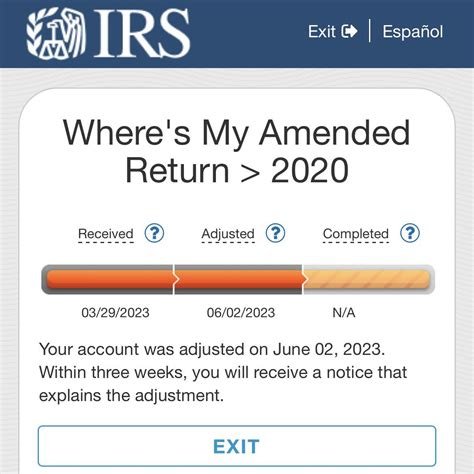

Tax Amendment Status

Welcome to this in-depth exploration of the Tax Amendment Status, a crucial aspect of financial and legal systems around the world. Tax amendments are an essential tool for governments to adapt tax laws to changing economic conditions and societal needs. These amendments can significantly impact individuals, businesses, and the economy as a whole, making it a topic of great interest and importance.

Understanding Tax Amendments

A tax amendment refers to the formal process of modifying or updating existing tax laws and regulations. It is a legal mechanism that governments employ to address various economic, social, and political objectives. These amendments can take different forms, including changes to tax rates, tax brackets, deductions, credits, and even the introduction of entirely new taxes or the repeal of existing ones.

The need for tax amendments arises from a variety of factors. Economic shifts, such as recessions or periods of high growth, may prompt governments to adjust tax policies to stimulate or stabilize the economy. Additionally, societal changes, such as advancements in technology or shifts in the labor market, can necessitate updates to tax laws to ensure fairness and efficiency.

Furthermore, tax amendments can be used to address specific issues, such as tax avoidance or loopholes, and to promote certain behaviors, like encouraging investment in renewable energy or supporting small businesses. In essence, tax amendments are a flexible tool for governments to shape their tax systems to suit contemporary needs and priorities.

The Process of Tax Amendment

The process of enacting a tax amendment is a complex and carefully regulated procedure. It typically involves several key steps, which may vary slightly depending on the jurisdiction.

Proposal and Drafting

The journey of a tax amendment often begins with a proposal. This proposal can originate from various sources, including government departments, tax experts, industry representatives, or even the public. Once a need for a tax change is identified, a draft of the proposed amendment is prepared. This draft outlines the specific changes to the tax law, including amendments to existing statutes or the introduction of new ones.

For instance, imagine a government proposes an amendment to introduce a new tax credit for businesses that invest in research and development. The draft would detail the specific criteria for eligibility, the amount of the credit, and any restrictions or limitations.

Review and Consultation

After the initial drafting, the proposed amendment enters a review and consultation phase. This step is crucial to ensure the amendment is well-informed and considers various perspectives. Government agencies, industry associations, legal experts, and sometimes the public are consulted to provide feedback and ensure the proposed changes are feasible, fair, and effective.

During this stage, detailed analysis and research are conducted to understand the potential impact of the amendment. Economic models are run, and data is scrutinized to predict the effects on tax revenues, economic growth, and various sectors of the economy.

Legislative Process

Once the proposal has been thoroughly reviewed and any necessary revisions have been made, it moves on to the legislative process. This typically involves the amendment being introduced as a bill in the relevant legislative body, such as a parliament or congress. The bill then goes through a series of readings, debates, and votes, where legislators discuss and decide on the proposed changes.

The legislative process can be lengthy and involves careful consideration of the amendment's potential impact on different constituencies and interest groups. Amendments to the bill may be proposed and debated, ensuring that the final legislation is a consensus of the legislators' views.

Enactment and Implementation

If the proposed tax amendment bill is passed by the legislative body, it becomes law. At this stage, the amendment is officially enacted and added to the tax code. However, the process doesn’t end there; the next critical step is implementation.

Implementation involves a range of activities, including updating tax forms, instructions, and guidelines to reflect the new law. Tax authorities must also provide clear guidance to taxpayers and tax professionals to ensure they understand the changes and can comply with the new requirements.

Additionally, training and resources may be provided to tax administrators to ensure they can effectively enforce the new law. This implementation phase can take time and requires careful planning to ensure a smooth transition for all stakeholders.

Key Considerations in Tax Amendment

Tax amendments are not made in isolation; they are part of a broader economic and social context. Here are some key considerations that often come into play when discussing tax amendments.

Economic Impact

One of the primary considerations is the economic impact of the proposed amendment. Tax changes can significantly affect businesses and individuals, influencing their behavior and decisions. For instance, a reduction in corporate tax rates may encourage businesses to invest and expand, leading to job creation and economic growth. Conversely, an increase in personal income tax rates could reduce disposable income, potentially impacting consumer spending and the overall economy.

Economic modeling and forecasting play a crucial role in understanding these impacts. Advanced analytics and simulations help policymakers predict the short-term and long-term effects of tax amendments, ensuring they make informed decisions.

Equity and Fairness

Tax systems are often designed to promote equity and fairness. When proposing tax amendments, ensuring that the changes do not disproportionately benefit or burden certain groups is essential. For example, introducing a progressive tax system, where tax rates increase with income, can help ensure those with higher earnings contribute a larger share of their income to the tax system.

However, balancing equity with other objectives, such as economic growth or simplicity in the tax system, can be challenging. Policymakers must carefully consider these trade-offs to ensure the tax system remains fair and just.

Administrative Feasibility

While the economic and social impacts of tax amendments are crucial, the administrative feasibility of implementing the changes is equally important. Tax authorities must have the resources and capabilities to enforce the new laws effectively. This includes ensuring tax forms and guidelines are updated, training tax administrators, and providing clear guidance to taxpayers.

Complex tax amendments can sometimes lead to increased compliance costs for taxpayers and tax authorities. Policymakers must consider these costs and ensure they do not outweigh the benefits of the proposed changes.

Real-World Examples of Tax Amendments

To illustrate the concepts discussed, let’s explore a few real-world examples of tax amendments and their impacts.

Corporate Tax Reform in the United States

In 2017, the United States enacted a significant tax reform package, which included a reduction in the corporate tax rate from 35% to 21%. This amendment aimed to make the U.S. more competitive globally and encourage businesses to invest and create jobs. The reform also included changes to international tax rules to prevent corporate tax avoidance.

The impact of this amendment was significant. Many corporations saw a reduction in their tax liabilities, which led to increased profits and share buybacks. However, the reform also sparked debate about whether the benefits were evenly distributed and whether it led to the desired economic growth and job creation.

Carbon Tax in Sweden

Sweden introduced a carbon tax in 1991 as part of its efforts to combat climate change. The tax is levied on the carbon content of fossil fuels, such as coal, oil, and natural gas. The revenue generated from this tax is used to fund renewable energy initiatives and other environmental projects.

The carbon tax has been successful in reducing Sweden's greenhouse gas emissions. It has encouraged businesses and individuals to adopt more sustainable practices and has contributed to the country's transition to a low-carbon economy. However, the tax has also faced criticism for potentially increasing energy costs for households and businesses.

Digital Services Tax in the European Union

In 2020, the European Union proposed a digital services tax aimed at large tech companies, such as Google, Amazon, and Facebook. The tax would apply to revenues generated from certain digital activities, such as online advertising and the sale of user data. The aim of this amendment was to ensure these companies pay their fair share of taxes in the countries where they operate.

While the proposal received support from some EU member states, it also faced opposition from others, as well as from the tech companies themselves. The debate surrounding this tax amendment highlights the challenges of taxing digital services, especially in a globalized economy.

Future Implications and Challenges

Tax amendments will continue to play a critical role in shaping tax systems and addressing economic and social challenges. However, several key challenges and implications must be considered as we move forward.

Global Tax Reform

The digital age and the rise of multinational corporations have made it increasingly challenging to tax businesses fairly and effectively. The OECD (Organisation for Economic Co-operation and Development) has been leading efforts to develop a global framework for taxing digital services and addressing tax avoidance by multinationals. As these efforts progress, tax amendments will be necessary to implement these reforms at the national level.

Environmental Tax Reforms

As the world grapples with the climate crisis, tax amendments will likely play a crucial role in promoting sustainable practices and reducing carbon emissions. Carbon taxes, like Sweden’s, and other environmental tax reforms will be essential tools for governments to encourage a transition to a greener economy.

Tax Complexity and Compliance

As tax systems become more complex, with numerous amendments and changes, ensuring compliance can be challenging for taxpayers and tax authorities alike. Simplifying tax systems and providing clear guidance will be essential to maintain a fair and efficient tax system.

Technology and Tax

Advancements in technology, such as blockchain and artificial intelligence, are already impacting tax systems. Tax amendments will need to keep pace with these changes to ensure the tax system remains effective and can leverage these technologies to improve compliance and efficiency.

Conclusion

Tax amendments are a powerful tool for governments to shape their tax systems and respond to changing economic and social landscapes. By understanding the process, key considerations, and real-world examples, we can appreciate the complexity and importance of tax amendments. As we move forward, the effective use of tax amendments will be crucial in addressing economic, social, and environmental challenges, while ensuring fairness and efficiency in our tax systems.

How often do tax amendments occur?

+The frequency of tax amendments varies by jurisdiction. Some countries may have annual tax reforms, while others may make changes less frequently. The need for amendments can arise from various factors, such as economic shifts, social changes, or specific issues that require addressing.

Who proposes tax amendments?

+Tax amendments can be proposed by various entities, including government departments, tax experts, industry representatives, or even the public. The proposal process varies by jurisdiction, but it typically involves a formal process of drafting, review, and consultation before the amendment is introduced for legislative consideration.

What are the potential benefits of tax amendments?

+Tax amendments can have a wide range of benefits. They can be used to stimulate economic growth, encourage certain behaviors (such as investment in renewable energy), address tax avoidance, and promote fairness in the tax system. Amendments can also be made to adapt to changing economic conditions and societal needs.

How do tax amendments impact individuals and businesses?

+Tax amendments can have a significant impact on individuals and businesses. Changes to tax rates, deductions, or credits can affect their tax liabilities and disposable income. For businesses, tax amendments can influence their investment decisions, operational costs, and overall competitiveness.

What are some common challenges in implementing tax amendments?

+Implementing tax amendments can be challenging due to the need for clear and concise guidelines, updated tax forms, and effective training for tax administrators. Complex amendments can lead to increased compliance costs and confusion for taxpayers. Additionally, ensuring the tax system remains fair and efficient while adapting to changing needs is an ongoing challenge.