Capital Gains Tax Uk

Capital gains tax (CGT) is an essential aspect of the UK's tax system, impacting individuals and businesses alike. This tax is levied on the profit made from selling or disposing of assets, such as properties, stocks, and shares, and understanding its intricacies is crucial for effective financial planning and compliance. With the UK government's focus on CGT reform and potential changes on the horizon, staying informed is more critical than ever for investors and homeowners.

Understanding Capital Gains Tax in the UK

Capital Gains Tax is a tax on the profit made when selling an asset that has increased in value. It applies to various capital assets, including:

- Residential and commercial properties

- Shares and stocks

- Business assets

- Artwork, collectibles, and antiques

- Land and agricultural assets

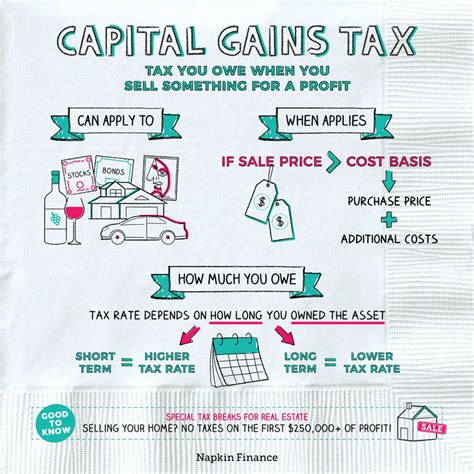

The UK’s CGT system aims to ensure that individuals and entities pay tax on the profits from their investments and asset sales. The tax is calculated on the difference between the selling price and the acquisition cost of an asset, often referred to as the “disposal proceeds” and the “base cost” respectively.

Exemptions and Allowances

Not all assets are subject to CGT. The UK offers certain exemptions and allowances to help individuals manage their tax liabilities. Here are some key exemptions:

- Principal Private Residence (PPR): The main residence of an individual is usually exempt from CGT. However, if a portion of the property was used for business purposes or if the individual has lived in multiple properties, CGT may apply.

- Gifts: Assets given as gifts to family members or charities are often exempt from CGT. However, the conditions for this exemption can be complex and depend on the relationship between the donor and recipient.

- Annual Exempt Amount: Each tax year, individuals in the UK have an annual exempt amount for CGT. For the 2023⁄24 tax year, this amount is set at £13,100. Any gains below this threshold are not subject to CGT.

Calculating Capital Gains Tax

The calculation of CGT in the UK involves several steps. Firstly, the base cost of the asset is determined, which includes any acquisition costs and improvement expenses. Then, the disposal proceeds, or the selling price, are calculated. The difference between these two values represents the capital gain.

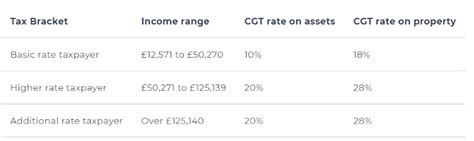

The capital gain is then taxed at different rates, depending on an individual’s income tax bracket. For the 2023⁄24 tax year, the rates are as follows:

| Taxable Income Bracket | CGT Rate |

|---|---|

| Basic rate taxpayer | 18% |

| Higher rate taxpayer | 28% |

It’s important to note that CGT is calculated separately from income tax, and the rates can change annually based on government policies.

Reporting and Payment

Individuals and businesses must report CGT liabilities when they sell or dispose of assets. For most asset sales, the CGT is due within 30 days of the sale. However, for UK residential property sales, the CGT must be reported and paid within 60 days. This is a relatively recent change, introduced in 2020, to ensure quicker payment of CGT on property sales.

Real-World Examples of CGT

Let’s look at a few scenarios to better understand how CGT works in practice.

Scenario 1: Property Sale

John purchased a house in London in 2010 for £300,000. After living in it for five years, he decided to sell it for £500,000 in 2023. Since this is his primary residence, he is eligible for the principal private residence exemption. However, he also used a portion of the house for his home office, which is considered a business use.

To calculate his CGT liability, John would first need to determine the proportion of the house used for business. Let’s say it’s 20%. So, 20% of his gain (£500,000 - £300,000) is taxable. This amounts to £40,000.

John’s income for the year is £60,000, putting him in the higher rate taxpayer bracket. Therefore, his CGT liability for this sale would be £40,000 x 28% = £11,200.

Scenario 2: Share Investment

Emma bought 1,000 shares of a tech company in 2018 for £5,000. The shares have performed well, and she decides to sell them in 2023 for £12,000. Emma’s base cost for these shares is £5,000, so her capital gain is £12,000 - £5,000 = £7,000.

Emma’s income for the year is £30,000, which puts her in the basic rate taxpayer category. Therefore, her CGT liability is £7,000 x 18% = £1,260.

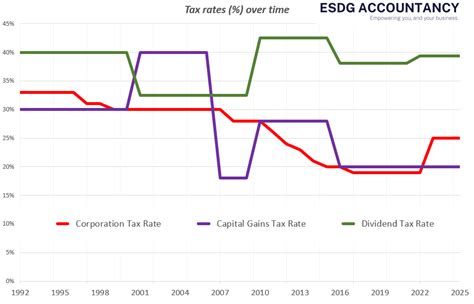

The Future of Capital Gains Tax in the UK

The UK government has been discussing reforms to the CGT system, with a focus on aligning it more closely with income tax rates and removing some of the exemptions. While no concrete changes have been announced yet, here are some potential implications if such reforms were to take place:

Increased Tax Burden

If CGT rates were to align with income tax rates, it could mean a higher tax burden for individuals, especially those with significant capital gains. This could impact not only investors but also homeowners looking to sell their properties.

Simplified Tax System

Removing certain exemptions, such as the principal private residence exemption, could simplify the CGT system. This might make it easier for individuals to understand their tax liabilities, but it could also result in higher taxes for some.

Impact on Property Market

Changes to CGT could have a significant impact on the UK’s property market. If selling a primary residence becomes more expensive due to higher CGT, it could discourage some homeowners from moving, potentially affecting the supply of properties in the market.

Potential Benefits

On the other hand, aligning CGT with income tax rates could also bring some benefits. It might encourage more responsible investing, as individuals would be more aware of the tax implications of their asset sales. Additionally, it could lead to a more progressive tax system, where those with higher incomes contribute more to the tax base.

Stay Informed and Plan Ahead

With the potential for significant changes to the UK’s CGT system, it’s essential for individuals and businesses to stay informed and plan their financial strategies accordingly. Regularly reviewing assets, understanding their base costs, and keeping up-to-date with tax reforms can help mitigate potential CGT liabilities.

Frequently Asked Questions

When do I need to pay Capital Gains Tax in the UK?

+You must pay Capital Gains Tax within 30 days of selling or disposing of most assets. However, for UK residential property sales, the tax must be reported and paid within 60 days.

Are there any exemptions or allowances for CGT?

+Yes, the UK offers several exemptions and allowances, including the principal private residence exemption, gifts to family members or charities, and an annual exempt amount.

How do I calculate my CGT liability?

+Calculate your capital gain by subtracting the base cost (acquisition cost and improvement expenses) from the disposal proceeds (selling price). Then, apply the appropriate CGT rate based on your income tax bracket.

What is the current CGT rate for the 2023⁄24 tax year in the UK?

+For the 2023⁄24 tax year, the CGT rates are 18% for basic rate taxpayers and 28% for higher rate taxpayers.

Are there any potential reforms to the CGT system in the UK?

+The UK government has discussed potential reforms, including aligning CGT rates with income tax rates and removing certain exemptions. While no concrete changes have been announced, it’s essential to stay informed about any potential reforms.