Jefferson County Tax Records

Welcome to this comprehensive guide on the Jefferson County Tax Records, a resource aimed at providing an in-depth understanding of the tax system within this county. This article will delve into the intricacies of property taxation, offer insights into the assessment process, and explore the various avenues for taxpayers to manage their obligations effectively. By the end of this read, you should have a clear grasp of the tax landscape in Jefferson County, empowering you to navigate it with confidence.

Understanding the Jefferson County Tax System

The tax system in Jefferson County is designed to generate revenue for the local government, which is then utilized for the development and maintenance of public services and infrastructure. This revenue is primarily sourced from property taxes, which are levied on real estate properties within the county.

The Jefferson County Assessor's Office plays a pivotal role in this process. It is responsible for the fair and accurate assessment of all taxable properties in the county, ensuring that each property owner contributes their fair share towards the community's well-being. The assessor's work is governed by state laws and regulations, aiming for uniformity and equity in the taxation process.

The Assessment Process: A Step-by-Step Guide

The property assessment process in Jefferson County involves several critical steps. First, the assessor’s office collects data on all taxable properties, including physical characteristics, location, and any recent improvements. This data is then used to determine the property’s assessed value, which forms the basis for calculating the property tax.

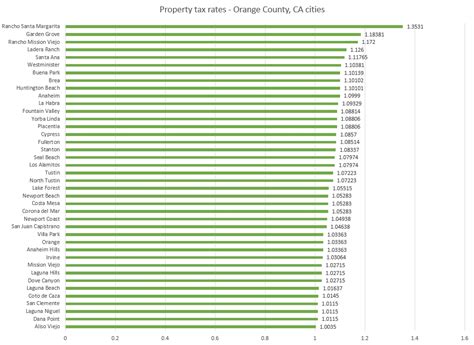

The assessed value is not the market value of the property but rather a value determined by the assessor based on factors like replacement cost, depreciation, and income potential. Once the assessed value is established, it is multiplied by the tax rate, which is set by the county and can vary based on the property's location and type.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 7.95% |

| Commercial | 11.5% |

| Industrial | 10.5% |

| Agricultural | 10% |

The resulting product is the property tax liability for the year. This amount is then divided into installments, typically two or four, to facilitate easier payment for taxpayers. It's worth noting that Jefferson County offers a homestead exemption for primary residences, which can significantly reduce the tax burden for homeowners.

Online Access to Tax Records: A Convenient Tool

Jefferson County has embraced technology to enhance taxpayer services. The Jefferson County Tax Records Portal is an online platform that allows residents and stakeholders to access a wealth of information related to property taxes. This portal provides a user-friendly interface where taxpayers can:

- Search and view property tax records, including assessment details, tax history, and payment status.

- Calculate estimated property taxes based on the property's characteristics and location.

- Access and download relevant tax forms and documents.

- Make online payments, ensuring a secure and convenient transaction process.

The portal also serves as a valuable resource for real estate professionals, investors, and researchers, offering a transparent view of the county's tax landscape.

Managing Your Tax Obligations

While the tax system in Jefferson County is designed for fairness and equity, it’s natural for taxpayers to have questions and concerns. The county offers a range of resources and support to help taxpayers navigate the process smoothly.

Tax Payment Options: Flexibility and Convenience

Jefferson County understands that taxpayers have varying needs and preferences when it comes to making tax payments. To accommodate this, the county provides several payment options, including:

- Online Payment: The most convenient method, allowing taxpayers to make payments securely from their bank accounts or credit cards.

- Mail-in Payment: Taxpayers can send their payment via check or money order to the county treasurer's office. This method is ideal for those who prefer a more traditional approach.

- In-Person Payment: Taxpayers can visit the treasurer's office to make payments in person. This option provides an opportunity for direct interaction with county officials.

- Automatic Payment Plans: For taxpayers who prefer a hands-off approach, Jefferson County offers automatic payment plans, where the tax amount is deducted from the taxpayer's account on specified dates.

These flexible payment options ensure that taxpayers can choose the method that best suits their circumstances and preferences.

Appealing Property Assessments: Ensuring Fairness

Jefferson County recognizes that property assessments can sometimes be a source of concern for taxpayers. If a taxpayer believes their property has been unfairly assessed, they have the right to appeal the assessment. The process involves a review by an independent board, which can adjust the assessment if it finds the initial valuation to be incorrect.

The Jefferson County Board of Equalization is responsible for hearing these appeals. Taxpayers can present their case, providing evidence and expert opinions to support their claim. This process ensures that the tax system remains fair and equitable for all property owners.

Tax Relief Programs: Supporting the Community

Jefferson County is committed to supporting its residents, especially those facing financial challenges. To this end, the county offers several tax relief programs, including:

- Homestead Exemption: As mentioned earlier, this program provides a substantial tax break for primary residence homeowners, reducing their tax liability significantly.

- Senior Citizen Tax Relief: Jefferson County offers reduced property taxes for senior citizens who meet certain income and residency criteria. This program aims to ease the financial burden on older residents.

- Disabled Veteran Exemption: Veterans with service-connected disabilities can qualify for a property tax exemption, which can provide much-needed financial relief.

These programs demonstrate the county's commitment to supporting its residents and ensuring that tax obligations are manageable for all.

Future Implications and Continuous Improvement

The Jefferson County tax system is not static; it is a dynamic process that adapts to changing circumstances and technological advancements. As the county continues to grow and evolve, the tax system will need to keep pace to ensure fairness and efficiency.

Adopting New Technologies

Jefferson County has already embraced technology with the Tax Records Portal, but there is potential for further integration. The county could explore the use of Artificial Intelligence (AI) and Machine Learning (ML) to enhance the assessment process. These technologies could analyze vast amounts of data, identify patterns, and make more accurate assessments, potentially reducing the workload for assessors.

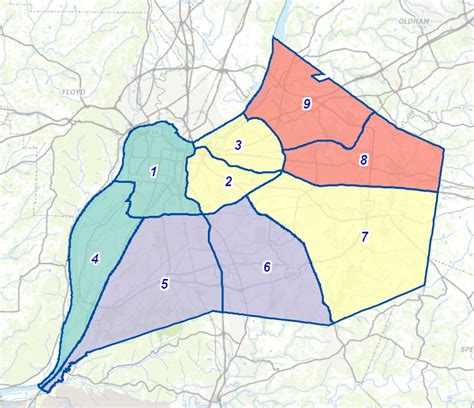

Additionally, the county could utilize Geographic Information Systems (GIS) to create detailed maps of properties, providing a visual representation of the tax landscape. This could be a powerful tool for taxpayers, assessors, and government officials alike, offering a clearer understanding of the county's tax structure.

Community Engagement and Transparency

Maintaining an open dialogue with taxpayers is crucial for a healthy tax system. Jefferson County could consider hosting regular town hall meetings or webinars to address taxpayer concerns and provide updates on the tax system. These events could also be used to gather feedback, ensuring that the tax system remains responsive to the community’s needs.

Furthermore, the county could explore the use of social media and online forums to engage with taxpayers, providing a platform for discussions and addressing common queries. This would foster a sense of community and encourage active participation in the tax process.

Continuous Training and Development

The success of the tax system relies heavily on the expertise and dedication of the county’s tax professionals. Jefferson County should invest in continuous training and development programs for its assessors, treasurers, and other tax officials. This would ensure that they stay abreast of the latest laws, regulations, and best practices, leading to more efficient and effective tax management.

In conclusion, the Jefferson County Tax Records system is a well-designed and fair process, but there is always room for improvement. By embracing new technologies, fostering community engagement, and investing in its tax professionals, Jefferson County can ensure that its tax system remains a model of efficiency and fairness for years to come.

How often are property assessments conducted in Jefferson County?

+

Property assessments in Jefferson County are typically conducted every two years. However, certain circumstances, such as significant property improvements or changes in market value, can trigger a reassessment outside of this cycle.

Can I request a reassessment of my property if I believe it is overvalued?

+

Absolutely! Jefferson County encourages taxpayers to request reassessments if they feel their property’s value has been incorrectly assessed. The process involves submitting a formal request and providing evidence to support your claim.

What happens if I miss the deadline for property tax payments?

+

Late payments in Jefferson County incur penalties and interest. It’s important to note that failure to pay property taxes can lead to legal consequences, including tax liens and potential foreclosure.

Are there any tax incentives for eco-friendly or energy-efficient property upgrades?

+

Yes, Jefferson County recognizes the importance of sustainable practices and offers tax incentives for property owners who make energy-efficient upgrades. These incentives can reduce the tax burden and promote a greener community.

How can I stay informed about changes to tax laws and regulations in Jefferson County?

+

The best way to stay updated is to regularly visit the Jefferson County website, which provides the latest information on tax-related matters. Additionally, you can sign up for email alerts or follow the county’s social media accounts for timely updates.