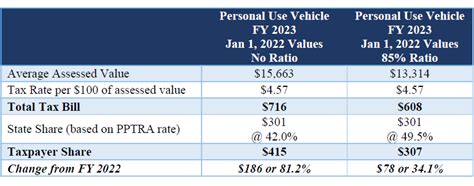

Tax Rates and Calculations

Property tax rates in Virginia are set by local governing bodies and can vary significantly from one locality to another. These rates are expressed in cents per 100 of assessed value. For instance, a tax rate of 0.85 could mean that for every 100 of assessed value, the property owner would pay $0.85 in taxes. The tax liability for a given property is calculated by multiplying the assessed value by the applicable tax rate.

| Locality | Tax Rate (Cents per $100) | Assessed Value ($) | Tax Liability ($) |

|---|---|---|---|

| Arlington County | 0.99 | 400,000 | $3,960 |

| City of Alexandria | 0.95 | 350,000 | $3,325 |

| Loudoun County | 1.17 | 500,000 | $5,850 |

In the above example, a property in Arlington County with an assessed value of $400,000 would owe $3,960 in taxes, while a similar property in Loudoun County would face a higher tax liability of $5,850 due to the difference in tax rates.

Factors Influencing Property Tax Assessments

Several factors come into play when determining the assessed value of a property in Virginia. These factors can vary depending on the locality and the type of property, but generally include:

- Property Type: Different types of properties, such as residential, commercial, or agricultural, may have different assessment methodologies and tax rates.

- Location: Properties in prime locations, such as those near amenities or with desirable views, may have higher assessments.

- Size and Condition: Larger properties or those with extensive improvements, such as renovations or additions, may be assessed at a higher value.

- Comparable Sales: The sale prices of similar properties in the area can significantly influence assessments. If nearby properties are selling for higher prices, it could drive up the assessed value of your property.

- Special Assessments: Certain improvements or developments, such as the installation of a new sewer system or the widening of a road, may result in a special assessment that increases the tax liability for affected properties.

Appealing Assessments

If a property owner believes their assessment is inaccurate or unfair, they have the right to appeal. The appeals process typically involves a review by a local board of equalization or a similar body, and may require the property owner to provide evidence and justification for their claim. It’s important to note that successful appeals can lead to a reduction in the assessed value, and consequently, a lower tax bill.

Paying Property Taxes in Virginia

Property taxes in Virginia are typically due twice a year, with payment deadlines usually set for the beginning of June and the beginning of December. However, it’s important for property owners to verify the exact due dates with their local tax office, as these can vary slightly from one locality to another. Most localities offer multiple payment options, including online payment portals, in-person payments at designated offices, and payment by mail.

Late payments can incur penalties and interest, so it's crucial to stay on top of due dates to avoid additional financial burdens. Some localities may also offer options for prepaying property taxes, which can be beneficial for those who want to budget their finances more effectively or who are considering a future move and want to plan their financial obligations accordingly.

Tax Relief Programs

Virginia offers several tax relief programs aimed at assisting certain groups of property owners. These programs can provide reduced tax rates, deferred payments, or even full or partial exemptions from property taxes. Some of the key programs include:

- Homestead Exemption: This program provides a tax credit for primary residences, effectively reducing the assessed value of the property for tax purposes. Eligibility and the amount of the credit can vary depending on the locality and the income of the homeowner.

- Land Use Assessment: As mentioned earlier, agricultural and horticultural lands are assessed based on their current use, which can result in lower tax bills. This program encourages the preservation of farmland and open spaces.

- Senior Citizen and Disabled Persons Relief: This program provides a reduced tax rate or a deferred payment option for eligible seniors or individuals with disabilities. The eligibility criteria and benefits can vary depending on the locality.

- Veterans Relief: Virginia offers various tax relief programs for veterans, including reduced tax rates, deferred payments, and even full or partial exemptions. The specific benefits and eligibility requirements can vary based on the veteran's service history and financial situation.

Strategies for Managing Property Taxes

Property taxes are an inevitable expense for homeowners and investors, but there are strategies that can help mitigate their financial impact. Here are some approaches to consider:

Regular Maintenance and Improvements

Keeping your property well-maintained and making necessary improvements can not only enhance its value but also potentially impact its assessed value. Regular maintenance shows that the property is in good condition, which could be favorable during the assessment process. However, it’s important to note that extensive renovations or additions may lead to a higher assessed value, resulting in increased tax liability.

Appealing Assessments

As mentioned earlier, if you believe your property’s assessed value is too high, you can appeal the assessment. This process can be time-consuming and may require professional assistance, but it can result in significant savings if successful. It’s advisable to research the appeals process in your locality and consult with a tax professional or attorney if needed.

Utilizing Tax Relief Programs

Virginia’s tax relief programs can provide substantial savings for eligible property owners. It’s important to stay informed about the programs available in your locality and to ensure you meet the eligibility criteria. These programs can offer significant financial benefits, especially for seniors, veterans, and those with limited incomes.

Considerations for Investors

For investors, understanding the local property tax landscape is crucial when deciding where to purchase investment properties. Higher tax rates can impact the cash flow and profitability of an investment, so it’s important to factor these costs into your financial analysis. Additionally, investors should be aware of any special assessments or potential changes in tax policies that could affect their holdings.

Conclusion

Virginia’s property tax system, while complex, is designed to fund essential services and maintain the infrastructure of the Commonwealth. Understanding the assessment process, tax rates, and available relief programs is key to managing your financial obligations effectively. Whether you’re a homeowner, an investor, or a prospective buyer, staying informed about Virginia’s property tax landscape can help you make the most of your financial situation and ensure you’re prepared for any changes that may arise.

Frequently Asked Questions

What happens if I miss the property tax payment deadline in Virginia?

+

Missing the property tax payment deadline can result in late fees, penalties, and interest charges. It’s important to note that these additional costs can quickly add up, so it’s advisable to pay your taxes on time to avoid unnecessary financial burdens.

Can I appeal my property tax assessment in Virginia?

+

Yes, if you believe your property’s assessed value is incorrect or unfair, you have the right to appeal. The appeals process typically involves submitting an application to the local board of equalization and providing evidence to support your claim. It’s advisable to consult with a tax professional or attorney for guidance.

Are there any tax relief programs for veterans in Virginia?

+

Yes, Virginia offers several tax relief programs for veterans. These programs can provide reduced tax rates, deferred payments, or even full or partial exemptions. The specific benefits and eligibility requirements can vary, so it’s important to research the programs and ensure you meet the criteria.

How often are property assessments conducted in Virginia?

+

Property assessments in Virginia are typically conducted on a regular basis, often every few years. The exact frequency can vary depending on the locality. Regular assessments ensure that tax liabilities are in line with current market conditions and property values.

Can I pay my property taxes online in Virginia?

+

Most localities in Virginia offer online payment portals for property taxes. However, it’s important to verify the availability and any specific requirements with your local tax office. Online payments can provide a convenient and efficient way to manage your tax obligations.