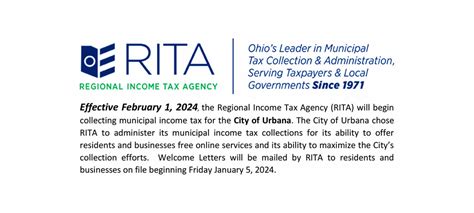

Regional Income Tax Agency

Regional Income Tax Agency: Navigating the Complexities of Income Taxation

The Regional Income Tax Agency (RITA) plays a pivotal role in the financial landscape of numerous municipalities and local governments across the United States. With its comprehensive services and expertise, RITA manages and collects income taxes on behalf of these entities, streamlining a critical aspect of local governance. This article delves into the intricacies of RITA's operations, its impact on local economies, and the strategies it employs to ensure efficient and fair taxation practices.

The Role of RITA in Local Governance

RITA stands as a pivotal entity in the administrative framework of local governments, assuming responsibility for income tax collection and management. This specialized agency serves as a vital link between taxpayers and the local authorities, ensuring a seamless and efficient process. By centralizing income tax administration, RITA alleviates the burden on individual municipalities, allowing them to focus on core governance responsibilities.

One of the key advantages of RITA's involvement is the standardization it brings to the income tax landscape. Through a unified approach, RITA establishes consistent tax rates and guidelines, mitigating potential confusion and ensuring fairness across different localities. This centralized system not only simplifies the process for taxpayers but also enhances transparency and accountability in tax administration.

Furthermore, RITA's expertise extends beyond mere tax collection. The agency provides valuable insights and support to local governments, assisting in budget planning and forecasting. By analyzing income tax trends and patterns, RITA enables municipalities to make informed decisions, optimize revenue streams, and effectively allocate resources. This proactive approach fosters financial stability and resilience within local communities.

Streamlining Tax Collection Processes

RITA’s primary function revolves around the efficient collection of income taxes. Through its sophisticated systems and dedicated staff, the agency ensures a smooth and timely process for taxpayers. By offering multiple payment options, including online platforms and direct deposits, RITA accommodates diverse taxpayer needs, making the payment process convenient and accessible.

In addition to its collection efforts, RITA prioritizes taxpayer education and support. The agency provides comprehensive resources and guidance, ensuring that individuals and businesses understand their tax obligations and can navigate the tax system with ease. This proactive approach not only enhances compliance but also fosters a positive relationship between taxpayers and the local government.

| Service | Description |

|---|---|

| Income Tax Collection | RITA collects income taxes on behalf of local governments, ensuring timely and accurate revenue streams. |

| Taxpayer Education | The agency provides resources and guidance to taxpayers, ensuring compliance and understanding of tax obligations. |

| Budget Analysis | RITA assists local governments in budget planning and forecasting, leveraging tax data for informed decision-making. |

Impact on Local Economies

The influence of RITA extends beyond tax collection, shaping the economic landscape of local communities. By efficiently managing income taxes, the agency ensures a steady revenue stream for essential public services, including education, infrastructure development, and social welfare programs. This consistent revenue base enables local governments to plan and execute long-term projects, contributing to the overall economic growth and prosperity of the region.

Moreover, RITA's presence contributes to a stable and attractive business environment. Through its streamlined tax processes and support services, the agency fosters investor confidence and encourages economic development. By providing a reliable and transparent tax system, RITA attracts new businesses and promotes job creation, further bolstering the local economy.

Promoting Fair Taxation Practices

At the heart of RITA’s mission is the commitment to fairness and equity in taxation. The agency strives to ensure that all taxpayers, regardless of their background or circumstances, are treated impartially and pay their fair share. Through rigorous enforcement and compliance measures, RITA curbs tax evasion and ensures that the tax burden is distributed equitably across the community.

In its pursuit of fairness, RITA actively engages with taxpayers, offering assistance and support to ensure compliance. The agency's proactive approach includes outreach programs, tax clinics, and educational initiatives, empowering taxpayers with the knowledge and tools to navigate the tax system successfully. By fostering a culture of transparency and accountability, RITA strengthens the social contract between taxpayers and the local government.

Future Implications and Strategies

As the economic landscape continues to evolve, RITA remains committed to adapting and innovating its strategies. The agency recognizes the importance of staying abreast of technological advancements and incorporates digital solutions to enhance its services. By leveraging data analytics and artificial intelligence, RITA aims to optimize tax collection processes, improve efficiency, and further reduce the administrative burden on taxpayers.

Furthermore, RITA actively engages with stakeholders, including local governments, taxpayers, and industry experts, to gather insights and feedback. This collaborative approach enables the agency to stay attuned to the needs and challenges of the community, ensuring that its services remain relevant and responsive. By embracing a culture of continuous improvement, RITA positions itself as a dynamic and reliable partner in local governance.

Conclusion

The Regional Income Tax Agency stands as a vital pillar in the administrative framework of local governments, playing a pivotal role in income tax administration. Through its expertise and dedication, RITA ensures efficient tax collection, promotes fair taxation practices, and contributes to the economic vitality of the region. As it continues to evolve and innovate, RITA remains a trusted partner, supporting local governments and taxpayers alike in their pursuit of financial stability and prosperity.

How does RITA determine tax rates for different localities?

+RITA works closely with each municipality to establish tax rates based on local needs and revenue requirements. These rates are carefully calculated to ensure fairness and adequacy in funding essential public services.

What support services does RITA offer to taxpayers?

+RITA provides a range of support services, including online tax filing assistance, payment plan options, and dedicated taxpayer hotlines. These resources aim to make the tax process accessible and manageable for all taxpayers.

How does RITA ensure data security and privacy for taxpayer information?

+RITA employs robust security measures, including encryption protocols and access controls, to safeguard taxpayer data. The agency adheres to strict privacy regulations to ensure that sensitive information remains protected and confidential.