Why Do I Owe Taxes This Year

Every year, individuals and businesses face the task of filing their tax returns and, for some, this means owing money to the government. Understanding why you owe taxes can be a complex matter, as it involves various factors such as income, deductions, credits, and tax laws. This article aims to shed light on the reasons behind tax liabilities and provide valuable insights to help you navigate the tax landscape.

The Basics of Tax Liability

Tax liability refers to the amount of tax an individual or entity is legally obligated to pay to the government. It is determined by various factors and can vary significantly from person to person or from one tax year to another. Here’s a breakdown of the key components that contribute to your tax liability.

Income and Tax Rates

Your tax liability is directly proportional to your income. As your income increases, so does your tax obligation. Different countries have different tax systems, but most follow a progressive tax structure, where higher income brackets are taxed at higher rates. For instance, let’s consider a hypothetical tax system with three income brackets and their corresponding tax rates:

| Income Bracket | Tax Rate |

|---|---|

| Up to $50,000 | 10% |

| $50,001 - $100,000 | 15% |

| Above $100,000 | 20% |

In this scenario, if your total income for the year was $60,000, your tax liability would be calculated as follows:

- $50,000 x 10% = $5,000

- $10,000 x 15% = $1,500

- Total tax liability: $5,000 + $1,500 = $6,500

Deductions and Exemptions

Deductions and exemptions are amounts that can be subtracted from your taxable income, reducing your overall tax liability. These can include expenses related to business, investments, medical costs, charitable donations, and more. For instance, if you incurred $2,000 in business expenses during the tax year, you could deduct this amount from your taxable income, thus reducing your tax obligation.

Tax Credits

Tax credits are direct reductions of your tax liability, often granted for specific reasons such as having children, purchasing energy-efficient appliances, or making charitable contributions. These credits can significantly decrease your tax bill. For example, the Child Tax Credit allows parents to reduce their tax liability by a certain amount for each qualifying child.

Tax Laws and Regulations

The tax landscape is shaped by a complex web of laws and regulations. These laws determine how income is taxed, what deductions and credits are available, and how tax liabilities are calculated. Staying updated with the latest tax laws is crucial to ensure compliance and optimize your tax strategy.

Common Reasons for Owed Taxes

Now that we’ve covered the basics, let’s explore some of the common scenarios that can lead to owing taxes at the end of the year.

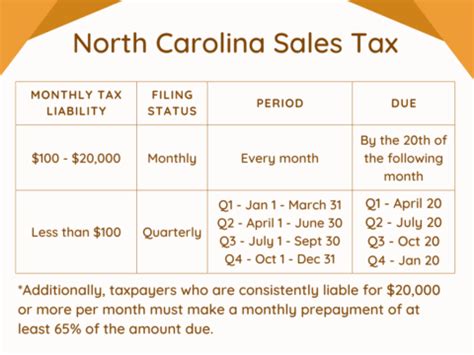

Underpayment of Taxes Throughout the Year

Many individuals and businesses pay their taxes incrementally throughout the year, either through payroll deductions or estimated tax payments. If you underestimate your income or overestimate your deductions, you may not pay enough tax during the year, resulting in a balance due when you file your tax return.

Inaccurate Withholding or Estimated Tax Payments

The tax system relies on individuals and businesses to accurately estimate and pay their taxes. If you miscalculate your income or deductions, or if your financial situation changes significantly during the year, you may end up with an unexpected tax liability.

Self-Employment and Business Income

Individuals who are self-employed or own businesses often face unique tax challenges. They are responsible for paying both the employer and employee portions of taxes, which can lead to higher tax liabilities. Additionally, business income can fluctuate, making it challenging to estimate taxes accurately.

Capital Gains and Investments

When you sell assets, such as stocks or real estate, you may incur capital gains. These gains are subject to tax, and if you haven’t adequately accounted for them or haven’t made sufficient estimated tax payments, you may owe additional taxes.

Unreported Income

Failing to report all sources of income can lead to tax liabilities. Whether it’s freelance work, rental income, or side hustles, all income must be reported accurately to avoid penalties and interest.

Tax Credits and Deductions Overlooked

Tax credits and deductions can significantly reduce your tax burden. However, if you overlook eligible credits or deductions, you may end up owing more taxes than necessary. It’s crucial to stay informed about the various tax benefits available to you.

Strategies to Minimize Tax Liabilities

While owing taxes is a reality for many, there are strategies you can employ to minimize your tax liabilities and ensure you’re not paying more than you legally owe.

Accurate Income and Deduction Estimation

Take the time to accurately estimate your income and potential deductions for the year. This can help you make more informed decisions about tax payments and reduce the chances of owing a large sum at the end of the year.

Stay Updated with Tax Laws

Tax laws can change frequently, so staying informed is essential. Keep an eye on tax reforms, new deductions, and credits that may benefit you. Consult tax professionals or use reputable tax software to ensure you’re taking advantage of all available opportunities.

Utilize Tax Credits and Deductions

Maximizing your tax credits and deductions is a powerful way to reduce your tax liability. Explore options such as the Child Tax Credit, Education Credits, Home Office Deduction, and Retirement Account Contributions. These can provide significant tax savings.

Consider Tax-Advantaged Investments

Certain investments, such as 401(k)s and IRAs, offer tax advantages. Contributions to these accounts can reduce your taxable income, leading to lower tax liabilities. Additionally, the growth and earnings within these accounts may be tax-deferred or tax-free.

Seek Professional Tax Advice

Navigating the complex world of taxes can be challenging. Consider consulting a tax professional or using reputable tax preparation services. They can help you optimize your tax strategy, identify potential deductions and credits, and ensure compliance with tax laws.

Conclusion

Understanding why you owe taxes is a crucial step towards financial awareness and planning. By grasping the fundamentals of tax liability, common reasons for owed taxes, and strategies to minimize liabilities, you can take control of your financial situation. Remember, staying informed, accurate, and proactive can help ensure a smoother tax journey and potentially reduce your tax obligations.

What happens if I can’t afford to pay my tax liability in full?

+If you’re unable to pay your tax liability in full, it’s important to take action promptly. You can contact the tax authority and explore payment plans or installment agreements. They may also offer options for penalty abatement or offer in compromise. Seeking professional advice can help you navigate these options effectively.

Are there any tax credits or deductions specific to certain professions or industries?

+Yes, certain professions and industries may have specific tax benefits. For instance, teachers may be eligible for the Educator Expense Deduction, while small business owners may benefit from the Qualified Business Income Deduction. It’s important to research and understand the deductions and credits available in your industry.

How can I stay updated with the latest tax laws and changes?

+Staying updated with tax laws can be done by regularly visiting official government websites, subscribing to tax-related newsletters or blogs, and following reputable tax professionals on social media. Additionally, attending tax workshops or seminars can provide valuable insights into the latest changes and trends.