Unlock Your Nebraska Tax Refund Today

For many Nebraska residents, navigating the state’s tax system can seem complex and often frustrating, especially when trying to understand how and when they can access their tax refunds. Yet, amid the myriad of forms, deadlines, and procedural nuances, lies an opportunity to streamline your financial planning and ensure you receive what’s rightfully yours—your Nebraska tax refund. This article aims to demystify the process, debunk common misconceptions, and offer a data-informed roadmap to unlock your refund efficiently.

The Fundamental Mechanics of Nebraska Tax Refunds

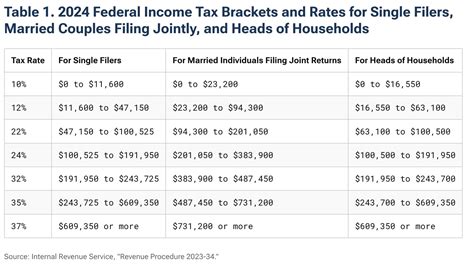

Understanding the basic structure of Nebraska’s tax refund system is essential for taxpayers eager to optimize their financial health. At its core, the Nebraska Department of Revenue processes individual income tax filings annually, typically between late January and April 15—or later if extensions are granted. The refund itself stems from overpayments relative to your actual tax liability, often resulting from withholding, estimated payments, or refundable credits. Contrary to popular belief, the refund eligibility isn’t merely a matter of filing on time but hinges heavily on accurate reporting, timely submission, and compliance with state-specific regulations.

Common Myths Debunked About Nebraska Tax Refunds

- Myth 1: Filing early guarantees a faster refund. While early submission can expedite processing, the actual refund timeline depends largely on the accuracy of your return and whether additional reviews are necessary. Moreover, IRS and Nebraska processing times are not always synchronized, especially during peak periods.

- Myth 2: You receive your refund immediately after filing. Refunds often require several weeks to process, especially if paper returns are filed or discrepancies arise. Online filing and direct deposit significantly reduce wait times compared to mailed returns and check-based refunds.

- Myth 3: Once filed, your refund is assured without follow-up. Problems such as missing information, mismatched Social Security numbers, or incomplete forms can delay or prevent refunds. Confirming receipt and tracking your return status through official channels is best practice.

Step-by-Step Guide to Claiming Your Nebraska Refund

1. Accurate and Complete Filing

One of the primary pillars of a smooth refund process is submitting an error-free return. Use the latest Nebraska Department of Revenue forms, available online, and double-check all entered data—including Social Security numbers, income figures, and credit claims. Employ certified tax software vetted for Nebraska compliance, or consult a credentialed tax professional.

2. Choosing the Optimal Filing Method

Electronic filing paired with direct deposit remains the fastest way to receive your refund. The Nebraska Department of Revenue offers multiple e-filing options—Thomson Reuters, TurboTax, and others—which are fully integrated into their secure platform. Paper filings, although still accepted, extend processing times by several weeks and increase risk of misplacement or delay.

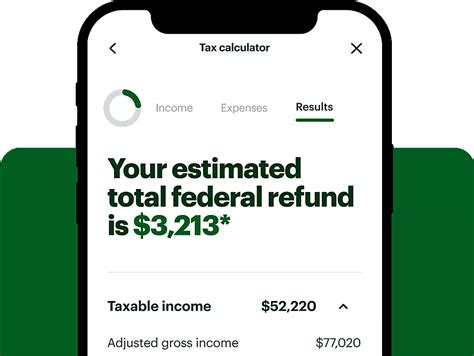

3. Monitoring Your Refund Status

Once filed, tracking the refund status is straightforward through Nebraska’s online portal or via the state’s phone hotline. Typically, refunds are processed within 4–6 weeks if there are no issues. During peak tax season, this duration might extend slightly, making early submission and verification vital.

| Relevant Category | Substantive Data |

|---|---|

| Average Refund Processing Time | Approximately 4 to 6 weeks for e-filed returns with direct deposit |

| Common Delay Causes | Incomplete information, mismatched SSNs, audit reviews |

| Refund Receipt Rate | Over 85% of refunds issued within 6 weeks during peak tax season |

Understanding Refund Timing and Potential Obstacles

While most refunds are straightforward, certain factors may cause delays or complications. For instance, if your return flags for audit review due to inconsistencies or anomalies—such as unusually high deductions relative to income—the process can extend beyond the standard timeframe. Additionally, discrepancies in reported income levels or unreported income sources found during cross-referencing with third-party data can lead to hold-ups.

How to Minimize Refund Delays

- File early to avoid congestion during the peak filing period.

- Use reputable e-filing services and verify all entries before submission.

- Ensure that your bank account details match your banking records exactly for direct deposit.

- Respond promptly to any correspondence or audit notices from the Nebraska Department of Revenue.

Tax Credits and Their Influence on Your Refund

Many consider tax credits a way to increase their refund, yet misconceptions abound about their effects. In Nebraska, credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) are designed to offset tax liabilities or provide direct refunds if no taxes are owed. Properly claiming these credits can significantly boost your refund amount, but errors or omissions on returns often lead to rejections or recalculations.

Expert Tips for Maximizing Refunds via Credits

Ensure eligibility criteria are met and documentation is complete. For example, accurate reporting of qualifying children, income thresholds, and residency status is vital. Consulting tax software that offers built-in validation can prevent common mistakes, while professional advice can uncover credits you might overlook.

| Relevant Category | Substantive Data |

|---|---|

| Credit Impact on Refunds | Up to 25% increase in average refund amount for eligible claimants |

| Common Errors | Incorrect qualification status, missing documentation, misreported income |

| Claiming Deadlines | Generally aligned with federal deadlines—April 15 or extended dates |

Addressing Refund Discrepancies and Corrections

Occasionally, taxpayers find themselves faced with discrepancies or errors after receiving their refunds. This might be due to data entry mistakes, subsequent correction needs, or issues flagged during post-processing reviews. Recognizing how to address these issues promptly is key to avoiding long delays or potential penalties.

Procedures for Corrections and Overpayment Recovery

If you identify an error shortly after filing, amending your return via Nebraska’s amended return process—Form 20X—is recommended. For overpayments, the state typically issues a corrected refund check or adjusts future liabilities for subsequent years. Staying informed through official notifications and responding within the stipulated timelines ensures smooth resolution.

| Relevant Category | Substantive Data |

|---|---|

| Amendment Filing Timeline | Within 3 years of original filing or within 2 years after paying the tax |

| Correction Processing Time | Approximately 8–12 weeks for amended returns |

| Overpayment Refund Method | Direct deposit or check; typically within 6 weeks of approval |

Concluding Reflections: Your Roadmap to a Smooth Refund Experience

While the pathways to securing your Nebraska tax refund may appear labyrinthine, a strategic approach rooted in accuracy, early action, and vigilant follow-up can simplify the journey. From correcting misconceptions about delays to harnessing credits effectively, informed taxpayers position themselves to claim what’s owed efficiently. The true power lies in understanding the process intricately and engaging proactively with the Nebraska Department of Revenue’s resources.

Key Points

- Accurate, timely filing paired with electronic submission accelerates refunds.

- Proactive tracking and prompt responses prevent delays and disputes.

- Maximizing credits and understanding correction procedures can optimize refund amounts.

- Awareness of potential obstacles like audits or mismatched info is essential for planning.

- Leveraging digital tools and professional consultations reduces processing times and errors.

How quickly can I expect to receive my Nebraska tax refund?

+Most e-filed returns with direct deposit are processed within 4 to 6 weeks, but timing can vary based on processing volume and any issues flagged during review.

What should I do if my refund is delayed beyond the typical processing time?

+Check your refund status online or via the hotline, verify all submitted information, and respond promptly to any correspondence from the Nebraska Department of Revenue to resolve potential issues.

Can claiming more credits increase my refund significantly?

+Yes. Properly claiming eligible credits—like the EITC or Child Tax Credit—can boost your refund, but accuracy and documentation are vital to avoid delays or rejections.

How can I correct an error if I’ve already received my refund?

+If the error is discovered shortly after filing, submit an amended return (Form 20X). For overpayment issues, the state usually issues a corrected refund within 6 weeks after approval.

Are physical or paper filings still recommended in Nebraska?

+While still accepted, electronic filings with direct deposit are strongly advised for faster processing and fewer errors—aiming to receive refunds promptly and securely.